Ready to see the market clearly?

Sign up now and make smarter trades today

Education

October 20, 2024

SHARE

How to Trade Effectively Around Iceberg Orders: Key Strategies & Tips

Detect what’s hidden and turn every trade into a success. Confused? This popular market adage might seem confusing, but it holds the key to optimizing your trading.

In this article, you’ll learn about “iceberg orders” that are partially hidden from the market and can influence price movements and market stability. We’ll explore various strategies for identifying and trading around these orders. Reading them will help you better understand how they work and how to use them to your advantage.

Furthermore, you’ll discover how to spot iceberg orders by analyzing volume patterns and using real-time tools like the Stops & Icebergs Indicators offered by us. These tools provide visual cues and detailed data that reveal hidden orders.

Moreover, we will also discuss strategies for trading with or against iceberg orders and cover how scalpers can use iceberg orders to find short-term trading opportunities in stable price ranges. Let’s get started.

What Are Iceberg Orders? A Brief Overview of Their Market Impact

Iceberg orders are specialized types of orders where only a small portion of the total order size is visible to the public. This allows traders to execute large trades without revealing their full intentions. The primary objective of placing these orders is to:

- Minimize market impact

and

- Conceal trade size.

It is worth mentioning that iceberg orders hide the true size of their trades. They do so by showing only a fraction of the total order at any time. As the visible portion is filled, another segment of the order is automatically revealed. In this way, it keeps the majority of the order concealed.

By revealing only a portion of the total order, iceberg orders affect market liquidity and price movements. They create the illusion of lower supply or demand. This influences the decisions of other market participants.

Moreover, large iceberg orders have significantly influenced market conditions in two primary ways:

| Method I: Stabilizing the Market by Providing Liquidity | Method II: Moving the Market Due to Concealed Order Size |

|

|

Are you looking for a more detailed explanation of iceberg orders? Read out our exclusive blog from here.

How to Identify Iceberg Orders in Real-Time?

To identify iceberg orders in real time, most traders use advanced market analysis tools like Bookmap. These tools offer modern features that help in the easy detection of iceberg orders. Let’s check them out:

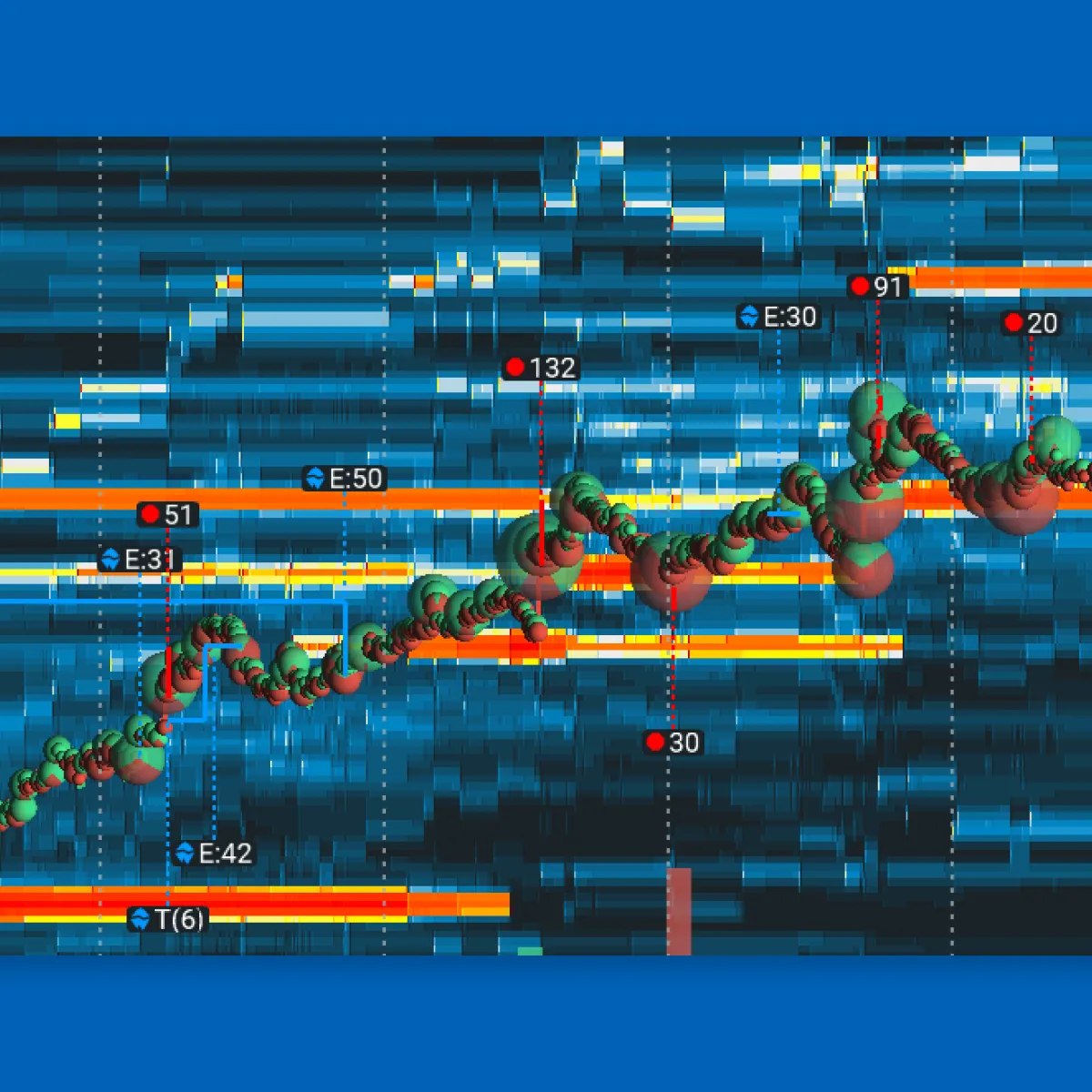

A) Stops & Icebergs Sub-Chart Indicator

The Stops & Icebergs Sub-Chart Indicator is a powerful add-on offered by us. It allows traders to identify and monitor the execution of iceberg orders in real time. This tool provides a detailed overview of market activities associated with these hidden orders. It does so by using advanced data detection and analysis. For more clarity, let’s study some of its key features:

Key Features

- Accurate Detection

- The indicator accurately identifies the execution of iceberg orders and stop orders.

- It offers traders a clear view of these significant market events.

- True Size Display

- It reveals the true size of aggressor orders by including partially executed limit orders.

- This gives insights into the actual limit price.

- Order Size Filtering

- Traders can apply an order size filter to focus on substantial market activities.

- This allows for more targeted analysis.

- Real-Time Computation

- The tool processes and displays data instantly as events unfold.

- It ensures that traders have real-time insights.

- High-Speed Data Processing

- It handles millions of market data events per second.

- The tool allows for immediate re-computation when settings are adjusted.

- This re-computation ensures up-to-date and precise market information.

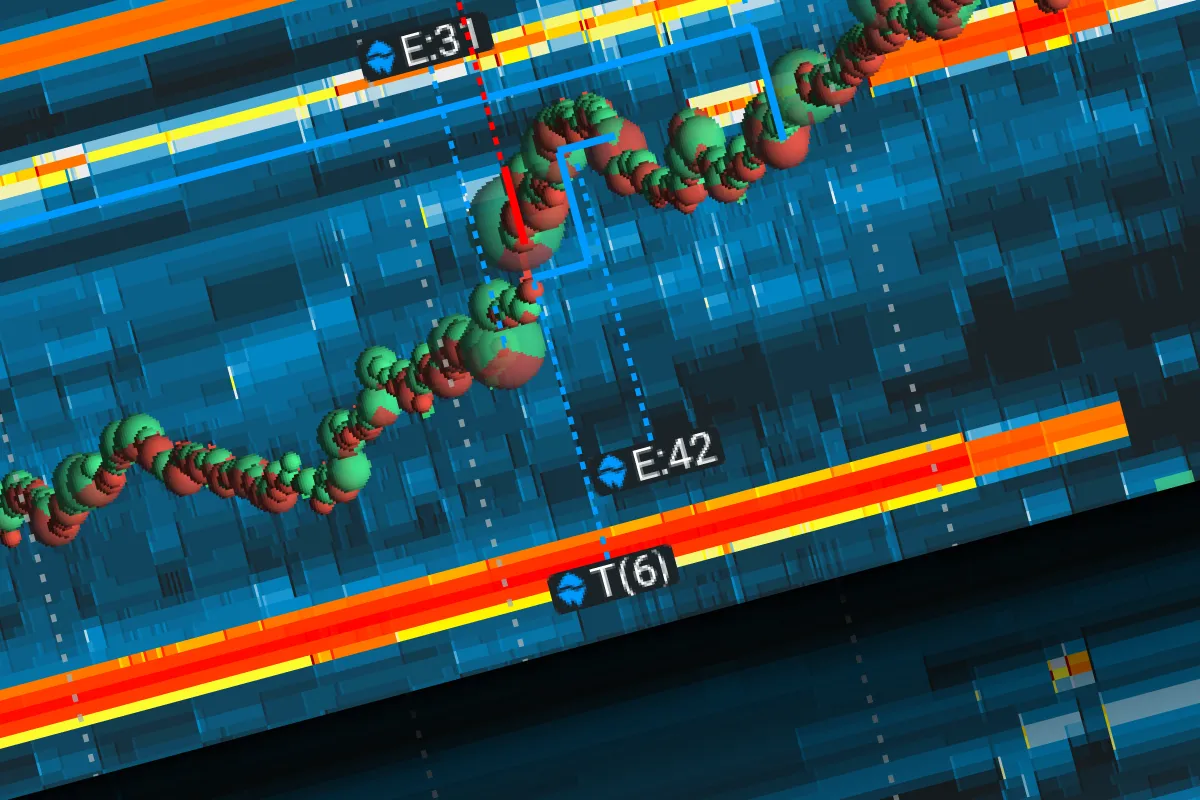

B) Stops & Icebergs On-Chart Indicator

The Stops & Icebergs On-Chart Indicator is another add-on offered by us. It is specifically designed to track the:

- Evolution of iceberg orders

and

- Execution of stop orders directly on the main chart

It visually displays when and at what price iceberg orders are detected, traded, fully executed, or canceled. Also, it highlights executed stop-order trades. Let’s check out its key features:

Key Features

- Visual Cues on the Main Chart

-

-

- The indicator provides visual markers on the main chart.

- It pinpoints the exact moments and prices at which iceberg orders interact with the market.

- This makes it easier to understand market dynamics.

-

- Complementary Analysis

-

-

- It can be used alongside the Sub-Chart Indicator.

- This tool offers a more comprehensive analysis of icebergs and stop orders.

- In this way, it enhances a trader’s ability to interpret market movements.

-

- Real-Time Market Impact Tracking

-

- This tool visually tracks the real-time market impact of large hidden orders.

- This visualization offers a clearer understanding of how these orders affect market behavior.

How to Spot Iceberg Orders Through Volume Patterns?

Traders often spot iceberg orders by analyzing volume patterns in the market. For example,

- For instance, repeated large volumes are being executed at the same price with minimal price movement.

- Now, it could indicate that an iceberg order is absorbing trades.

- This pattern suggests that a large hidden order is being executed in small portions.

- Also, it indicates that this large hidden order is preventing significant price changes despite substantial trading activity.

Learn to spot iceberg orders with precision using Bookmap – Join now!

How to Use Price Action for Confirmation?

It is worth mentioning that price action when used in conjunction with tools like the Stops & Icebergs Indicators, can provide additional confirmation of iceberg orders.

Let’s understand better through an example:

- Say the price consistently fails to break through a certain level despite heavy selling.

- Now, it could indicate the presence of an iceberg buy order absorbing the sell pressure.

- These tools help visualize such scenarios.

- They show traders when and where iceberg orders are likely to influence market behavior.

- This combined approach offers a more comprehensive understanding of market dynamics.

- It helps traders make better-informed decisions.

Recognizing Iceberg Order Absorption

Most traders detect iceberg order absorption by observing how market orders are executed at specific price levels. Usually, this recognition is done in the following manner:

-

- Say a trader notices repeated buying pressure at a particular price level with minimal upward movement.

- This situation indicates a large iceberg sell order is absorbing the buy orders.

- Despite the continuous buying, the price doesn’t rise.

- This happens because the hidden sell order is gradually being executed without fully revealing its size.

For more clarity, let’s study a scenario related to spotting an iceberg sell order:

Assume that a trader sees that every time the price of a stock reaches $50, there is strong buying activity. However, the price fails to move higher and remains stagnant. Now, this pattern suggests that an iceberg sell order is present at $50. This order absorbs the buying pressure and prevents the price from rising.

How Can You Confirm Iceberg Orders with Real-Time Order Flow Analysis?

To confirm the presence of iceberg orders, traders use real-time order flow analysis by monitoring the order book. If they see large orders consistently refreshing after partial execution, it indicates an iceberg order.

For example,

- Say a large order at a specific price is only partially filled.

- But it reappears at the same level repeatedly.

- Now it suggests that the hidden portion of an iceberg order is being executed.

- This real-time analysis, combined with tools like the Stops & Icebergs Indicators, provides strong confirmation of iceberg orders in the market.

Enhance your trading with Bookmap’s tools for detecting iceberg orders. Sign up today!

Strategies for Trading Around Iceberg Orders

Iceberg orders often conceal the true size of large trades. By doing so, they offer unique trading opportunities. Traders can capitalize on them by understanding either of the following:

- How to align with hidden orders?

or

- How to trade against these hidden orders?

Moreover, traders can also use real-time tools and scalping techniques. Now, let’s check out some popular strategies for trading around iceberg orders:

Strategy I: Trading with the Iceberg Order

When traders detect an iceberg order, it often indicates substantial hidden demand (for buy orders) or supply (for sell orders). By aligning their trades with the direction of the iceberg order, traders can capitalize on the market’s underlying strength. Let’s understand through an example:

- Say a large iceberg buy order is identified at a specific price level.

- Here a trader decides to enter a long position.

- They are expecting that the hidden demand will support the price.

- As the iceberg order gradually absorbs selling pressure, the trader anticipates a price rally once the iceberg order is fully executed.

Now, it is significant to note that the presence of a substantial iceberg order provides traders with greater confidence in the market’s direction. It reduces the perceived risk of the trade. When traders see repeated absorption of market pressure at a critical level, it signals that the iceberg order is likely to maintain a strong support or resistance point.

Strategy II: Trading Against the Iceberg Order

One strategy for trading against an iceberg order is to wait until the iceberg order is fully executed. This often leads to:

- A price reversal

or

- A continuation in the opposite direction

This happens as the market reacts to the exhaustion of hidden liquidity. For example,

- Say a trader identifies a large iceberg sell order consistently absorbing buy orders.

- Now, they wait for the sell order to be fully executed.

- Once the selling pressure subsides, the trader enters a long position.

- They anticipate a rebound as the market stabilizes and buyers regain control.

While practicing this strategy, traders also use real-time order flow tools. These tools help to detect when an iceberg order has finished absorbing market orders. It must be noted that this is often followed by rapid price movement, which creates an opportunity for quick profits.

For example:

-

- Say that a trader observes a large iceberg sell order being executed at a resistance level.

- As the order nears completion, buy orders begin to overwhelm the remaining sell orders.

- This signals the end of absorption.

- Now, the trader enters a long position.

- They do so as they are anticipating a breakout above resistance as the hidden selling pressure diminishes.

Strategy III: Scalping Opportunities Around Iceberg Orders

Iceberg orders often create short-term “price stability.” They absorb significant market orders without allowing the price to move significantly. Most scalpers capitalize on this by trading within the narrow range established by the iceberg order.

For example:

- A scalper identifies an iceberg buy order absorbing sell orders at a specific level.

- By entering long positions near the bottom of this range and quickly exiting as the price moves up slightly, the trader accumulates small profits with minimal risk.

- By following this strategy, the trader benefits from the temporary stability provided by the iceberg to make consistent gains.

How Scalpers Can React to Changes in Order Flow?

Scalpers must be ready to react quickly to any changes in the order flow around iceberg orders. That’s because a sudden reduction in the effectiveness of an iceberg order often leads to swift price movements. This presents a prime opportunity for quick scalp trades.

For example:

- Say a scalper notices that an iceberg order is starting to get overwhelmed by aggressive market orders.

- They swiftly enter a position to capture the ensuing price movement.

- Whether the price continues in the same direction or reverses, the scalper profits from the quick changes in market dynamics which is caused by the shift in order flow.

Conclusion

Trading around iceberg orders significantly enhances trading strategies. That’s because these orders influence market behavior by hiding large trades. This creates opportunities for traders who can identify and react to these hidden orders. Whether you choose to trade with or against these orders, by recognizing the presence of iceberg orders you can predict price movements more accurately.

By aligning your trades with the direction of an iceberg order, you can benefit from the support or resistance they provide. On the other hand, waiting for an iceberg order to be fully executed can open up opportunities to trade in the opposite direction. In this manner, you can capitalize on the price shifts that often follow the order’s completion.

Scalpers, too, can take advantage of the temporary price stability created by iceberg orders. They can also make quick profits from small price movements within a narrow range. Moreover, by leveraging our advanced market analysis tools and modern features, we enable you to monitor real-time order flow and enhance your detection abilities. Join us today!