Ready to see the market clearly?

Sign up now and make smarter trades today

Education

October 22, 2024

SHARE

Paper Trading for Advanced Traders: Refine Your Strategy Without the Risk

The fear of losing money can churn stomachs! But does it mean you don’t experiment? Try paper trading. It is your risk-free playground for mastering market strategies. In this article, we will explain and present you the world of paper trading, starting with a clear explanation of what it is and how it mimics real trading environments.

Next, you will discover the benefits of using paper trading for strategy testing, market exploration, and risk management. We’ll also cover why experienced traders rely on this method to fine-tune their strategies and adapt to changing market conditions. Plus, you’ll learn how our advanced tools like Bookmap’s liquidity heatmap and DOM Pro can optimize your paper trading game. Let’s begin.

What is Paper Trading?

Paper trading is a method of simulating real-world trading. It does not involve any financial risk. In this practice, traders make trades using virtual funds in live market conditions. This technique draws inspiration from flight simulators, which enable pilots to practice without danger. Paper trading provides the same opportunities to learn, test, and refine trading strategies in a safe environment. This practice is invaluable for both:

- Beginners who want to gain experience,

or

- Experienced traders looking to test new strategies without the fear of losing money.

It is worth mentioning that the simulation mimics real trading platforms. It provides access to live market data. This enables traders to place buy and sell orders just as they would in actual trading. Most paper trading platforms replicate the order execution processes, and traders can track their portfolio performance in real-time.

The ability to analyze performance and adjust strategies without risk allows traders to experiment and hone their skills. This makes paper trading a valuable tool for learning how markets work. For those looking to transition from paper trading to live trading and understand the process in more detail, read our exclusive article.

Pros and Cons of Paper Trading

Through paper trading, users can practice and refine their strategies without financial risk. This makes it an excellent learning tool. However, on the negative side, it lacks the emotional intensity and market execution challenges of live trading. To present you with a complete picture, let’s study both the pros and cons of paper trading:

Pros of Paper Trading

- Risk-Free Practice:

Paper trading is an excellent tool for beginners to gain experience safely. Even experienced traders can use it to practice without risking any real money. This happens because it mimics real trading but uses simulated funds. In this way, paper trading allows traders to test strategies and learn about market movements without any financial risk.

- Strategy testing

Traders can use paper trading to test different strategies under real market conditions. They can experiment with complex strategies and analyze outcomes. Next, trading strategies can be adjusted without worrying about losses. This is especially beneficial before applying these strategies in live markets with real capital.

- Market Exploration

Through paper trading, you can explore various asset classes, such as futures or commodities, which are generally unfamiliar to a trader. You can easily experiment and learn how these markets work without facing any financial consequences.

Practice without the risk and learn how to trade like a pro with Bookmap’s paper trading. Start here!

Cons of Paper Trading

- Lack of Emotional Impact

Since no real money is involved, paper trading lacks the emotional experience of live trading. Traders don’t face the psychological highs and lows that come with real gains or losses. This can cause them to develop poor habits or fail to prepare for the emotional pressures of real trading.

- Execution Differences

Paper trading doesn’t fully replicate live markets. In real trading, factors such as slippage (when the price of a trade changes between placing and executing an order) and volatility affect trade execution. These differences lead to unrealistic expectations when transitioning from paper trading to live markets.

Successful trades in a paper trading environment sometimes lead to overconfidence when traders switch to real money. The lack of real financial risk causes traders to underestimate the challenges of live trading, where emotional pressures and market conditions are much more intense.

Why Experienced Traders Should Use Paper Trading

Experienced traders often use paper trading to refine their existing strategies. It is worth mentioning that even professional traders need to adapt their methods so that they can stay strong during market volatility or changing trends. For example,

- Say an experienced trader uses a high-frequency trading algorithm.

- They want to tweak its performance for volatile markets.

- Instead of risking real capital to test the adjustments, they safely simulate these changes in a paper trading environment.

- This helps them to gain confidence in the strategy’s effectiveness without the fear of financial loss.

Additionally, paper trading also allows experienced traders to experiment with unfamiliar markets, such as commodities or futures. That too without exposing themselves to risk.

It is common for professional traders who already have deep knowledge in one market to venture into another. For example:

- Say a crypto trader is interested in oil futures.

- They use paper trading to learn about the pricing, behavior, and trading patterns of this market.

- This process helps them gain experience in new asset classes and strategies.

- While doing so, they do not risk any capital.

Try your strategies in a risk-free environment with our real-time paper trading tools on Bookmap. Join now!

Optimizing Strategy Development with Advanced Paper Trading Backtesting

Through paper trading, traders can perform extensive back-testing of their trading strategies. Both manual and algorithmic strategies can be fine-tuned by running them through simulated markets. This allows traders to identify weaknesses and inefficiencies in their methods without risking real money.

In this way, paper trading enhances their real-time performance and ensures that their strategies are more adaptable and reliable. Traders must note that the paper trading technique is largely based on:

- Past data,

and

- Simulated future scenarios.

Now, let’s see the several ways in which traders can optimize their strategies via paper trading:

A) Test Strategies in Different Market Scenarios

One of the major advantages of advanced paper trading is the ability to test strategies across multiple market conditions:

- Bullish,

- Bearish, and

- Flat markets.

This helps traders understand how their strategies perform under various scenarios without any financial exposure. For example, a trader can simulate a highly volatile market during a major news event. By doing so, the trader can observe how well their risk management system holds up. Moreover, this type of testing indicates how strategies will perform in unpredictable environments.

B) Test Algorithmic Systems with Paper Trading

Several experienced traders use paper trading to check the performance of their algorithmic trading systems, such as high-frequency trading (HFT) algorithms. By simulating real-time market environments, they can observe how these systems perform without risking any capital.

For example:

- Say a trader implements a new HFT algorithm.

- They use paper trading to monitor its behavior during periods of high volatility or market stress.

- In this way, they assess how well the algorithm manages:

- Order execution,

- Latency, and

- Market fluctuations.

- This assessment ensures that the algorithm performs efficiently even in challenging scenarios.

C) Refine Algorithms for Better Results

Paper trading allows traders to fine-tune their algorithms based on real-time feedback from simulations. In a high-volume and volatile market, an algorithm generally needs adjustments to account for:

- Slippage,

- Trade execution delays, and

- Unexpected price movements.

By testing the system in a controlled environment, traders can refine these parameters. They can ensure the algorithm is well-optimized before it’s deployed in live trading. Such an assessment reduces the chances of losses and improves overall performance in real-world conditions.

Multi-Market Paper Trading Strategies

Traders aiming for multi-market diversification can also use paper trading. By using it, they can explore various asset classes without taking on real risk. This is particularly useful for traders who are proficient in one market but want to expand into others, like an equities trader exploring forex. See the graphic below to better understand its practical usage:

Moreover, paper trading also allows traders to test “cross-asset strategies,” such as analyzing correlations between different asset types. For example,

- Say a trader experiments with the relationship between oil prices and the USD/CAD currency pair.

- They use paper trading to simulate trades in both commodities and currencies.

- The trader observes how fluctuations in oil prices impact the value of the Canadian dollar.

- They fine-tune their hedging or correlation strategies.

- This gives traders valuable insights into how cross-asset dynamics function without real financial exposure.

Enhance your trading skills with our paper trading feature on Bookmap. Sign up today!

The Role of Bookmap in Advanced Paper Trading

Bookmap is a powerful market analysis tool that many traders use to get a detailed and real-time view of market activity. One of its standout features is the “liquidity heatmap.” It allows traders to see liquidity zones. These are areas where large buy or sell orders are placed across the order book. This visual representation helps traders understand:

- “Where market participants are positioned?”

and

- “Where do price reversals or support/ resistance occur?”

By using our liquidity heatmap in a paper trading environment, traders can practice and take positions based on this liquidity data without risking real money. For example, in futures markets, traders can enter and exit trades around these liquidity zones, helping to refine strategies in a simulated setting.

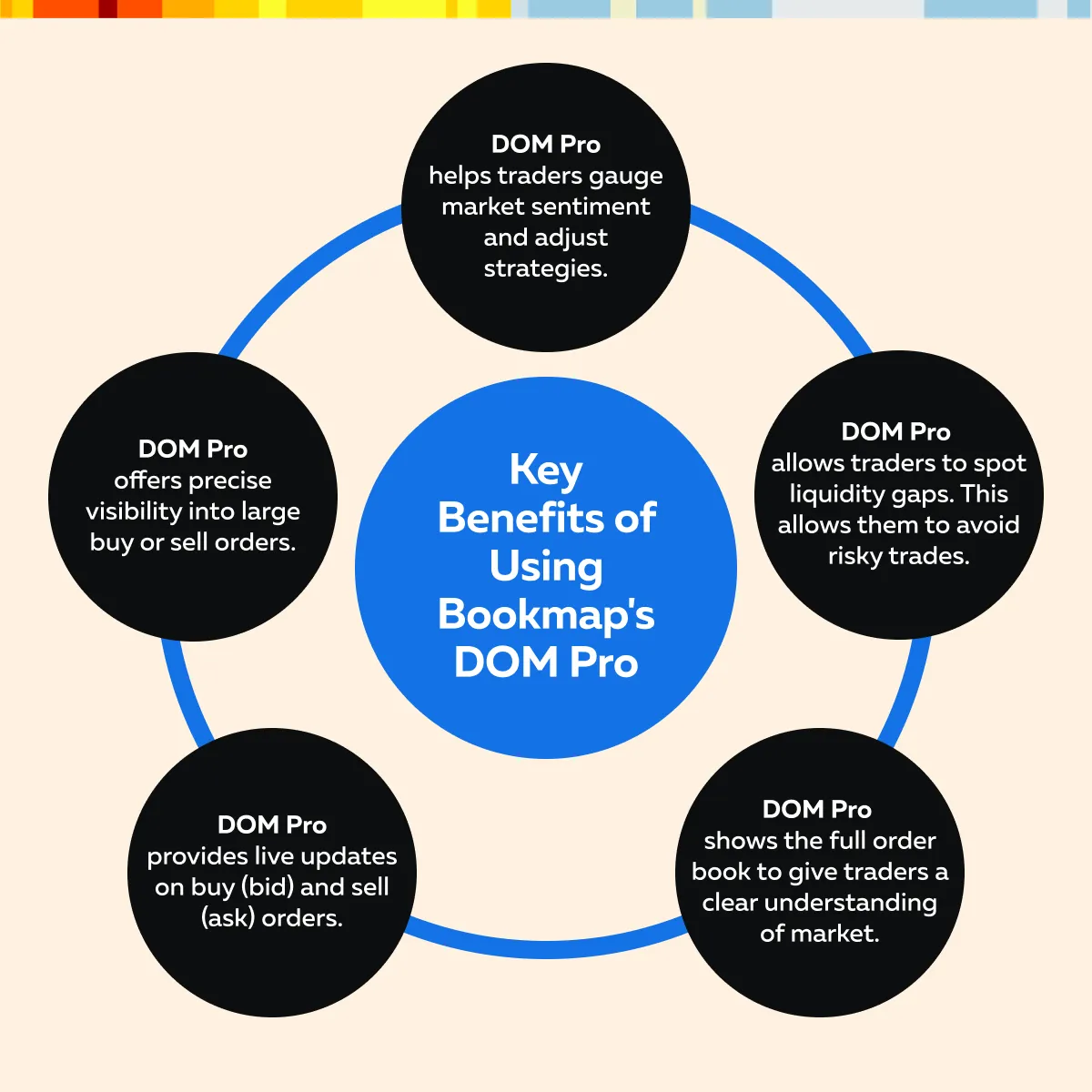

Another important feature of Bookmap is “DOM Pro (Depth of Market).” It shows the entire order book with real-time updates on bid and ask orders. For more clarity, see the graphic below to check the five key benefits of using DOM Pro in Bookmap:

Use Bookmap to Spot Real-Time Market Behavior

Bookmap also excels in providing detailed:

- Order flow analysis,

and

- Liquidity analysis.

For the unaware, order flow shows how many orders are executed at various price levels. By analyzing it, traders can understand the real-time buying and selling pressure. Moreover, this data can be used to refine strategies for entering trades during volatile moments, such as news releases or earnings reports. For example,

- Say a trader is using Bookmap’s DOM Pro to monitor the market during a company’s earnings report.

- Before the report, the order book shows:

- 1,000 buy orders at $50,

and

- 1,200 sell orders at $55.

- The market seems balanced, with no major shifts in price expected.

Now, after the earnings report is released, the company announces better-than-expected profits. Immediately, the trader notices a spike in the number of buy orders.

-

- Suddenly, 5,000 buy orders appear at $52, while sell orders remain at 1,200.

- This signals increased demand and shows that the stock price might rise soon due to positive sentiment.

- After this, the trader decides to adjust their entry strategy.

- Instead of waiting for the price to hit $50, they place a buy order at $53.

- By doing so, they can enter the market before it moves too high.

- Since they are paper trading, they simulate the trade without risking real money.

Additionally, the trader develops a risk management strategy. Given the volatility following the earnings report, they place a stop-loss order at $49.50.

Conclusion

Paper trading helps both beginners and experienced traders. It offers a risk-free way to test strategies in real market conditions. For advanced traders, it provides a platform to refine existing strategies and adapt to market changes without the fear of financial loss. Whether you’re testing high-frequency trading algorithms or exploring unfamiliar markets like futures or commodities, paper trading allows you to experiment safely.

Now, coming to our Bookmap, you can significantly enhance your paper trading experience using our advanced market analysis tool. It offers several real-time data features like the “liquidity heatmap” and “DOM Pro.” These tools offer a detailed view of the market and allow traders to analyze:

- Order flow,

- Liquidity zones, and

- Future price movements

Using these insights during paper trading, you can smartly refine your strategies for entering and exiting trades. Moreover, you can even test your strategies across different market scenarios; bullish, bearish, or flat. Do you wish to make your paper trading even more effective? Join our Bookmap today and see the difference!