Our 4th of July Sale is Live

Offer Valid July 4 – July 11

Get 50% off Global+ AND data for 3 months—or save 30% on Global+ for the full year

Claim Your DealReady to see the market clearly?

Sign up now and make smarter trades today

Education

April 6, 2024

SHARE

Order Flow Phenomena

All financial market assets, especially financial derivatives such as futures, can experience substantial price movements, which occur more frequently than efficient market theories suggest they should. This can often be down to the collective crowd psychology experienced by speculative markets, which has led to panicked buying and selling throughout history.

Most markets have experienced extreme price movements at one time or another, and this is something that speculative traders try to catch by positioning themselves on the right side of such moves.

Order flow can explain such moves, from the bog standard day-today price discovery process of market microstructure, to epic price moves such as flash crashes.

What Is Order Flow?

All electronic financial markets are dual auctions, with the price discovery process dictating changes in price. Price equilibrium is temporarily found when buyers and sellers are matched. But as soon as aggressive buyers step into the market for whatever reason, they can push prices higher if there isn’t enough liquidity on the other side. The same is true in reverse, with aggressive sellers threatening the equilibrium of price if they take too much liquidity out of the market.

Types of Order flow events

While there is no “system” of order flow analysis, there are various methods than can be used to gauge activity in the market. This usually simply comes down to studying the interactions between volume and liquidity at various price levels.

Let’s explore some of the most important order flow events that are relatively common and easy to spot.

Order Book Imbalance

Order Book Imbalance is calculated by subtracting the number of accountable limit sell orders from the number of account limit buy orders in the order book. On the Bookmap Imbalance indicator, this number is presented as a ratio.

This value can be used to quickly see how one-sided the market is, which could tip you off as to the extent of the momentum behind any move, or if there is a potential exhaustion in play.

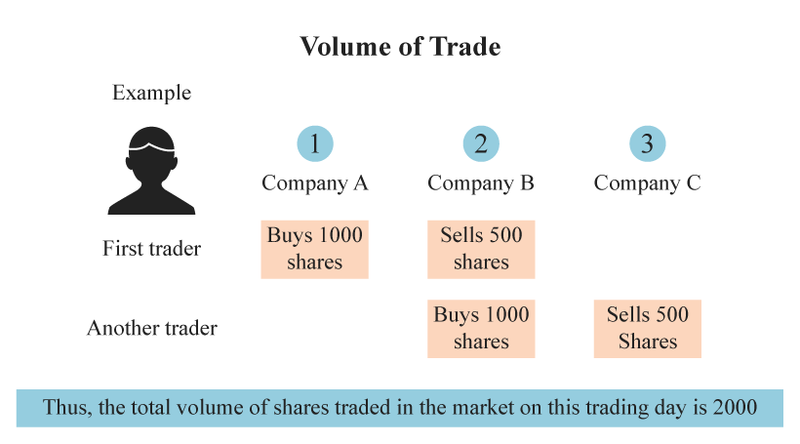

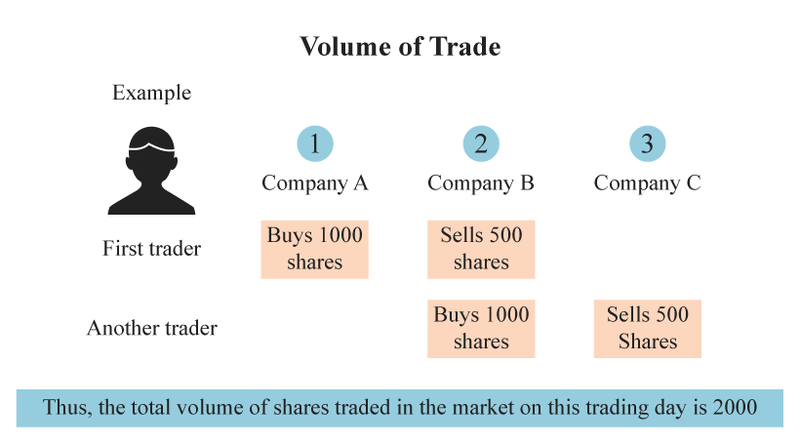

Volume of Trade

This is the total number of shares or contracts traded between buyers and sellers across any given time frame (usually a day).

Volume of Trade can be used in conjunction with other order flow analysis techniques, and is often used to track accumulation. It can be also useful for understanding if a price breakout is sustainable or not.

Stop Runs

Stop running is sometimes referred to as a stop hunting, but not every stop run is a “price manipulation” event. Triggering stop orders is a vital function in financial markets, because they can be used to limit losses (when used correctly).

Since stop orders are executed in the market like market orders and consume liquidity, if there are many large stop orders, they can push prices further and further, thereby triggering more stop orders. This is known as a stop cascade.

Stop runs generally occur at market extremes and other areas where traders tend to put protective stop losses (such as support and resistance levels or round numbers), and tend to be very quick and explosive moves. With MBO data, it is possible to see stop runs on the chart after they have occurred with the Stops & Icebergs Indicator.

Triggered Iceberg Orders

Iceberg orders are orders that have been broken into smaller limit orders (often with the aid of an algorithm) to disguise the actual quantity of orders intended to be traded.

Due to the hidden majority of the orders, the visible orders are just the “tip of the iceberg.”

Like stops, triggered icebergs on the CME can be seen with the Stops & Icebergs indicator. Many Bookmap traders use the location of Icebergs in their arsenal of trading signals. Join our free Discord chatroom and see how they do it today.

Spoofing orders

Spoofing orders basically act as “fake” support or resistance levels, using the huge order resting in the order book to intimidate other market participants into trading in the opposite direction. Spoofing orders are not intended to be traded and are usually cancelled before they can be hit, but it doesn’t mean that they can’t be hit.

We have written exclusively about spoofing in our article What is Spoofing in Trading?

Order Flow Indicators

With the advent of Bookmap and its order flow visualization tools, understanding order flow has never been easier. One of the issues traders often struggled with was the fact there are so many constantly changing numbers to keep track of, which are now especially faster with HFTs involved.

Large Lot Tracking

The Large Lot Tracker can display an approximation of the largest single pending order above a certain threshold. For the order to be shown, its size must be at least 20% of the total order at the relevant price level.

Large lots can show the presence of large, dominant market participants are specific price levels.

Strength Level Indicators

Strength level indicators contain two modes: Underflow and Resistance. By reading the amount of orders in the order book and the size of the transactions, Underflow also measures the volume of the orders. The transaction is deemed an iceberg order if it exceeds the liquidity in the order book.

Resistance mode measures how fast limit orders are added to the order book after a transaction.

The Strength Level indicator is all about highlighting the possibility of hidden orders in the market, which could prove to be vital to price movements.

Volume Delta

Volume delta is the difference between the volume of aggressive market trades, both on the buy and sell side.

Cumulative Volume Delta is often used to look for divergences against price action. You can watch our short video about this indicator here.

Conclusion

Bookmap is all about order flow. If you want to really understand market microstructure and the resulting order flow phenomena, you need to see into the market.

Try it out for free today.