Ready to see the market clearly?

Sign up now and make smarter trades today

Education

April 8, 2025

SHARE

How USD Strength and Weakness Impacts Liquidity, Volatility, and Execution Across Markets

The backbone of global trade is the USD! As of January 2025, the U.S. dollar accounted for 50.2% of all international currency transfers via SWIFT, marking its highest share since mid-2023. Thus, we can say USD doesn’t just move markets. It shakes them! Whether trading stocks, futures, or crypto, you must understand how USD impacts markets. Its strengths, weaknesses, and volatility significantly affect market liquidity. Besides, it also influences price swings and creates execution challenges.

Want to trade profitably despite USD fluctuations? In this article, you’ll learn how USD strength and weakness shift liquidity (across asset classes) and how sudden USD moves make trade execution more challenging. Also, some practical strategies for dealing with USD-driven events will also be shared. We will introduce you to our modern real-time market analysis tool, Bookmap, and tell you how to track real-time liquidity using it. You will also learn to maintain a Trading Journal with us for performance analysis.

Read this article till the end to anticipate market shifts and execute better trades.

Why does the USD matter across futures, stocks, and crypto?

The U.S. dollar (USD) is the world’s reserve currency.

Most global trade, commodity pricing, and financial transactions are conducted in USD.

Thus, when the dollar moves, it affects nearly every asset class (from futures and stocks to crypto). Let’s learn how through the graphic below:

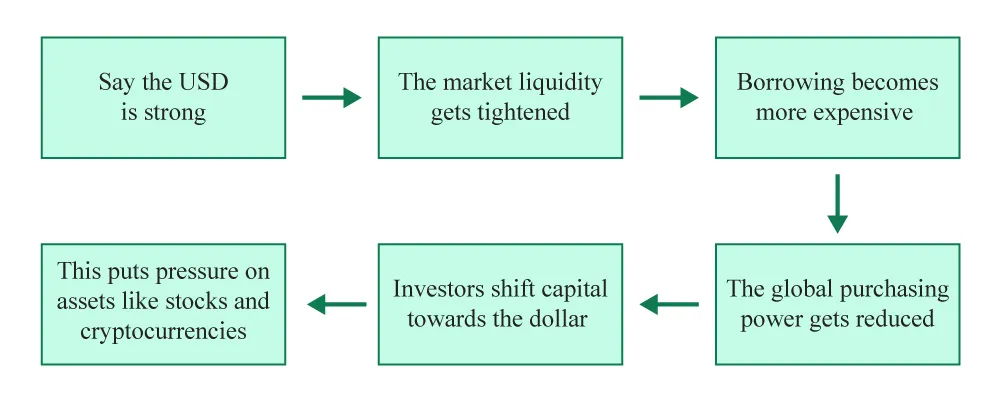

How does USD Strength impact markets?

Let’s understand better through an example:

- Suppose the Federal Reserve raises interest rates.

- Higher rates attract investors to USD-based assets.

- This move makes the dollar rally.

Such a rally has ripple effects across asset classes:

| Commodities (like oil and gold) | Stocks | Crypto |

|

|

|

Dollar Volatility & Trading

When the USD moves unpredictably, it creates uncertainty in the markets. Such a dollar volatility usually leads to sharp price swings across:

- Futures,

- Stocks, and

- Crypto.

This volatility makes trading riskier, making it necessary to watch USD movements closely.

How USD Strength and Weakness Influence Liquidity?

The strength or weakness of the USD affects market liquidity. It causes shifts in capital flows between:

- U.S. assets,

and

- International markets.

These shifts significantly impact stocks, bonds, and emerging economies.

The Impact of USD Strength on Liquidity

When the USD strengthens, global investors move their money into U.S. assets like:

- U.S. stocks,

- U.S. bonds, and

- Treasury securities.

This shift occurs because a stronger dollar makes U.S. investments more attractive. Also, it becomes relatively safer compared to riskier foreign markets. Now, please note that these capital movements lead to two major effects:

| Effect I: Liquidity increases in U.S. equity markets | Effect II: Liquidity tightens in emerging markets |

|

|

Let’s understand better through an example:

In early 2022, the Federal Reserve aggressively raised interest rates. It did so to combat inflation, causing the USD to strengthen as higher rates made U.S. assets more appealing. The impact was clear:

- Investors moved capital into U.S. stocks and bonds, increasing market liquidity in the U.S.

- Many emerging markets (which rely on foreign investment) saw outflows. Their stock markets declined, and borrowing costs rose. Consequently, their currencies weakened.

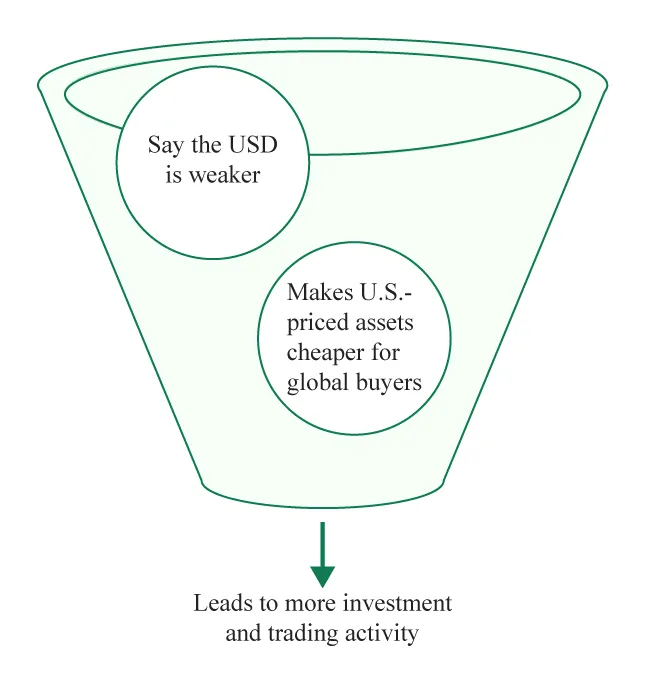

USD Weakness and Its Liquidity Effects

When the USD weakens, investors shift their money into alternative assets like:

- Commodities,

- Emerging markets, and

- Crypto.

This shift increases market liquidity in these areas. Learn why through the graphic below:

The impact of USD weakness on liquidity

Let’s gain more clarity:

How Does a Weak USD Impact Liquidity?

Primarily, it leads to:

| Commodities Gain Liquidity | Emerging Markets Benefit | Crypto Sees More Capital Inflows |

|

|

|

Let’s Study an Example Related to 2021 Weak Dollar and Market Liquidity

In 2021, the USD weakened due to:

- Ultra-low interest rates,

and

- Massive stimulus measures.

This weakening had a clear impact on markets:

| Commodities surged | Crypto rallied | Emerging markets saw inflows |

|

|

|

This clearly shows that USD strength can dramatically change liquidity conditions across different asset classes. Understand real-time market responses clearly. Visit the Bookmap Learning Center for detailed trading insights.

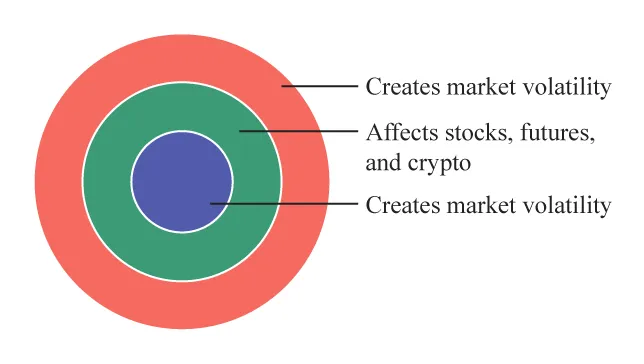

The Connection Between USD Volatility and Market Volatility

Please realize that the USD is a major driver of global markets. Check out the graphic below to learn what happens when its value swings unpredictably:

How do unpredictable USD price swings impact the market?

Let’s understand all these impacts in detail:

Increased Volatility from Sudden USD Shifts

Sharp and unexpected changes in the USD can trigger significant market swings because:

-

- Stocks react to currency shifts:

- A sudden jump in the USD hurts multinational companies.

- It reduces their foreign earnings.

- In contrast, a weaker USD boosts exports.

- Stocks react to currency shifts:

- Futures markets become unstable:

-

- Commodities like oil and gold often see price spikes when there are unexpected swings in USD.

- Crypto experiences extreme swings:

- Now, many traders view Bitcoin as an alternative to fiat currencies.

- It has been observed that rapid USD movements lead to significant crypto price fluctuations.

Let’s study an example for better understanding:

- In March 2020, the Fed made an emergency rate cut due to COVID-19 fears.

- The USD initially weakened.

- It led to a sharp Bitcoin rally.

- Also, there was increased buying activity in gold.

- Later, in 2022, the Fed raised rates aggressively to fight inflation.

- Now, this caused the USD to strengthen.

- This move led to:

- Dollar volatility,

- A stock market sell-off, and

- Sharp drops in crypto prices.

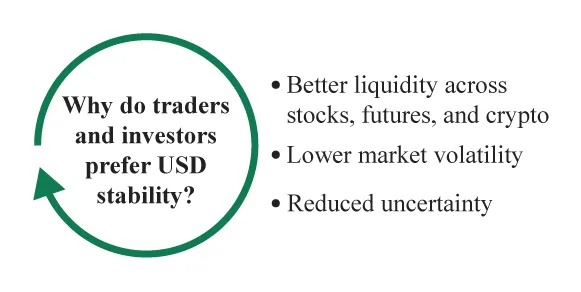

Predictability and Stability from USD Stability

When the USD remains stable, markets are usually calmer. Most traders and investors prefer USD stability. Let’s learn why through the graphic below:

How does USD stability help traders and investors?

Let’s gain more clarity:

How Does a Stable USD Affect Markets?

Primarily, it leads to three primary visible effects:

| Effect I: Reduced Intraday Volatility | Effect II: Clearer Trade Execution | Effect III: Calmer Trading Conditions |

|

|

|

Let’s study an example:

- In 2017, the Federal Reserve followed a stable monetary policy.

- It raised interest rates in a gradual and predictable manner.

- Due to this, the USD remained steady.

- This steadiness led to the following:

- Lower stock market volatility allowed steady growth in equities.

- Commodities moved in predictable ranges because traders weren’t reacting to sharp currency swings.

Navigate liquidity shifts caused by USD movements confidently—use Bookmap’s advanced visualization tools.

How USD Moves Impact Execution in Trading?

The USD plays a critical role in trading. When its value changes rapidly, it affects:

- Market liquidity,

- Spreads, and

- Trade execution.

Such sudden USD moves make it harder for traders to enter and exit positions. Let’s understand in detail:

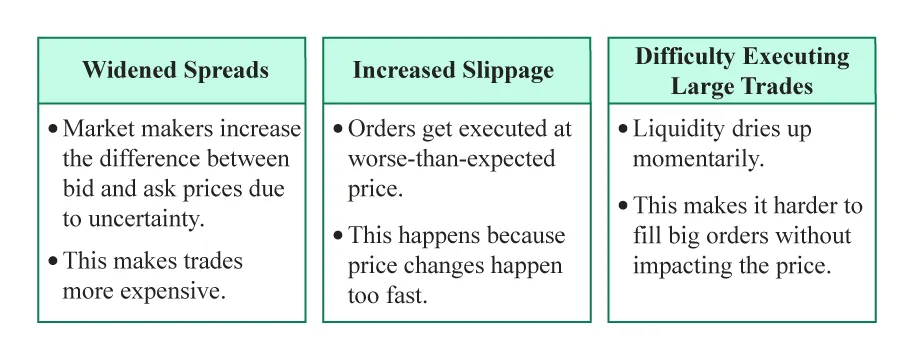

Order Execution Challenges Amid Rapid USD Moves

Usually, USD moves sharply due to:

- Economic data,

- Central bank decisions, and

- Unexpected events.

In such cases, you, as a trader, often face several execution challenges. Learn them through the graphic below:

Execution challenges arising due to USD volatility

Let’s study an example:

Say a trader is placing an order right before a critical U.S. CPI report (inflation data) or a Fed interest rate decision:

- Now, assume that the USD suddenly strengthens or weakens after the announcement.

- The markets react instantly.

- Due to such a reaction, the trader trying to buy or sell (a stock, futures contract, or crypto asset) experiences slippage.

- Their order gets filled at a less favorable price than expected.

Please note that high-frequency traders and algorithms often operate in such trading environments. They can react faster than human traders, which makes execution even trickier.

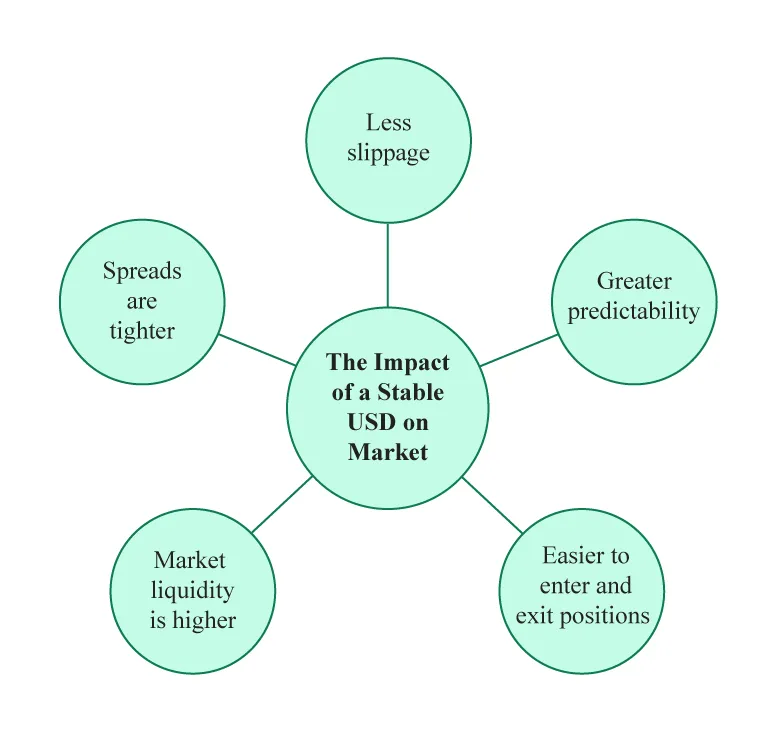

Improved Execution Conditions in Stable USD Markets

In contrast, when the USD remains stable, trading conditions improve significantly. Let’s see how through the graphic below:

How does a stable USD impact the market?

Let’s achieve a better understanding through an example:

- In 2019, the Federal Reserve maintained a steady monetary policy.

- The USD remained relatively stable.

- This stability created ideal conditions for traders.

- Equities saw smooth order execution. Investors could buy or sell large positions without major price disruptions.

- Futures markets remained highly liquid. It was easier for traders to enter and exit positions without excessive costs.

Track and improve your strategies during USD volatility—start journaling trades with Bookmap’s Trading Journal.

Actionable Insights: Trading Effectively Around USD Movements

The USD impacts market trends. It influences:

- Market liquidity,

- Volatility, and

- Trade execution.

As a trader, you can follow these key strategies to trade smartly when the USD moves:

Recognize High-Impact Events in Advance

Please note that the USD movements are often a result of certain scheduled economic events, such as:

- FOMC Meetings: Federal Reserve interest rate decisions cause sharp shifts in USD strength.

- CPI Releases: Inflation data directly influences Fed policy. It impacts dollar volatility.

- Nonfarm Payrolls (NFP): Job reports affect market expectations on interest rates. They cause quick market reactions.

Some Practical Tips to Prepare for Major USD Events

Firstly, develop your entry and exit strategies. Before high-impact USD events, you should define:

- Risk levels,

- Target prices, and

- Stop losses.

Additionally, you should:

- Use Limit Orders: Market volatility can cause price jumps; limit orders help avoid unfavorable fills.

- Reduce Position Size if Necessary: During volatile USD periods, it is better to work with smaller positions.

Visualize Liquidity Changes in Real-Time

You can start using liquidity visualization tools, such as our platform, Bookmap. Using it, you can easily track how orders are placed, canceled, and executed in response to USD movements. Also, you can:

- Observe liquidity changes in real time,

and

- Improve your trade timing.

How Does Real-Time Visualization Help Traders?

By using our avant-garde real-time analysis tool, Bookmap, for visualization, you can gain the following benefits:

| Identify Large Buy/ Sell Orders | See Liquidity Drain Before Volatility Hits | Confirm Trade Setups |

|

|

or

|

Let’s gain more clarity through an example:

Say a trader watches Bookmap before a Nonfarm Payrolls (NFP) release:

- Pre-Event Liquidity Clusters: The trader notices strong buy liquidity at a key support level.

- Sudden Liquidity Pull Before Release: Market makers withdraw large orders, signaling likely volatility.

- Sharp Move Post-Announcement: The trader waits for price confirmation based on liquidity positioning before entering.

Keep a Trading Journal for USD-Driven Trades

Ideally, you should keep a trading journal which helps you to:

- Analyze how USD strength impacts markets,

and

- Refine your strategies over time.

Generally, a structured journal records the following:

| Items covered by a trading journal | Meaning |

| Trade Rationale |

|

| Execution Details |

|

| Outcome and Lessons |

|

Let’s understand the practical application through an example:

A trader records trades made during an FOMC meeting in the following manner:

| Observation | Trade Setup | Result | Lesson |

| Fed raised rates by 0.25%, causing USD to strengthen rapidly. | Shorted EUR/ USD based on expected dollar strength. | Exit hit the profit target. However, slippage occurred due to high volatility. | Use limit orders next time for better execution. |

Confused about where to begin? You can start using our Bookmap’s Trading Journal. Using it, you can record USD-driven trades. Such a recording allows you to adjust your trading strategies based on USD strength and market liquidity fluctuations. Explore Bookmap’s Trading Journal to track your trades during major USD moves.

Conclusion

USD movements influence market liquidity and volatility. A strong USD can pull capital into U.S. assets, while a weaker USD boosts commodities, emerging markets, and crypto. They also create serious challenges in trade execution because rapid dollar shifts widen spreads and increase slippage.

To deal with USD-driven events, you must prepare in advance by tracking liquidity in real time and refining strategies through trade journaling. The perfect tool for both is our modern real-time analysis tool, Bookmap!

Using Bookmap, you can visualize the market, letting you identify liquidity shifts and improve your trade timing. At the same time, by maintaining a trading journal with us, you can smartly learn from past USD-driven trades. Visit the Learning Center to master trading in volatile USD conditions.