Ready to see the market clearly?

Sign up now and make smarter trades today

Education

October 20, 2024

SHARE

What Really Happened with the GameStop Short Squeeze? A Deep Dive into the Market Phenomenon

Spotting “market sentiments” is the key to success in financial markets. Still, skeptical? In this article, we explore the infamous “GameStop short squeeze,” one of the most dramatic events in recent market history. For your greater understanding, we’ll start by explaining what a short squeeze is and how it works. This will give you a solid foundation for understanding why short sellers are vulnerable in such situations.

Next, we’ll explain how GameStop, a struggling video game retailer, became the target of massive short-selling by hedge funds. We’ll see how a group of retail investors, organized through the subreddit WallStreetBets, saw an opportunity to challenge these hedge funds. Eventually, this led to an explosive rise in GameStop’s stock price.

Additionally, we’ll show you several key reactions of both retail investors and hedge funds. Finally, we’ll examine the aftermath, including regulatory scrutiny and the impact on market dynamics. Let’s get started.

Understanding Short Squeezes: The Basics

A short squeeze represents a unique situation in the stock market where short sellers (investors who bet against a stock) are forced to buy back the shares at a higher price. This event (a short squeeze) pushes the stock price up even more than expected. As the price keeps rising, the risk keeps on increasing for short sellers. This happens because they might have to buy the stock at a much higher price than they sold it for. Usually, this leads to huge financial losses.

For clarity, let’s study the process of short selling:

- Short sellers borrow shares.

- They sell them at the current market price.

- While selling, they expect the price to fall.

- If it does, they can:

- Repurchase the shares at a lower price,

- Return them, and

- Pocket the difference.

- However, in a short squeeze, the price rises.

- Now, they must buy back the shares at a higher price.

- Ultimately, this can lead to unlimited losses.

One of the notable short squeezes that happened in 2021 is known as the “GameStop short squeeze”. In this case, retail investors drove up the stock price which caused massive losses for hedge funds. Another famous short squeeze event is the “Volkswagen squeeze” of 2008. In this event, Porsche’s announcement of owning most of Volkswagen’s stock led to a sharp rise in prices. This also squeezed short sellers.

For a better understanding of the short squeeze, read our exclusive article on market cheating and lessons learned.

The Build-Up: How GameStop Became the Target?

GameStop was a brick-and-mortar video game retailer. Due to technological advancements, it was perceived as a declining business in an increasingly digital world. As gaming shifted to online platforms, many institutional investors believed GameStop’s model was outdated. This led them to heavily short the stock.

Now, hedge funds saw GameStop as a company on the brink of failure. This perception led to an enormous short interest in GameStop stock. Many investors expected its value to plummet further.

As this perception built up, the “subreddit WallStreetBets” noticed the unusually high interest in GameStop and saw an opportunity. Users began buying shares and options in large quantities, which squeezed the short sellers. This community-driven buying frenzy caused GameStop’s stock price to skyrocket. This situation caught hedge funds off guard and forced them to cover their short positions at much higher prices.

Want to be better prepared for the next big market move? Learn how Bookmap’s visualization tools can help you navigate volatile situations like the GameStop saga. Join now!

The Short Squeeze Unfolds: A Day-by-Day Breakdown

As discussed above, the GameStop short squeeze began when retail investors on forums like WallStreetBets started buying shares. This caused a sudden and sharp rise in the stock’s price. Furthermore, this move caught short sellers off guard, which led to a chain reaction that further propelled the stock upwards.

For a greater understanding of this event, let’s break down some of the key events:

- At the start of January, GameStop’s stock was trading under $20.

- As retail investors poured in, the stock price began to climb.

- By mid-January, the price had surged past $40.

- This rapid rise continued and reached over $300 by the end of the month.

- Short sellers, who had bet against the stock, were forced to buy back shares at these inflated prices to cover their positions.

Regarding the hedge funds’ response, “Melvin Capital”, which had heavily shorted GameStop, suffered massive losses. They were forced to cover their short position at much higher prices. Moreover, some hedge funds closed their positions to avoid further losses, while others doubled down and hoped that the stock would eventually fall.

When it comes to retail investors, they profited handsomely during the squeeze. Some even reported life-changing gains by selling at the peak. However, others who bought during the frenzy saw the stock’s value plummet after the peak. Additionally, social media played a crucial role in coordinating the buying frenzy. Posts on WallStreetBets drove both excitement and fear among investors.

Curious how real-time data could have helped during the GameStop short squeeze? Explore Bookmap’s advanced tools to see market depth like never before. Sign up today!

The Aftermath and Market Implications

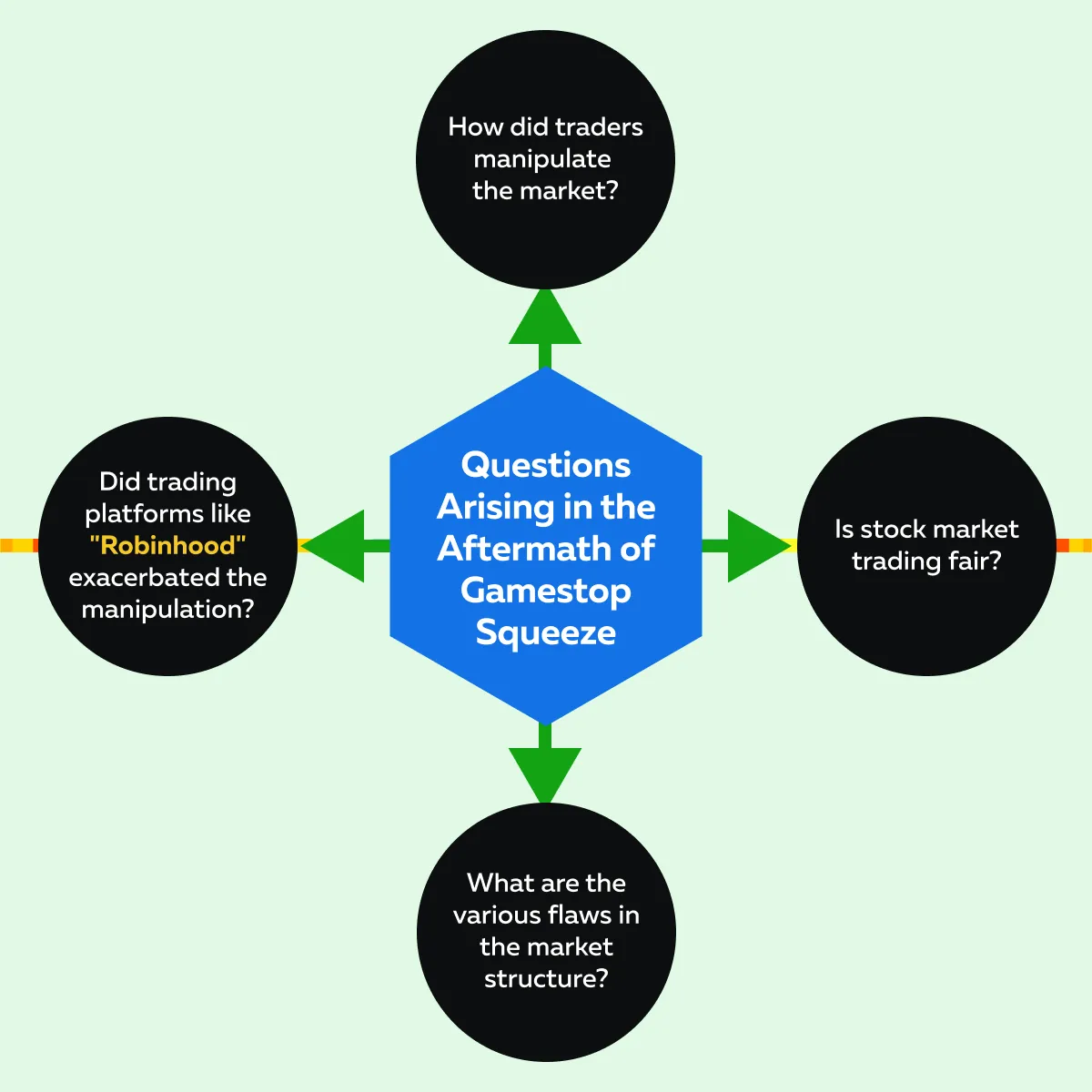

In the aftermath, the GameStop short squeeze led to significant regulatory scrutiny and raised legal questions. These questions particularly revolved around market manipulation and the role of trading platforms like Robinhood. This event also highlighted flaws in market structure and sparked debates about fairness in trading.

It is worth mentioning that during the squeeze, platforms like Robinhood restricted trading in GameStop and other heavily shorted stocks. This was due to liquidity concerns. This move further led to widespread outrage, with many accusing Robinhood of protecting hedge funds at the expense of retail investors. The U.S. Congress even held hearings to investigate the incident. They specifically focused on the following questions:

- Had market manipulation occurred?

- Were retail investors unfairly disadvantaged?

Moreover, the GameStop event demonstrated the growing power of retail investors. Through coordinated efforts, they were able to challenge large institutional players. It also changed the perception of short selling, with many now viewing it as a riskier and destabilizing practice. Hedge funds and other institutional investors have since become more cautious. They have started reassessing their strategies in light of retail-driven market disruptions.

Furthermore, the short squeeze led to increased awareness about the following:

- Influence of social media on stock prices

and

- Its potential for market volatility.

Gain insights into market events like the GameStop short squeeze by leveraging Bookmap’s real-time order flow analysis. Get started here!

Lessons Learned: What Traders Can Take Away

The GameStop short squeeze shows the immense power of market sentiment, especially driven by retail investors through social media. In today’s market, understanding and monitoring these platforms is important for predicting the likely stock price movements.

In the case of the GameStop squeeze, retail investors united through social media and made significant changes in stock prices. Hence, as an advisory, traders should always actively monitor platforms like Reddit and Twitter to gauge market sentiment. This will also help identify the expected trends that could lead to sharp price movements.

Additionally, traders can learn the following lessons:

A) Always Manage Risk in Volatile Markets

Managing risk is extremely crucial, especially in unpredictable situations like short squeezes. To do so, traders should use tools like stop-loss orders. These orders automatically sell a stock if its price falls to a certain level. In this way, traders can limit their likely losses.

Additionally, they should avoid investing too much in stocks that have been heavily shorted, as these can be very risky. By doing so, traders can protect themselves from huge financial losses when the market behaves unexpectedly.

B) Be Aware of Liquidity Challenges

Liquidity plays a critical role in trading, especially during a short squeeze. In the GameStop squeeze, rapid price movements created liquidity challenges. This made it difficult for traders to buy or sell shares at desired prices. Hence, traders should be aware of liquidity risks. They must understand that in a fast-moving market, the ability to execute trades efficiently can be severely impacted. Often, it leads to unexpected losses or missed opportunities.

Conclusion

One can say that the GameStop short squeeze was a landmark event in market history. It showcased the power of retail investors and the impact of social media on stock prices. In this event, initially, hedge funds bet against GameStop, viewing it as a failing business. However, retail investors, particularly from the WallStreetBets subreddit, saw an opportunity to push back. They bought up GameStop shares in large numbers. This buying frenzy drove the stock price from under $20 to over $300 in just a few weeks.

Next, this surge forced short sellers to buy back shares at much higher prices, which led to massive losses for hedge funds. In the aftermath, this event sparked regulatory scrutiny, especially when platforms like Robinhood restricted trading. Also, questions related to market fairness were raised.

From this event, the two most important lessons for traders are the importance of monitoring market sentiment (especially on social media) and risk management. By using tools like stop-loss orders and being cautious with highly shorted stocks, traders can better manage the risks in such volatile situations.

Always remember that the GameStop event is a perfect example of how quickly markets can change. To prepare better and enhance your predictive abilities, try our latest indicator, Bookmap, with its modern features. Join Bookmap now and spot market changes with ease!