Ready to see the market clearly?

Sign up now and make smarter trades today

Education

August 6, 2025

SHARE

How the Federal Reserve Was Born — And How It Shaped the Great Depression

The market crash is dangerous, but do you know what’s even worse? – A central bank that sleeps through it! Yes, in the early years, the Federal Reserve was not as powerful an entity as we see it today.

During the 1930s crisis, the Fed simply remained silent, hesitated, and made late decisions. The result? A manageable recession turned into the Great Depression! Want to learn more about history? You must, as a trader! After all, knowledge of the past can always give you an edge in the present.

In this article, you’ll learn how and why the Fed was created and how it failed during the Great Depression. From gold-backed dollars to modern tools like quantitative easing, you’ll learn how the Fed evolved and why traders still hang on to every word it says! Read this article till the end to understand how deeply liquidity, confidence, and central bank policy affect markets.

Why Was the Fed Created? Panic, Instability, and the Search for Stability

The primary reasons were:

- Panic,

- Instability, and

- The search for stability!

Yes, before the Federal Reserve, or “the Fed,” existed, the U.S. financial system was extremely unstable. During the 19th and early 20th century, the country faced several banking panics. These were sudden events when people lost trust in banks and rushed to withdraw their money. This often caused banks to fail. Some major examples are:

- The Panic of 1873

and

- The Panic of 1893.

Most importantly, you must be aware of the next event, the Panic of 1907! This event almost crashed Wall Street. Let’s see what happened in 1907:

At that time, the U.S. had no central bank to step in and calm the chaos. As a result, it was the famous banker J.P. Morgan who personally stepped in. The organization J.P. Morgan used its own money for:

- Organizing other bankers

and

- Bailing out the system.

This event clearly showed how fragile and unorganized the system was!

What Was Wrong with the System?

These repeated panics exposed several problems:

- Banks acted on their own. There was no national system to back them up.

- There was no way to inject emergency cash into the system when panic hit.

- People had little faith in banks and even the currency itself.

There was clearly a need for an apex body!

The Beginning of the Federal Reserve

After the 1907 crisis, Congress decided things had to change. First, they passed the Aldrich-Vreeland Act in 1908 to allow emergency currency. But it was a short-term fix! Later, the Federal Reserve Act of 1913 was passed. It created the Federal Reserve System.

What Was the Fed Designed to Do?

The Fed was created to:

- Control the money supply and keep bank reserves organized.

- Act as a lender of last resort, meaning it could give emergency funds to banks during a crisis.

- Manage credit and interest rates to avoid dangerous speculation, like borrowing too much to invest in risky assets.

- Rebuild public trust in the banking system.

A Political Compromise

Interestingly, the Fed wasn’t created as one powerful central bank like in some other countries. Instead, it was designed as a network of 12 regional reserve banks (RRBs). These RRBs were coordinated by a central Board in Washington, D.C.

This structure was a political compromise! Why? That’s because:

- Some feared it would give too much power to the government,

- While others feared private bankers would dominate.

Please note that the final design tried to balance both concerns. Its creation marked a major turning point in Fed history and changed how the financial system works ever since.

The Fed’s Early Years: Structure, Constraints, and Missed Signals

When the Federal Reserve was created in 1913, it was a new kind of central bank! The Fed was still figuring out how to manage a modern economy. From 1913 to 1929, the Fed had a few limited tools to influence the financial system, compared to what we see today.

What Tools Did the Fed Have?

In its early years, the Fed mainly used three tools:

| Discount Rates | Reserve Requirements | Open Market Operations (OMO) |

| This is the interest rate the Fed charged banks when they borrowed money from it. | These rules told banks how much money they had to keep in reserve and not lend out. | In OMO, the Fed bought or sold government bonds to manage the money supply. |

The Gold Standard Held the Fed Back!

At the time, the U.S. followed the gold standard. That meant every dollar had to be backed by a fixed amount of gold. Because of this, the Fed couldn’t freely print money or expand credit, even during times of financial stress. Its hands were tied.

The Effect? The Roaring Twenties Were a Missed Opportunity!

In the 1920s, the U.S. economy boomed. This era, known as the Roaring Twenties, was marked by:

- Rapid economic growth,

- Easy credit, and

- Heavy speculation in both real estate and stock markets.

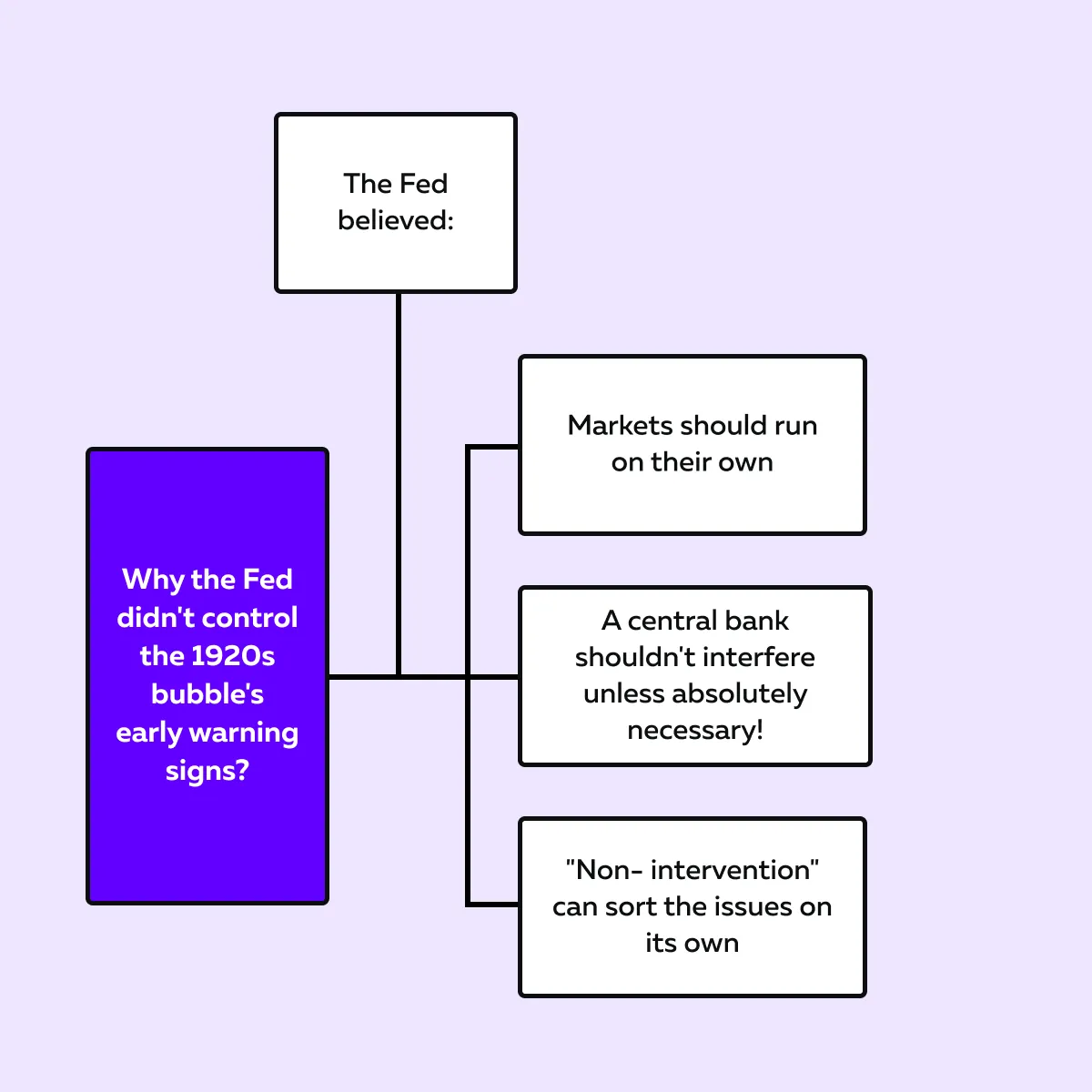

People were borrowing a lot of money to invest, and asset prices skyrocketed. This was a clear warning sign of a bubble! But the Fed didn’t act quickly. Let’s understand why through the graphic below:

Markets still react to the Fed like it’s 1929. Learn to read the flow and spot shifts before they happen. → Compare Plans

The result? A Late Response!

In 1928, the Fed finally recognized that a bubble was forming. In response, the Fed raised interest rates to try to slow things down. But by then, the damage was done!

Instead of calming the economy, the rate hike put even more pressure on already overheated financial markets. This misstep added to the instability that eventually led to the 1929 market crash.

Internal Problems in the Fed

The structure of the Federal Reserve also caused problems. You must note that:

-

- The Fed was made up of 12 regional reserve banks.

- These banks didn’t always agree!

- Some wanted tighter credit, and others wanted looser credit.

- There was no clear mission like today’s dual mandate (to fight inflation and support employment).

The policymakers back then worried more about moral hazard. They believed that helping banks in trouble might encourage risky behavior. Because of this, they hesitated to act, even when trouble was brewing.

What Can You Learn as a Trader?

In those days, the Fed wasn’t the proactive, data-driven institution we know today. It didn’t guide markets with forward-looking statements.

Also, it underestimated how credit contraction, a pullback in lending, could:

- Negatively impact the economy

and

- Trigger a downturn.

The Great Depression: How Fed Inaction Worsened the Collapse

The stock market crash of 1929 was a massive shock to the U.S. economy. What was the worst it caused? It led to a disaster as deep as the Great Depression. But why? The Federal Reserve didn’t do what it was supposed to! Let’s understand in detail:

The Fed’s First Real Test

After the crash, the U.S. economy was in a fragile state!

- Investors had lost confidence.

- Markets were in chaos.

- Businesses were nervous.

This was the moment when the central bank should have stepped in to stabilize the system. But the Federal Reserve failed its first major test!

The Fed Failed!

Instead of lowering interest rates or injecting money into the banking system, what we call easing monetary conditions, the Fed did almost nothing! It did not provide enough liquidity. Due to the shortage, the cash and credit banks could not keep lending and functioning smoothly.

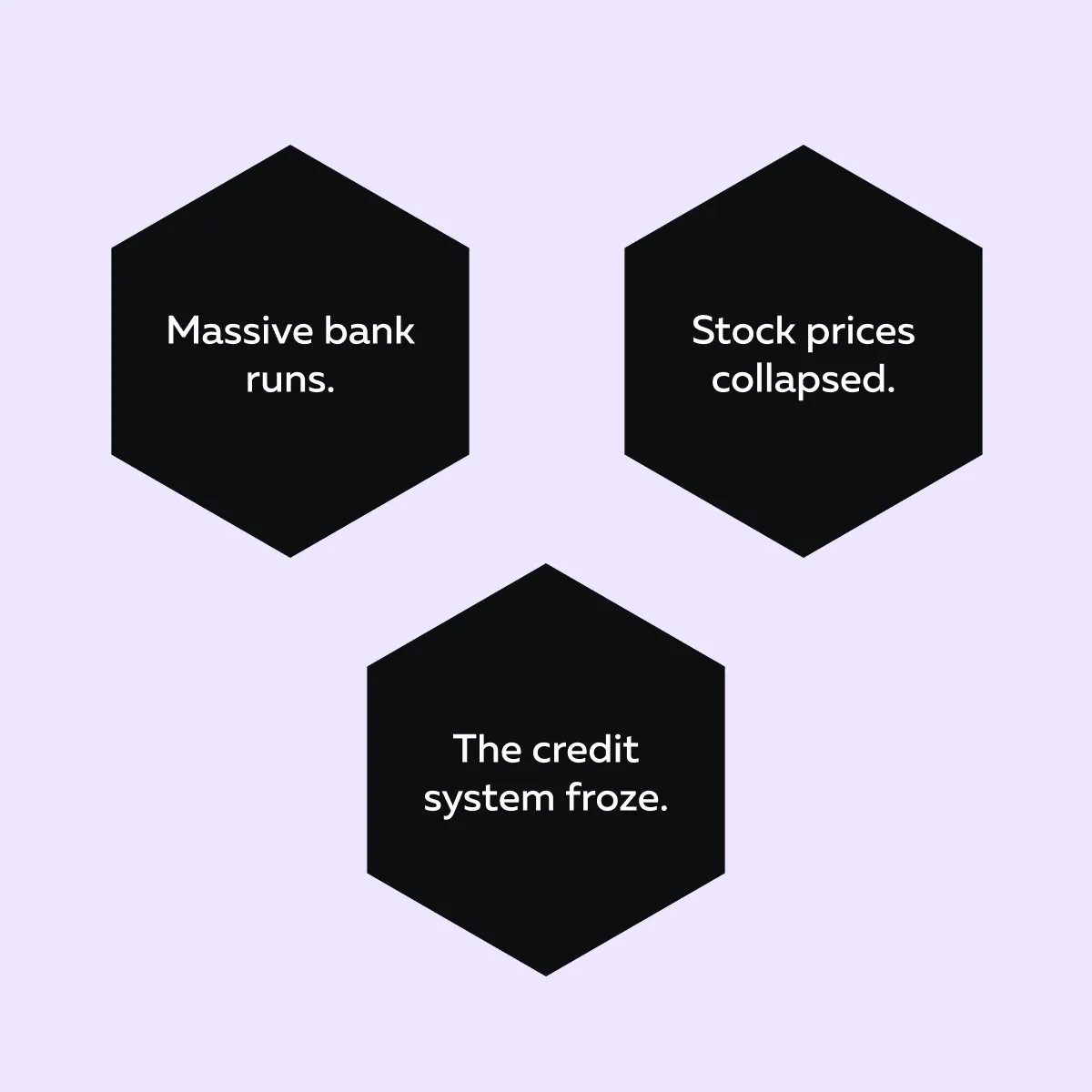

The Banking Collapse (1930–1933)

Between 1930 and 1933, things got much worse! Almost one-third of all U.S. banks failed. Did you know? When a bank collapsed back then, depositors often lost everything. That’s because there was no deposit insurance like we have today.

Each time a bank failed:

- People lost their savings.

- There was less money in circulation.

- The overall money supply shrank.

And this shrinking money supply led to deflation! It is a situation where prices fall across the economy. Does it sound good to you? No, it’s actually very damaging! Check out the ill effects of deflation through the graphic below:

This is a Vicious Cycle

During those times, deflation took hold. As a result:

- Credit dried up: Most banks that survived became too scared to lend.

- Consumption dropped: Most people had less money and were afraid to spend.

- Unemployment soared: Businesses couldn’t afford to keep workers.

This was not just a normal downturn! It was a deep and spiraling collapse. You must note that it was exactly the kind of situation a central bank is supposed to prevent.

The Fed’s Critical Mistake

One of the Federal Reserve’s core responsibilities, even back then, was to be the lender of last resort. That means when banks are in trouble, the Fed is supposed to step in with emergency loans to keep the system running.

But during this crisis, the Fed stayed passive! It did not act like a true lender of last resort. The Fed was still operating under old beliefs, like:

or

- Concern about helping failing banks. It was viewed as encouraging moral hazard.

The Fed’s inaction allowed the crisis to get worse with each passing month.

The result? It Led to The Great Depression!

Because the Fed didn’t take bold action, what could have been a “manageable recession” turned into the “worst economic collapse” in modern history! This event is known as the Great Depression.

Later economists, including Milton Friedman, strongly criticized the central bank’s failures during this time. They argued that the Fed should have done the following:

- Cut interest rates,

- Lend freely to banks, and

- Expand the money supply.

By doing so, the Fed could have softened or even prevented the worst effects of the depression.

The Interpretation of The Fed’s Missed Opportunity

When economists look back at the Great Depression, many agree that the Federal Reserve’s inaction deepened the crisis. Let’s learn how the several leading voices have interpreted this event:

A) Milton Friedman & Anna Schwartz

Two of the most influential economists on this topic were Milton Friedman and Anna Schwartz. In their famous book on Fed history, they argued that the worst part of the Great Depression wasn’t the stock market crash itself. Instead, it was the Federal Reserve’s failure to act afterward!

They said the Fed should have expanded the money supply by lowering interest rates, which would have made it easier for banks to lend. But instead, the Fed did nothing! As a result, the banking system collapsed, and the economy spiraled.

According to Friedman and Schwartz, this silence made the Depression “Great.” Their message:

- It wasn’t the collapse!

- The Fed’s silence during the panic was the culprit.

- It caused lasting damage.

Trade macro moves with better insight. The Bookmap shows how large players respond to volatility around Fed events. → View Packages

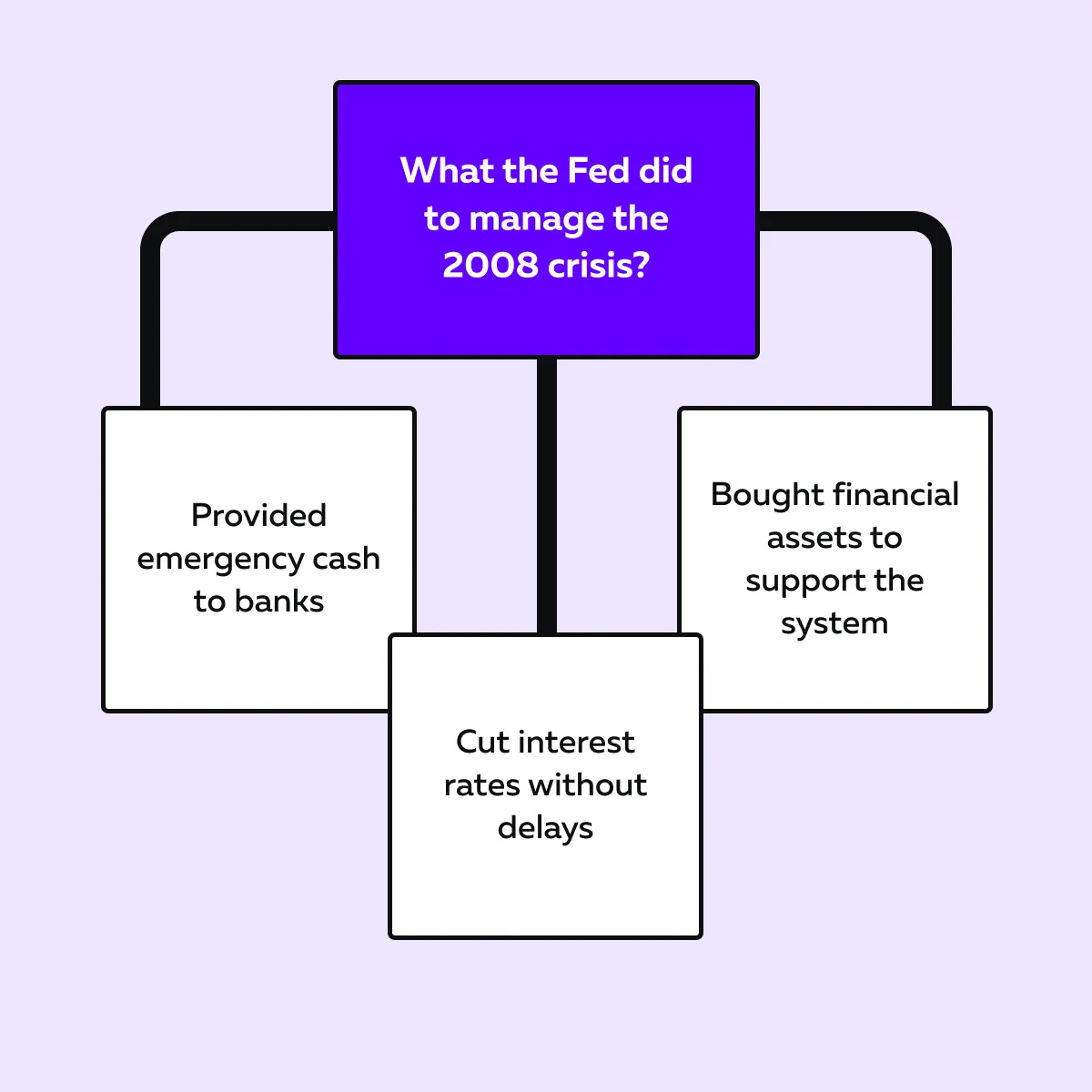

B) Ben Bernanke’s View

Years later, Ben Bernanke, who would become Chair of the Federal Reserve during the 2008 financial crisis, strongly agreed with Friedman and Schwartz. He studied this era closely. Post-analyzing, he said that if the Fed had acted sooner and more aggressively, the Great Depression might have been avoided.

Bernanke learned from those mistakes! That’s why, during the 2008 crisis, he made sure the Fed responded with massive liquidity measures. Let’s see how the Fed managed the 2008 crisis during his time:

Breaking Free from the Gold Standard

Another big turning point came in 1933 when President Franklin D. Roosevelt (FDR) removed the U.S. from the gold standard. Until then, the Fed couldn’t freely create more money because every dollar had to be backed by gold.

Leaving the gold standard gave both the government and the Federal Reserve more flexibility. Now, the Fed could expand the money supply more easily in times of crisis.

A Changed Fed

The Fed’s structure and role started to evolve after the 1930s. People no longer saw it as just a behind-the-scenes institution! Over time, the Fed gained:

- A clearer mission to manage both inflation and employment,

- Stronger tools like open market operations (OMO), and

- More responsibility to act swiftly during financial shocks.

What Traders Can Learn from the Fed’s Origins

Now, you must have realized that the Federal Reserve wasn’t always as powerful as it is today! In fact, when it was first founded, it was:

- Cautious,

- Limited in tools, and

- Often too slow to act.

But one major lesson from the Great Depression changed everything! When a central bank does too little during a crisis, things can get much worse.

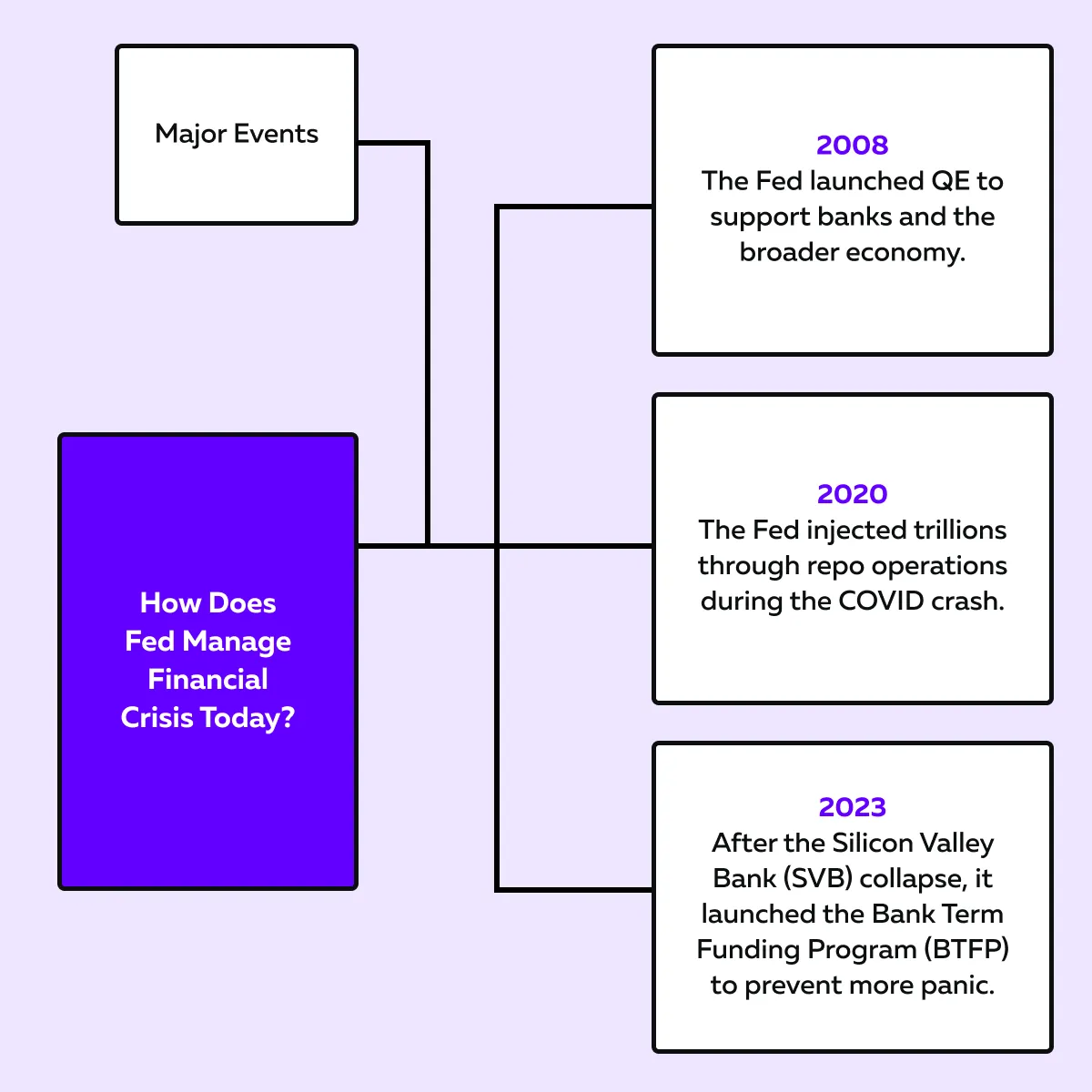

That failure shaped the modern Fed. Today’s Fed is now far more active and prepared to step in when markets are in trouble. Let’s understand in detail:

Lessons That Shaped Today’s Fed

Today, the Fed uses many tools, such as:

- Quantitative Easing (QE)

and

- Forward guidance (signaling future policy plans).

These tools exist because of what happened in the 1930s. Those painful years taught these three key lessons:

| Lessons learned from the Great Depression | Explanation |

| Liquidity must be abundant during panics. |

|

| Confidence is as important as cash. |

|

| Delays are dangerous. |

|

The Fed of Today is Faster, Bigger, Bolder!

Because of those lessons, the Fed now acts quickly and forcefully when trouble hits. Let’s check out the graphic below to study how it dealt with the recent economic crisis:

All of these actions were meant to restore liquidity and confidence, just like the Fed failed to do in the 1930s!

Now, What This Means for Traders Like You!

Even though the tools are more modern now, you, as a trader, should still focus on the same core signals:

| Liquidity | Interest rates | Confidence |

|

|

|

Want to get an edge? You must look beyond just headline rate changes! Do the following:

- Watch how big institutions reposition themselves before key Fed decisions.

- Notice when liquidity:

- Starts to dry up

or

- Flood back into the market.

-

- Both act as hints at what the Fed might do.

- Pay attention to order flow and price action near key psychological levels.

Conclusion

The Federal Reserve was created to bring order to a chaotic financial system. However, in its early years, it failed to act when it mattered most! Its inaction turned a manageable recession into the Great Depression.

That failure taught several lasting lessons. A central bank should always act quickly, maintain investor confidence, and keep money flowing during crises.

So, what do you get out of it as a trader? This history also shows how markets still react to the Fed’s tone, timing, and decisions. While today’s Fed has more tools and better knowledge, its silence or delay still moves markets. Curious how Fed policy affects today’s markets? See how liquidity shifts in real-time with Bookmap. → Compare Plans

FAQ

1. When was the Federal Reserve created, and why?

The Federal Reserve was created in 1913 after many years of financial chaos in the U.S. The biggest push came after the Panic of 1907. During this event, banks failed, and there was no central authority to help.

As a result, the Fed was set up to:

- Manage money,

- Prevent bank runs, and

- Act as a lender of last resort during financial emergencies.

Primarily, the Fed was formed to make the banking system more stable.

2. Did the Fed cause the Great Depression?

No, the Fed didn’t cause the Great Depression! However, the Fed’s inaction turned a manageable recession into a full-scale economic depression.

After the 1929 stock market crash, many banks began failing. Instead of stepping in and helping, the Fed stayed passive. It didn’t add enough money or credit to the system.

Because of this:

- People lost savings,

- Spending dropped, and

- The economy collapsed.

Most economists believe the Fed’s inaction during this time was a big mistake!

3. Was the Fed always this powerful?

No, the Fed was not always as powerful as it is now. In its early years, it had limited tools and had to follow the gold standard. As a result, it couldn’t freely control the amount of money in the economy.

However, after the gold standard was removed in 1933, the Fed slowly became more active. Over time, it even got more authority and tools, such as quantitative easing and forward guidance. This allowed it to take on a bigger role in:

- Fighting inflation,

- Supporting jobs, and

- Stabilizing markets.

4. How does this history help traders today?

As a trader, you must learn from this history that confidence and liquidity are what keep markets stable. When either is lost, even strong economies can collapse!

Today’s Fed uses many tools, but markets still react to its:

- Tone,

- Timing, and

- Decisions.

Most veteran traders who understand the Fed’s past know that delays or silence can trigger fear. And what follows next? – A highly volatile market!

Thus, you must learn from history. Knowledge of past events can help you spot early signals and make better decisions in today’s market environment.