Ready to see the market clearly?

Sign up now and make smarter trades today

Book Summaries

September 13, 2024

SHARE

Top 7 Must-Read Books for Traders in 2024

Staying ahead requires more than just a good strategy. Success in financial markets demands a deep understanding of both market dynamics and personal psychology. The best way to gain this insight is from some of the best books for traders.

This article presents seven must-read books for traders in 2024. Each book offers unique acumen to help you deal with the complexities of the financial markets. You’ll explore how mastering the mental game with Mark Douglas’s “Trading in the Zone” can improve your emotional discipline and trading consistency. Discover Jesse Livermore’s time-tested strategies in “Reminiscences of a Stock Operator” and learn the importance of market timing and trend analysis. From Nicolas Darvas’s “How I Made $2,000,000 in the Stock Market,” we will introduce you to the Darvas Box method for systematic trading.

Through James Dalton’s “Markets in Profile,” you will get a fresh perspective on market behavior through profiling. Moreover, Jack Schwager’s “Market Wizards” reveals the secrets of successful traders, and Michael Lewis’s “Flash Boys” uncovers the impact of high-frequency trading on the market. Finally, you will check Dr. Alexander Elder’s “Trading for a Living,” which integrates psychological insights with technical analysis for robust risk management. Reading these top trading books will certainly enhance your trading performance and your ability to make more informed decisions. Let’s begin!

1. “Trading in the Zone” by Mark Douglas

“Trading in the Zone” by Mark Douglas is a comprehensive guide. It specifically focuses on mastering the mental aspects of trading. Unlike many books that concentrate on strategies and technical analysis, Douglas’s work provides details about the psychological challenges traders face. It also shows how crucial the right mindset is to achieve consistent success in the markets.

Some Key Takeaways

- Develop Strong Trading Psychology

One of the central themes of the book is the importance of trading psychology. Douglas argues that the most significant obstacles traders face are not market conditions or lack of knowledge, but rather their own emotions and mental habits.

He stresses that successful trading requires a mindset that allows traders to stay calm and composed, even during periods of market volatility. This mindset is essential for making objective decisions based on strategy rather than emotion.

- Maintain Emotional Discipline

Emotional discipline is another key takeaway from Douglas’s work. He explains that traders must develop the ability to control their emotions, such as fear and greed, which can lead to impulsive and irrational decisions. By cultivating emotional discipline, traders can stick to their trading plans and strategies, regardless of market conditions. In this way, they can avoid common errors, such as exiting trades too early or holding onto losing positions for too long.

- Achieve Consistent Trading Behavior

Douglas also emphasizes the need for consistent trading behavior. He teaches that consistency is not just about executing the same strategy repeatedly but also about having a disciplined approach to risk management and trade execution. By being consistent in these areas, traders can build confidence in their strategies and reduce the emotional stress associated with trading.

What is Douglas’s Approach to Developing a Winning Mindset and Controlling Emotions During Trades?

Douglas’s approach to developing a “winning mindset” is a key example of how he helps traders manage their emotions during trades. He advocates for setting realistic expectations and focusing on the process of trading rather than the outcome of individual trades. By doing so, traders can shift their focus away from the fear of loss or the desire for immediate gains and instead concentrate on following their trading plan.

This shift in mindset allows traders to view each trade as just one of many. In this way, traders reduce the emotional impact of any single trade, which promotes long-term success.

2. “Reminiscences of a Stock Operator” by Edwin Lefèvre

“Reminiscences of a Stock Operator” by Edwin Lefèvre is a classic book that provides a semi-autobiographical account of Jesse Livermore, one of the most famous stock traders in history. Written in the early 20th century, this book offers timeless awareness of the world of market speculation and the psychological challenges that traders face.

Some Key Takeaways

- Understand Market Speculation

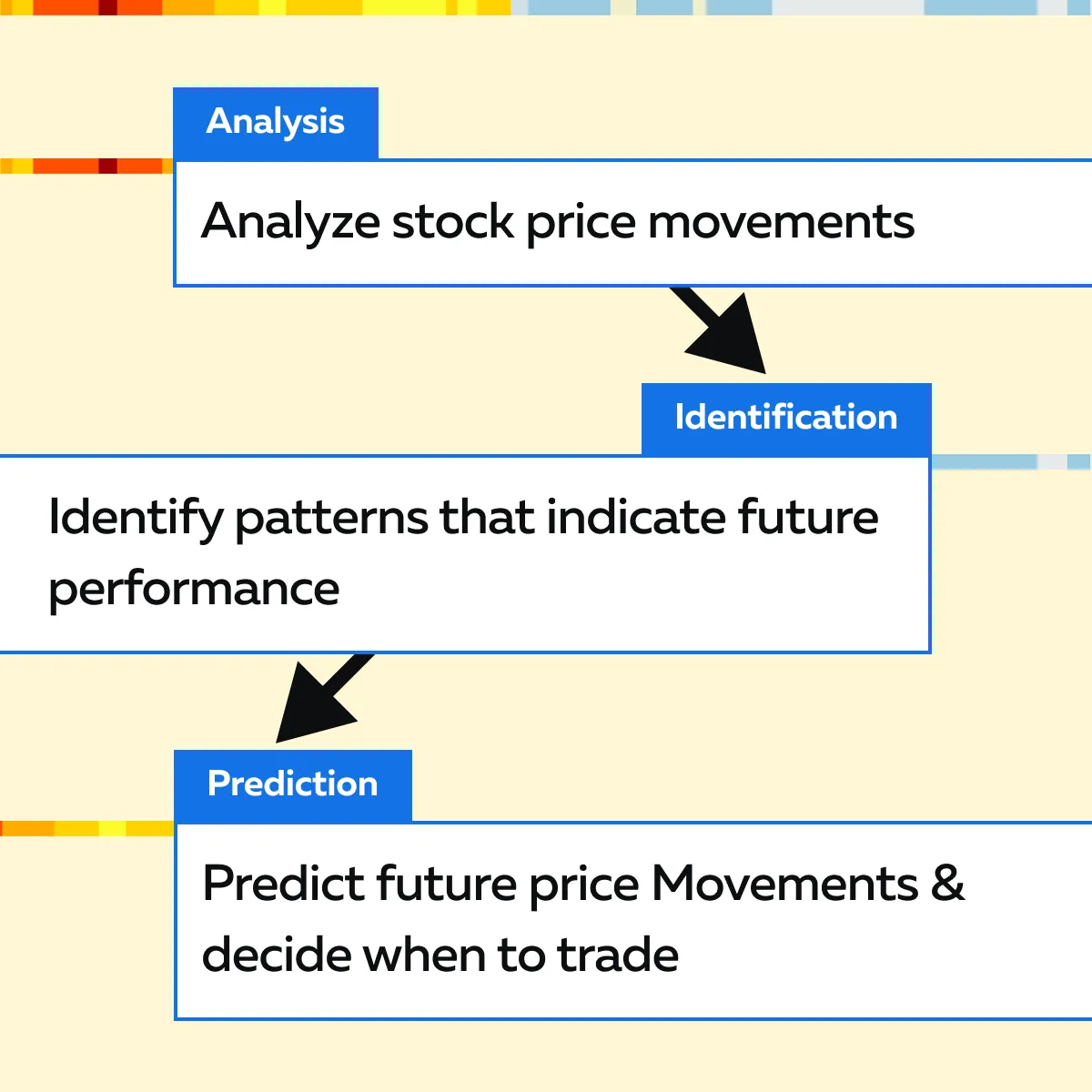

One of the primary lessons from the book is the importance of understanding market speculation. Livermore believed that successful trading was not just about picking the right stocks but also about grasping the broader market trends. See the graphic below to comprehend what he emphasized:

By doing so, traders could anticipate market movements and position themselves accordingly.

- Improve Market Timing

“Timing” is another crucial aspect that Livermore highlights. He believed that knowing when to enter and exit trades was often more important than the actual choice of stocks. Livermore’s approach was to wait patiently for the right moment rather than rushing into trades. He recognized that even the best analysis could be undermined by poor timing, which can ultimately lead to losses instead of profits.

- Control Emotions

The psychological aspects of trading are also a central theme in the book. Livermore was keenly aware of how emotions like fear and greed could impact a trader’s decisions. He developed strict rules for himself to avoid being swayed by emotions. For example:

- He would cut his losses quickly if a trade wasn’t working out.

- He would let his profits run when trade was going well (resisting the urge to cash out too soon).

What was Livermore’s Approach to Market Trends and his Rules for Trading?

Livermore’s approach to market trends was “methodical” and “disciplined.” He believed in the importance of following the market’s direction rather than trying to fight it. One of his famous rules was:

“Never try to sell at the top. It isn’t wise. Sell after a reaction if there is no rally.”

This rule reflects his understanding that it’s impossible to predict the exact peak or bottom of a market trend. Also, it’s better to trade based on observed market behavior rather than gut feelings or predictions.

Want to trade like a pro? Optimize your trading with insights from the best books. Get started here!

3. “How I Made $2,000,000 in the Stock Market” by Nicolas Darvas

“How I Made $2,000,000 in the Stock Market” by Nicolas Darvas is an inspiring account of how a professional dancer, with no formal background in finance, became a successful stock trader by developing his own unique trading strategy known as the “Darvas Box” method.

The book is both a memoir and a practical guide, offering perspectives on how Darvas turned an initial interest in the stock market into substantial profits.

Some Key Takeaways

- Always have a Systematic Approach

One of the central lessons from Darvas’s story is the importance of having a systematic approach to trading. Darvas didn’t rely on tips or insider information; instead, he created a methodical process for selecting and trading stocks.

See the graphic below to learn about his approach:

This systematic method allowed him to remove emotions from his trading decisions and act based on data and analysis rather than speculation.

- Be Disciplined

Discipline is another critical aspect highlighted in the book. Darvas maintained strict discipline in following his trading rules, which helped him avoid impulsive decisions that could lead to losses.

For example:

- He would only buy stocks that met his specific criteria.

- He would exit trades when the price moved outside his predetermined range.

This disciplined approach enabled him to consistently capitalize on market opportunities while minimizing risk.

- Develop a Personal Trading Strategy

The development of a personal trading strategy is also a key theme in the book. Darvas didn’t try to copy other traders; instead, he developed his own method that suited his personality and trading style. This personalized strategy, known as the “Darvas Box,” became the foundation of his success.

What is the Darvas Box Theory?

Following the “Darvas Box theory,” Darvas used to identify potential trading opportunities by examining the price and volume behavior of stocks. According to this theory, Darvas would:

- Draw a box around the price range where a stock was trading.

- If the stock broke out of the upper boundary of the box with increased volume, it was considered a buy signal.

- If the stock fell below the lower boundary, it was a sell signal.

The idea behind the Darvas Box was to capture the momentum of stocks that were poised for a breakout. At the same time, it protected against downside risk by setting clear boundaries for exits.

In this way, by applying the Darvas Box method, traders can systematically identify stocks that are likely to experience upward movement. Simultaneously, they can have a clear exit strategy in place if the trade doesn’t go as planned.

It is worth mentioning that this method is still used by traders today to capitalize on market trends with a disciplined and systematic approach.

4. “Markets in Profile” by James Dalton

“Markets in Profile” by James Dalton introduces traders to the concept of “market profiling.” It is a unique method of analyzing market behavior that goes beyond traditional technical analysis. The book offers guidance on:

- How can traders better understand market dynamics?

- How can they trade better by focusing on the behavior of the market?

- How can traders look beyond just price movements?

Some Key Takeaways

One of the primary lessons from the book is the importance of market profiling as a tool for reading and interpreting market behavior. Market profiling is a method that organizes market data into a profile, which shows how prices develop over time. It offers a visual representation of market activity.

This technique helps traders identify value areas, which are price ranges where a significant amount of trading occurs. These value areas indicate where the market finds equilibrium. By recognizing these value areas, traders can make more accurate predictions about where the market is likely to move next.

The book also shows several techniques for identifying value areas. Dalton explains:

- How can traders use market profiles to see where the majority of buying and selling takes place?

and

- How can these areas signal future market movements?

For example, if a market spends a lot of time trading within a certain price range, it indicates a balanced market. However, if it moves away from that range, it could signal the start of a new trend.

- Understand Market Dynamics

As per Dalton, traders must have a deep understanding of market dynamics. Dalton explains that the market constantly seeks balance. It moves between periods of equilibrium (where buyers and sellers agree on price) and disequilibrium (where one side dominates). By recognizing these patterns, traders can better anticipate market shifts and adjust their strategies accordingly.

How does Market Profiling Help in Predicting Market Movements and Improving Trade Execution?

Market profiling can significantly improve trade execution by providing a clearer understanding of market movements. For example:

- Say a trader sees that the market is forming a profile with a clearly defined value area

- Now, they can anticipate that prices are likely to stay within that range (unless new information disrupts the balance).

- If the market breaks out of the value area, this could signal the beginning of a new trend.

- In such a situation, traders have an opportunity to enter or exit a position.

For more clarity, check the various benefits of using market profiles in the graphic below:

5. “Market Wizards” by Jack D. Schwager

“Market Wizards” by Jack D. Schwager is a collection of interviews with some of the most successful traders in history. Through these conversations, Schwager uncovers the secrets behind their success. The book offers readers a glimpse into the mindset, strategies, and practices that have set these traders apart from the rest.

Some Key Takeaways

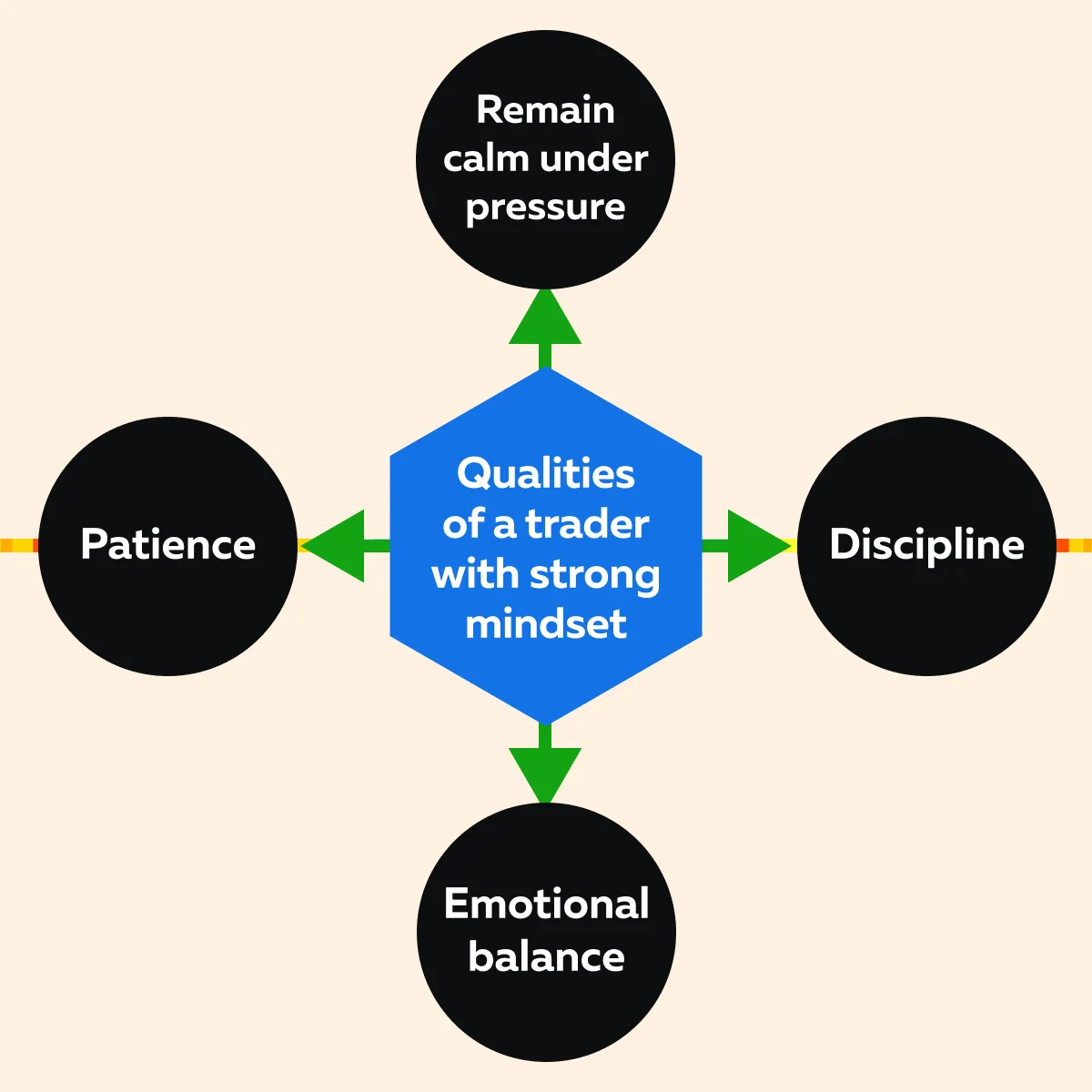

- Develop a Strong Mindset

One of the most valuable insights from “Market Wizards” is the importance of a trader’s mindset. The book highlights that successful trading isn’t just about having the right strategy; it’s also about having the right mental attitude. See the graphic below to check the various qualities emphasized in the book:

This book states that these traits help traders stay focused on their long-term goals, even in the face of short-term setbacks.

- Be Flexible

Another key takeaway is the variety of strategies used by these top traders. While each trader has their own unique approach, some common themes include:

- Adapt to changing market conditions,

- Maintain flexibility in trading strategies, and

- Constantly learn from both successes and failures.

The book also states that rigorous analysis is essential, along with having a deep knowledge of the markets in which traders operate.

Risk management is a central theme throughout the interviews. Almost every trader in the book talks about how crucial it is to manage risk effectively to ensure long-term success. They state that no matter how good a trading strategy might be, it’s essential to control losses and protect capital.

How does Risk Management Contribute to Success?

One standout example from the book is the approach to risk management used by Paul Tudor Jones, one of the traders interviewed by Schwager. Jones is known for his meticulous focus on protecting his capital. He believes that avoiding large losses is more significant than making large gains.

To achieve this, Jones employs a strict stop-loss strategy and ensures that he exits trades as soon as they start to move against him. In this way, he minimizes potential losses.

Moreover, by limiting losses and letting profits run, he maintains a favorable risk-to-reward ratio, even during periods of extreme volatility.

6. “Flash Boys” by Michael Lewis

“Flash Boys” by Michael Lewis is an investigative book. It displays the world of high-frequency trading (HFT) and its profound impact on the financial markets. Lewis sheds light on how HFT firms use advanced technology and algorithms to gain an edge in the market, often at the expense of other traders. The book reveals the inner workings of this controversial practice and raises important ethical questions about the fairness of modern financial markets.

Some Key Takeaways

- Develop an Understanding of High-Frequency Trading

One of the main takeaways from “Flash Boys” is an understanding of the mechanics of high-frequency trading. For the unaware, HFT involves the use of powerful computers and complex algorithms to execute trades at extremely high speeds, often in milliseconds.

These firms capitalize on minute price differences across various markets and execute large volumes of trades in a fraction of a second. This speed advantage allows HFT firms to make significant profits by getting ahead of other market participants.

- Learn How HFT Firms Manipulate Markets

The book also explores the ethical implications of HFT. Lewis argues that the speed and technological advantage held by HFT firms create an uneven playing field, putting ordinary investors and even large institutional traders at a disadvantage. He discusses how HFT firms manipulate markets to their benefit, often without contributing any real value to the market itself. This raises questions about the fairness and integrity of the financial system.

- The Role of Technology in Trading

Technology’s role in trading is another critical theme in “Flash Boys.” Lewis highlights how advances in technology have changed the way markets operate. He explicitly mentions that technology has made the markets more complex and, in some cases, less transparent. Additionally, this shift has made it more challenging for regulators to oversee the markets and ensure they function fairly for all participants.

What are the Implications of HFT for Retail Traders?’

The implications of HFT for retail traders are significant. That’s because often retail traders lack the sophisticated technology and speed of HFT firms, which puts them at a disadvantage when placing orders.

For example, an HFT firm might detect a retail trader’s order and place its own order milliseconds ahead. This act drives up the price before the retail trader’s order is executed. In the trading world, this practice is known as “front-running” and usually results in retail traders paying more for stocks or receiving less when selling.

Now, to protect themselves, retail traders can take several steps. One approach is to use limit orders rather than market orders. For the unfamiliar, a limit order specifies the maximum price a trader is willing to pay or the minimum price they are willing to accept. By placing this kind of order, traders can guard against exploitation from rapid price changes caused by HFT.

Additionally, traders can choose to trade during less volatile times of the day or use brokers who route orders in ways that minimize exposure to HFT tactics.

Beat HFTs in their own game. Enhance your trading knowledge with Bookmap’s advanced tools. Sign up today!

7. “Trading for a Living” by Dr. Alexander Elder

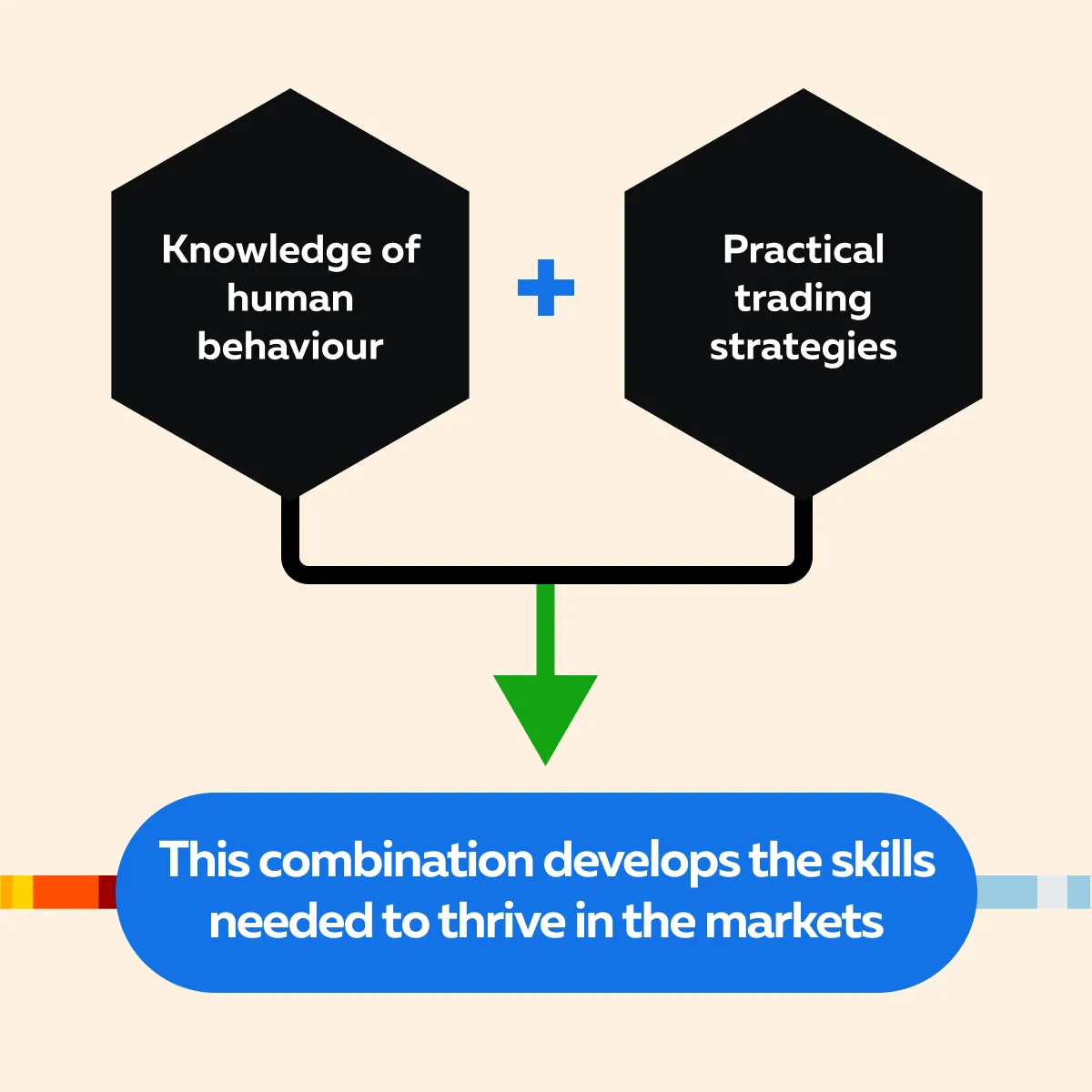

“Trading for a Living” by Dr. Alexander Elder offers techniques necessary for successful trading and gives guidance related to:

- Psychology,

- Tactics, and

- Money management.

See the graphic below to understand Dr. Elder’s mantra for trading success, a psychiatrist-turned-trader.

Some Key Takeaways

- Maintain Emotional Discipline

One of the central themes of the book is the crucial role of emotional discipline in trading. Dr. Elder emphasizes that a trader’s biggest enemy is often themselves— specifically, their emotions, impulses, and psychological biases.

He teaches traders how to recognize and control these emotions, such as fear and greed, to make rational and consistent decisions. By maintaining emotional discipline, traders can avoid impulsive actions that often lead to losses.

Another key takeaway is the use of detailed technical analysis to identify trading opportunities. Dr. Elder provides in-depth explanations of various technical indicators, charts, and patterns that traders can use to analyze the market.

He stresses the importance of understanding these tools and using them systematically. Furthermore, Dr. Elder advises traders not to rely on guesswork or intuition.

Don’t miss what candlesticks are hiding. Join Bookmap today and analyze order flows like never before!

- Appropriate Risk Management

Risk management techniques are also heavily emphasized in the book. Dr. Elder teaches that successful trading is not just about making profitable trades but also about protecting capital and managing risk. He advocates for the use of stop-loss orders, position sizing, and other risk management strategies to ensure that traders can survive in the market over the long term.

What is the Elder’s Approach to Using Oscillators and Moving Averages?

Dr. Elder’s approach to using oscillators and moving averages is a practical example of how technical analysis can be applied to improve trading decisions. For the unaware, oscillators are used to gauge the momentum of a stock and identify overbought or oversold conditions. Some common types are:

- Relative Strength Index (RSI), and

- Moving Average Convergence Divergence (MACD).

For example, if the RSI indicates that a stock is overbought, traders may interpret this as an indication of price correction and an exit signal.

On the other hand, moving averages are used to smooth out price data and identify trends. Dr. Elder recommends using a combination of short-term and long-term moving averages to generate entry and exit signals.

For instance, a common approach is the “moving average crossover.” In this strategy, a trader buys when a short-term moving average crosses above a long-term moving average (indicating a potential uptrend) and sells when the opposite occurs.

Additionally, Dr. Elder also guides how traders can combine oscillators with moving averages. Such a combined approach allows traders to confirm signals and reduce the likelihood of false entries or exits. It also provides a disciplined way to make trading decisions, helps traders stay aligned with market trends, and improves their overall performance.

Conclusion

By reading these top trading books, market participants can gain invaluable acumen in the mental and technical aspects of trading. From mastering trading psychology with Mark Douglas’s “Trading in the Zone” to understanding market trends with Jesse Livermore’s “Reminiscences of a Stock Operator,” each book provides practical advice and proven strategies. Also, Nicolas Darvas’s “How I Made $2,000,000 in the Stock Market” and James Dalton’s “Markets in Profile” present some unique methods for systematic trading and market analysis.

Not only this, Jack Schwager’s “Market Wizards” reveals the mindsets of successful traders, while Michael Lewis’s “Flash Boys” sheds light on high-frequency trading’s impact on markets. Lastly, Dr. Alexander Elder’s “Trading for a Living” integrates psychological discipline with technical analysis.

By applying the lessons from these top trading books, traders can enhance their skills and improve their performance. Furthermore, traders can consider using advanced market analysis tools like Bookmap to put these strategies into action and elevate their trading to the next level. Unlock advanced trading strategies with Bookmap – Join now!