Imbalance Indicators

Application

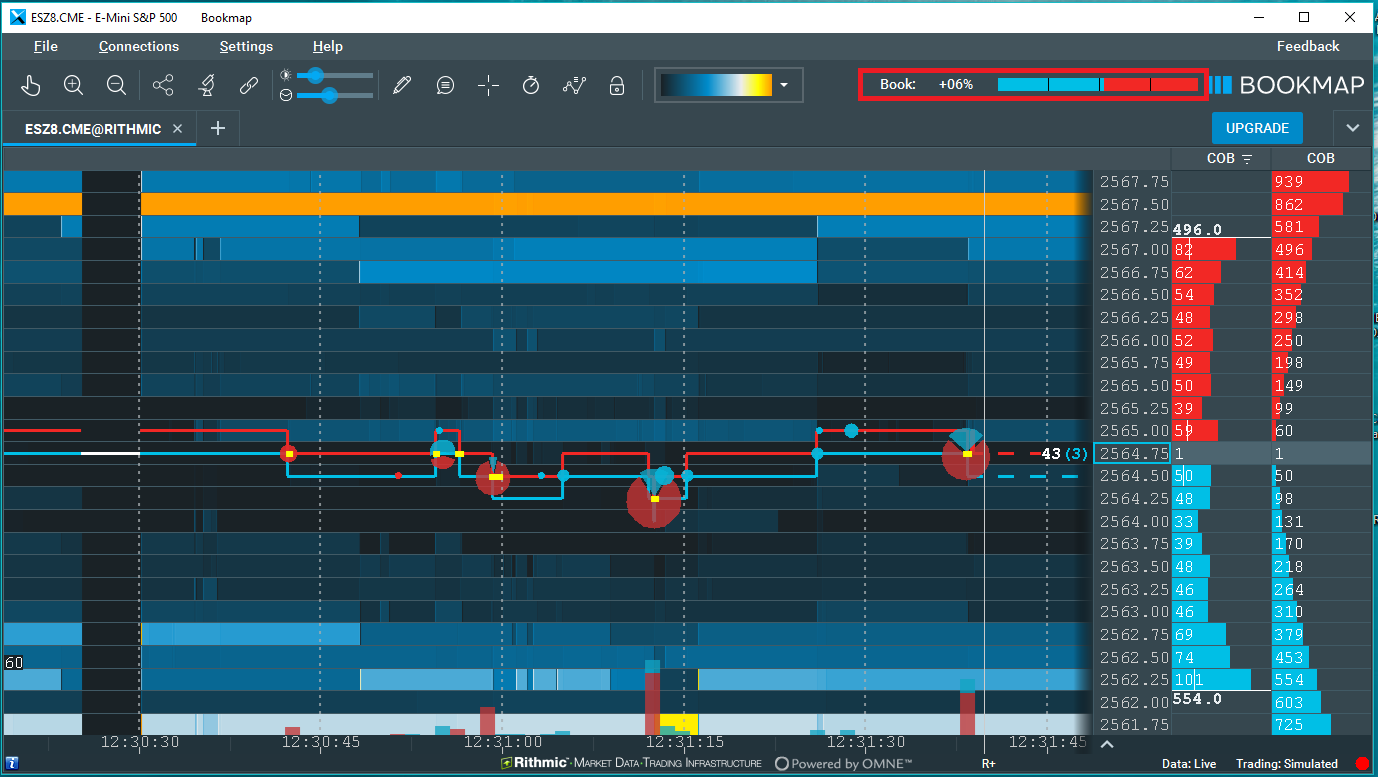

Located in the upper right corner of the chart, these indicators show Order Book Imbalance and Volume Imbalance.

Order Book imbalance represents the ratio between the average bid order book size versus the average ask order book size. The ratio is calculated as:

𝑁𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑎𝑐𝑐𝑜𝑢𝑛𝑡a𝑏𝑙𝑒 𝑏𝑢𝑦 𝑜𝑟𝑑𝑒𝑟𝑠 − 𝑁𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑎𝑐𝑐𝑜𝑢𝑛𝑡𝑎𝑏𝑙𝑒 𝑠𝑒𝑙𝑙 𝑜𝑟𝑑𝑒𝑟𝑠

𝑁𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑎𝑐𝑐𝑜𝑢𝑛𝑡a𝑏𝑙𝑒 𝑏𝑢𝑦 𝑜𝑟𝑑𝑒𝑟𝑠 + 𝑁𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑎𝑐𝑐𝑜𝑢𝑛𝑡𝑎𝑏𝑙𝑒 𝑠𝑒𝑙𝑙 𝑜𝑟𝑑𝑒𝑟𝑠

Volume imbalance represents the ratio between the volume generated by buying aggressors (market order transactions on the offer) versus the volume generated by selling aggressors (market order transactions on the bid). The ratio is calculated as:

𝑁𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑎𝑐𝑐𝑜𝑢𝑛𝑡a𝑏𝑙𝑒 𝑏𝑢𝑦 𝑣𝑜𝑙𝑢𝑚𝑒 − 𝑁𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑎𝑐𝑐𝑜𝑢𝑛𝑡𝑎𝑏𝑙𝑒 𝑠𝑒𝑙𝑙 𝑣𝑜𝑙𝑢𝑚𝑒

𝑁𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑎𝑐𝑐𝑜𝑢𝑛𝑡a𝑏𝑙𝑒 𝑏𝑢𝑦 𝑣𝑜𝑙𝑢𝑚𝑒 + 𝑁𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑎𝑐𝑐𝑜𝑢𝑛𝑡𝑎𝑏𝑙𝑒 𝑠𝑒𝑙𝑙 𝑣𝑜𝑙𝑢𝑚𝑒

The two imbalance indicators are calculated according to the current chart range. Any change to the chart range (either by dragging or by zooming in or out) will affect the readings of the imbalance indicators.

Interpretation

The Imbalance Indicators serve as tools for users to evaluate when market activity heavily favors one direction, influenced by order book and order flow activity. This assessment aids in identifying momentum shifts or potential exhaustion points in the market.

Settings

Imbalance Indicator Ratios are shown at the top right of the chart. When an Imbalance Ratio hits or surpasses 10%, it's displayed in the buyer's color. Conversely, if it's -10% or lower, it appears in the seller's color.

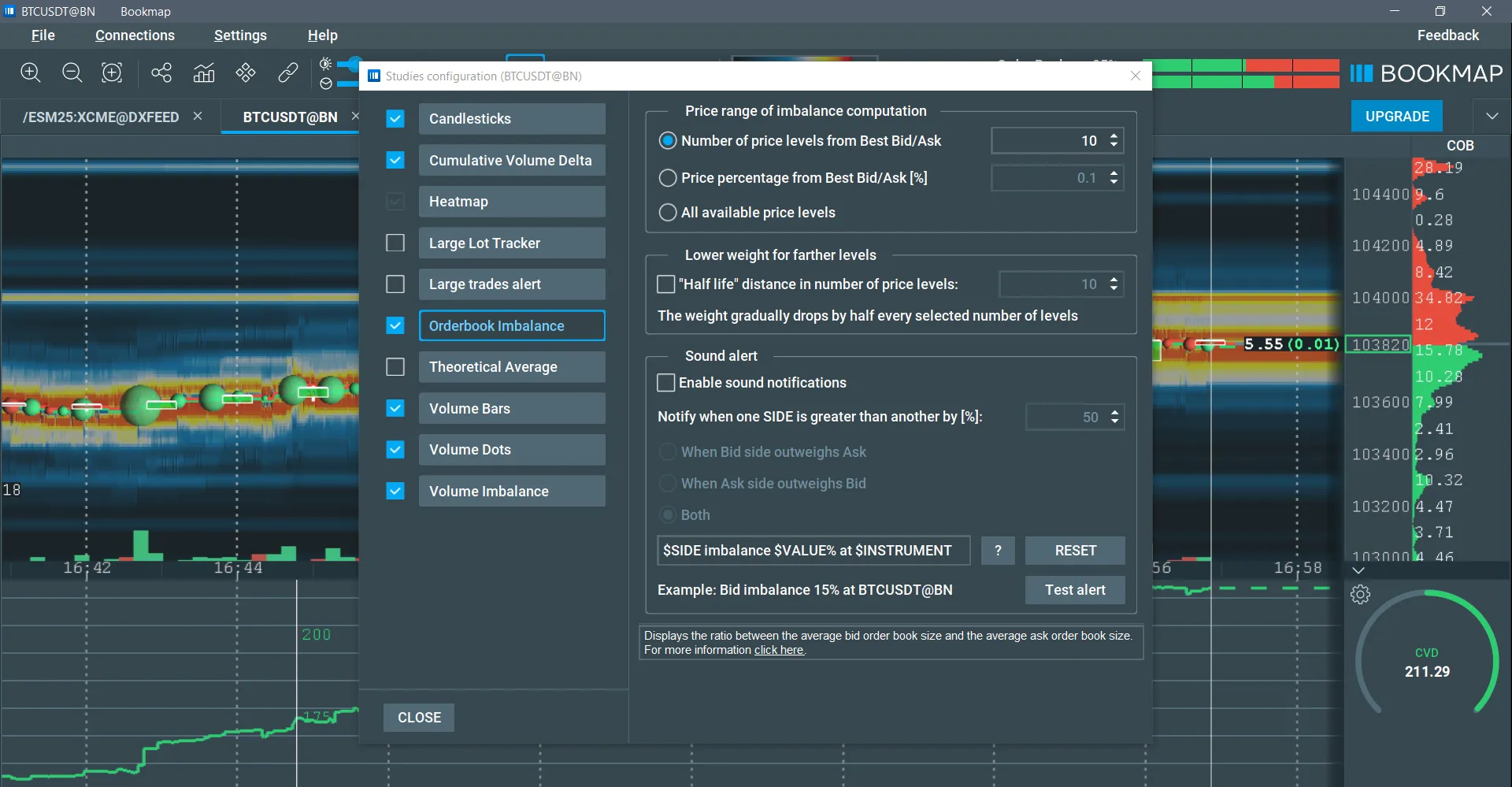

To activate the Imbalance Indicator Display, click the chart's studies panel icon and select an imbalance indicator.

For color customization, check the Colour Settings section. The studies panel also offers Order Book imbalance settings, as shown below.

Order Book Imbalance Settings

- Price Range for Imbalance Computation: You can determine the number of price levels to include in the computation. This can be set as an absolute number or as a percentage relative to the best bid and ask. Alternatively, you can choose to include all available levels.

- Weighting for Distant Levels: Adjust the weight assigned to different price levels. Levels closer to the best bid and ask can carry more weight in the imbalance calculation. Specify the number of levels interval at which the weight assigned to the next level decreases by 50%.

- Sound Alerts: Set up audible alerts triggered when the imbalance reaches a specific percentage you configure.

Limitations

Imbalance Indicators consider the entire visible range of the chart for their calculations. To modify the time range considered when computing imbalance ratios, users can zoom in, zoom out, or drag the chart accordingly.