Ready to see the market clearly?

Sign up now and make smarter trades today

Futures

August 25, 2025

SHARE

Trading Around Expiry: How Futures Liquidity Shifts When Contracts Roll Over

You are trading on a fine Monday morning when suddenly the price action starts acting weird. Your technical levels stop working, and liquidity seems to vanish into thin air. Scratching your head? Wondering what’s going on? Chances are, you have been caught in a futures contract rollover without realizing it.

You are trading on a fine Monday morning when suddenly the price action starts acting weird. Your technical levels stop working, and liquidity seems to vanish into thin air. Scratching your head? Wondering what’s going on? Chances are, you have been caught in a futures contract rollover without realizing it.

Want to avoid it? In this article, you will learn everything you need to know about contract expiry futures, how futures liquidity shifts, and what signs to watch during rollover week. Most importantly, you will understand how to trade safely during this tricky transition.

Read this article till the end to save yourself from poor fills and confusion!

What Is a Futures Rollover, and Why Does It Matter

A futures contract is an agreement to buy or sell:

- An underlying asset (like oil, gold, or a stock index),

- At a specific price, and

- On a specific date in the future.

These contracts don’t last forever! They expire, usually every three months, that is, in March, June, September, and December, for index futures.

But what happens when a contract is about to expire, and traders still want to hold their position? That’s where a futures contract rollover comes in. Instead of waiting for the current contract to expire, institutional traders like hedge funds or banks will close their position in the soon-to-expire contract and open a new one in the next month’s contract. This process is called rolling over.

Why Does This Matter for Traders?

When rollover happens, there are three important changes you must note:

| Volume shifts | Futures liquidity shifts | Price action becomes tricky |

| As more traders roll over, the old (expiring) contract starts to lose trading volume, and the new contract gains it. | Liquidity (how easily you can get in or out of a trade) moves to the new contract. As a result, the expiring one becomes less active. | Why? Because orders and volume are split between two contracts during the rollover period. Due to this, the price becomes harder to read. Consequently, you see odd or jumpy movements because liquidity is now fragmented. |

So, if you’re trading futures near expiration, you must pay attention to the rollover period. If you don’t, you might get stuck in a contract with:

- Low volume,

- Wide spreads, and

- Poor fills.

How Liquidity Behaves During Expiry Week

Expiry week is the period in which a futures contract approaches its expiration date. Let’s see what happens during this phase:

For a better understanding, let’s study these events in detail:

1. Sudden Drop in Volume

As traders prepare for contract expiry in futures, they start moving out of the old (front-month) contract and into the next one. This shift results in a sharp drop in volume in the expiring contract. Let’s see how it happens, step by step:

| Step I: Less activity | Step II: Wider spreads, thinner books | Step III: Resting liquidity vanishes |

|

|

or

|

Need a Pro Tip?

Look for the inflection point! Make this observation 3 to 5 days before the official contract expiry. Please note that this is when volume and futures liquidity in the new contract start to exceed that of the old one. Now, that’s your signal to:

- Roll over your own positions

or

- Shift your focus if you’re day trading.

See rollover flows play out visually with Bookmap →

2. Migration of Liquidity Zones

Want to know one of the most overlooked changes during futures contract rollover? Most traders don’t track how “liquidity zones” shift. For those unaware, these are price levels where there used to be strong buying or selling interest, like support and resistance. But when the contract expiry approaches, those levels lose their power.

Let’s check out three major reasons why this shift happens:

| Reason I: Support/ resistance levels may break down | Reason II: Resting orders don’t carry over! | Reason III: You need to reset technical levels |

|

|

|

For more clarity, let’s study a real example:

- During the ES futures rollover, 5250 was a strong bid zone in the June contract.

- But when trading rolled to the September contract, there was no interest at 5250 anymore.

- This caused prices to:

- Overshoot that level

or

- Drift aimlessly.

- This event confused traders, who were expecting the same reaction.

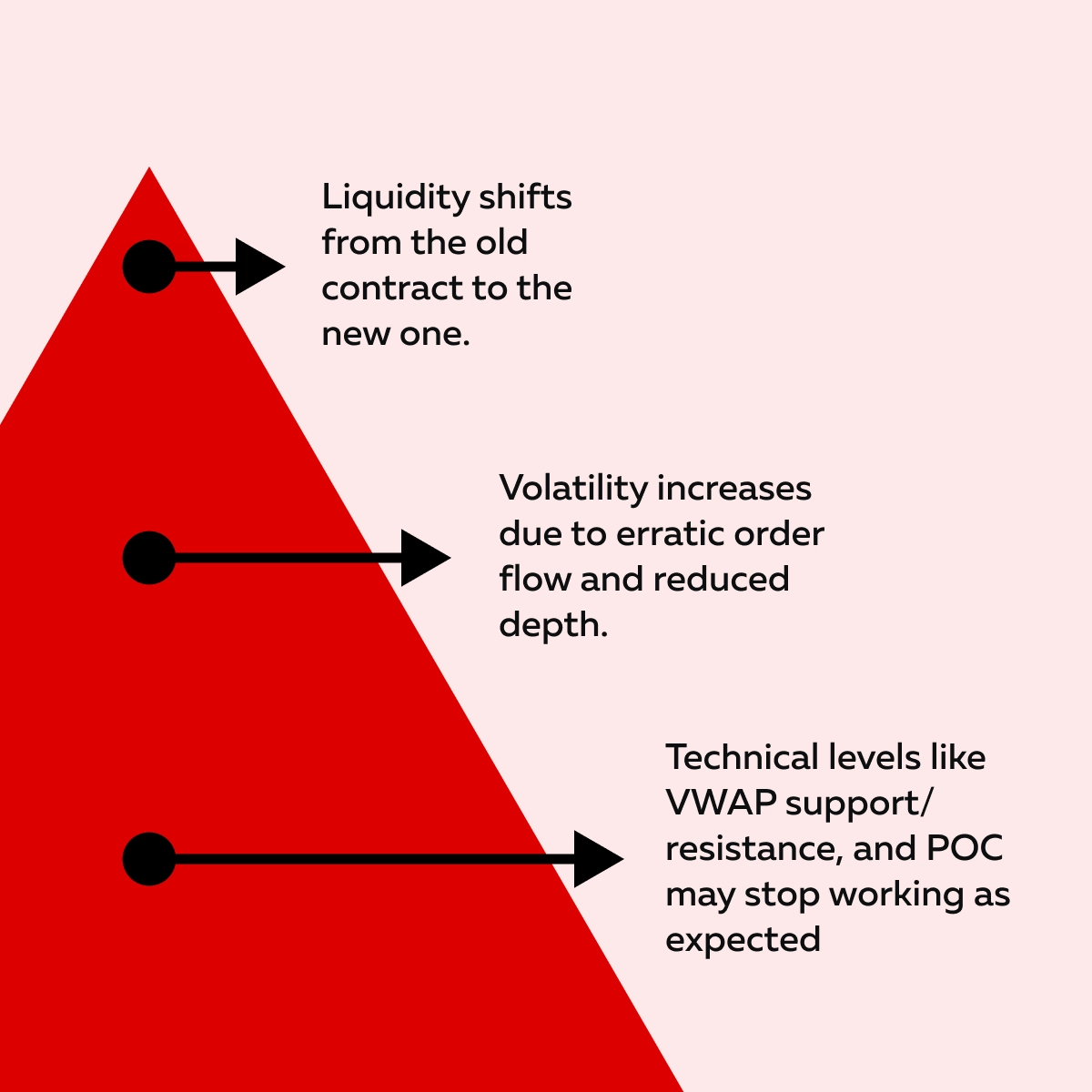

3. Disjointed Price Action

Want to know another big effect of trading futures near expiration? Mostly, price action becomes erratic and unpredictable. Let’s see what usually happens:

-

- Algorithms are rolling quietly:

- Large funds and institutions often use algorithms.

- Through algorithms, they roll their positions gradually over time.

- They also use a VWAP strategy (Volume-Weighted Average Price).

- Using it, they spread their trades across hours or days.

- This creates choppy or unclear price movements.

- Thin liquidity creates air pockets:

- Be aware that futures liquidity is now split between the old and new contracts.

- Due to this splitting, you get moments where there are very few orders in the book.

- These are called air pockets.

- In these zones, the price jumps suddenly or “whipsaws” back and forth.

- Algorithms are rolling quietly:

- Random-feeling fills:

-

- Near the expiration, you can:

- Get filled at prices you didn’t expect

- Near the expiration, you can:

or

- Miss fills entirely. This happens because the market moves too fast through low-liquidity zones.

All of this makes trading during expiry week feel like walking through fog! Yes, you can still trade, but you need to be extra cautious. As a tip, you should:

- Use a smaller size

and

- Watch volume and liquidity closely.

How to Trade Rollover Weeks Safely

As mentioned before, futures contracts don’t last forever! They have a set expiration date. Thus, every few months, traders must shift from the old contract to the next one. This transition period is called “rollover week.” This period usually causes a lot of confusion if you’re not prepared.

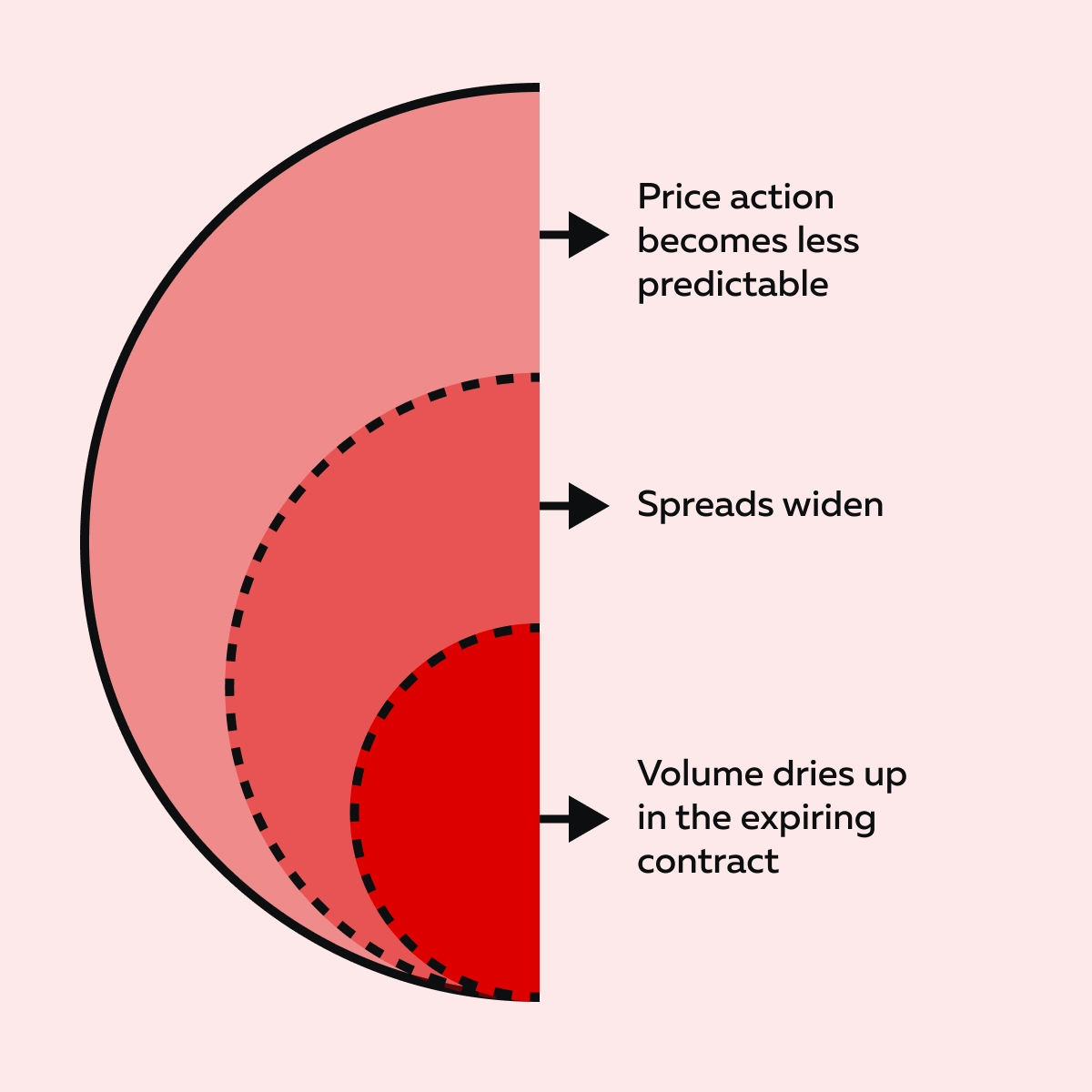

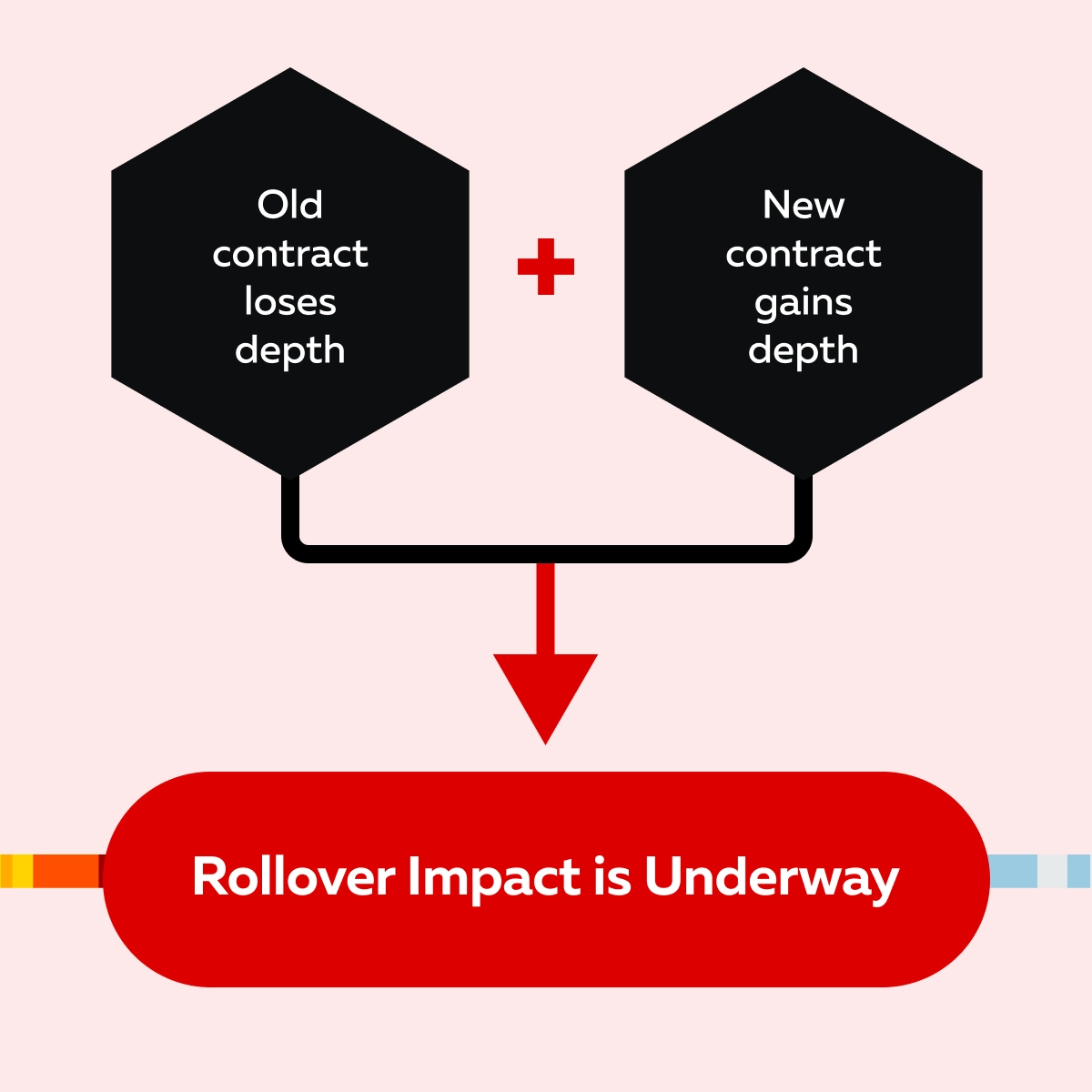

But why does the confusion happen? That’s because, during this time, three major things happen that affect your trading. Check them out in the graphic below:

But what if you continue to trade the expiring contract without watching for these changes? Chances are, you might end up with:

- Poor fills,

- Misleading setups, and

- Unexpected losses.

Want to avoid this? Let’s see what you can do to remain safe:

- A) Watch Open Interest and Volume Closely

One of the most important metrics during rollover is “open interest (OI).” It shows how many positions are currently open in a contract. Let’s see how you can observe it:

-

- As the current contract approaches expiry, OI starts to drop.

- At the same time, OI and volume begin to build in the next contract.

- When the new contract consistently has more volume and open interest, that’s your signal!

- It’s time to roll over and start trading the new one.

How does it help? This method ensures you’re trading in the most liquid environment, which improves execution and reduces slippage.

- B) Pay Attention to More Than Just OI

Volume and open interest are critical, but they are not the whole story! During futures contract rollover, other subtle changes matter too. Let’s check them out:

| Heatmap behavior changes | Passive liquidity moves | Spoofing and false signals |

| Watch tools like our advanced market analysis tool, Bookmap, and its heatmaps—resting liquidity zones shift to the new contract. | Liquidity providers begin placing orders in the next contract, which changes where support/resistance forms. | Some algos may place fake orders or shift size to take advantage of low-liquidity environments. This can lead to disjointed price action, especially during high-volume times. |

Besides, follow these tips to stay safe when trading futures near expiration:

Know When to Switch Contracts

Please note that most traders switch to the new contract when volume and open interest (OI) in the next month’s contract become higher than in the current (front-month) one. This usually happens a few days before contract expiry! However, the exact timing varies and depends on:

- What you’re trading (like ES, CL, or ZN)

and

- Your trading style.

Tools That Can Help You:

- CME and ICE websites post daily open interest updates.

- Our avant-garde real-time market analysis tool, Bookmap, allows you to compare:

- Real-time volume

and

- Futures liquidity.

- Via Bookmap, this comparison can be made to both the expiring and new contracts.

- Some trading platforms let you view both contracts side-by-side.

- Such a view makes it easier to spot when to switch.

One Important Point

If you’re a short-term trader using our real-time market analysis tool, Bookmap, and its heatmaps or intraday liquidity tools, the expiring contract may still look more active for a while. But be careful. You could be trading into a thin order book. In this order book, large institutions are:

- Exiting positions

and

- Not entering new ones.

That makes execution highly risky!

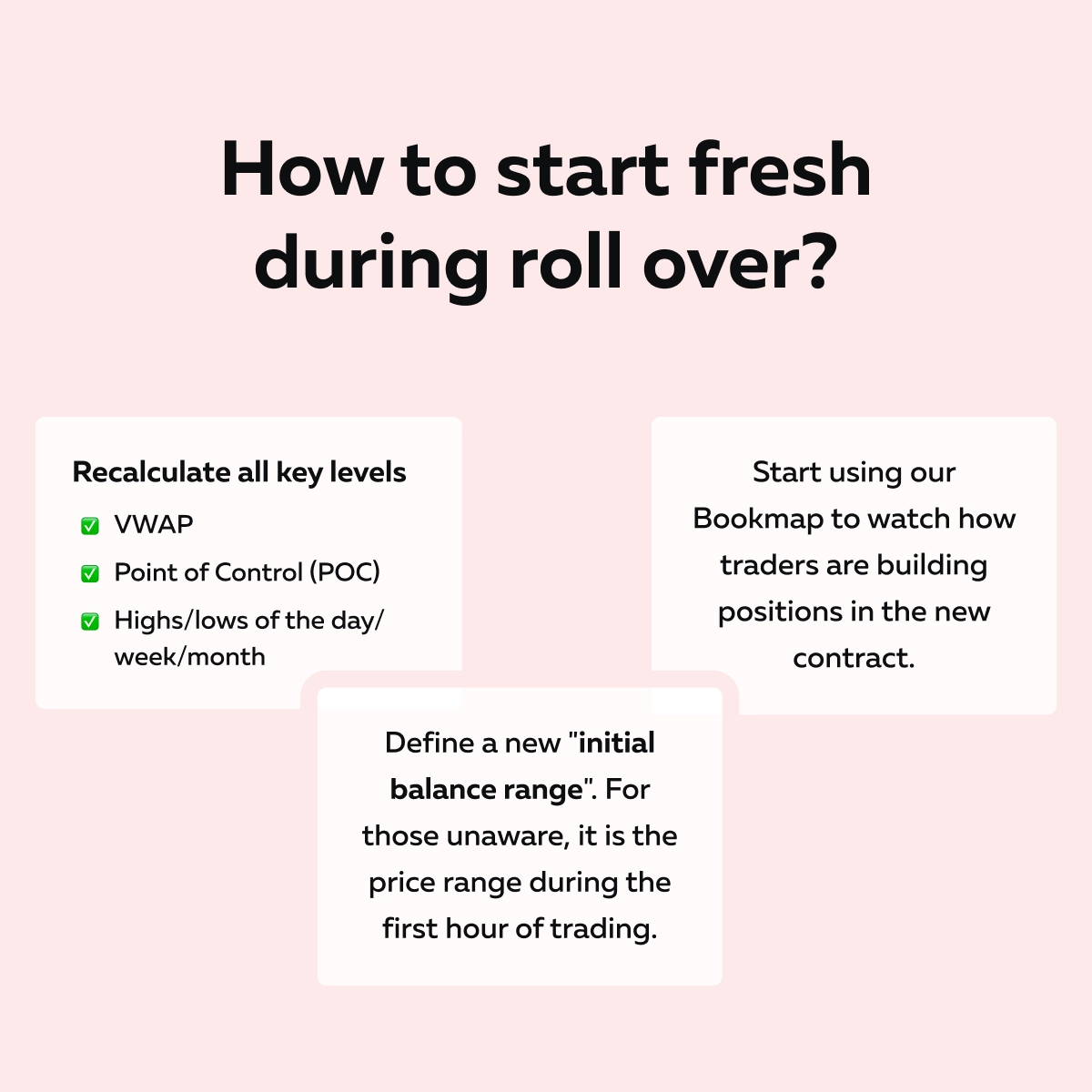

Reset Key Levels on the New Contract

You must realize that each futures contract is its own market. It has new participants and a fresh order flow. So, when you roll over, do not carry over old levels like VWAP or POC!

Instead, start fresh. Let’s learn how you can make a fresh beginning:

Why Should You Do So?

The technical levels from the old contract reflect activity from traders who are now closing out positions. They’re no longer relevant! From now on, only new volume and liquidity will guide price action.

Be Cautious of Decreased Liquidity

During futures contract rollover, liquidity often thins out. Particularly, this happens outside of regular trading hours (RTH). The ill effect? Thinning out of liquidity leads to:

- Fewer resting orders on the book

and

- More chance of getting caught in fake moves.

What You Should Do

- Trade a smaller size or widen your stops. By doing so, you can avoid being whipped out by random price spikes.

- Avoid trading right at the open if the order book looks unstable or fragmented.

- Watch for spoofing or fake liquidity walls! They’re easier to pull off when the depth is shallow.

Please note that even if there’s no news, you might see sharp price jerks! This usually happens due to temporary liquidity voids. It is a normal part of rollover impact. Don’t get trapped by them.

Understand Why Rollover Matters for Bigger Players

Do you want to really understand futures rollover? You must know what large institutions are doing! Usually, big players like banks, asset managers, and hedge funds:

- Exit their positions in the front-month

and

- Rebuild them in the next contract (often at fixed valuation levels).

Now, what does that mean for you?

These roll trades move a lot of volume even if the market looks quiet. On our advanced market analysis tool, Bookmap, and its heatmap, the old contract might still look busy! But much of that is just positions being closed. Don’t mistake it for a real new interest. The real price direction will come from new traders entering the new contract.

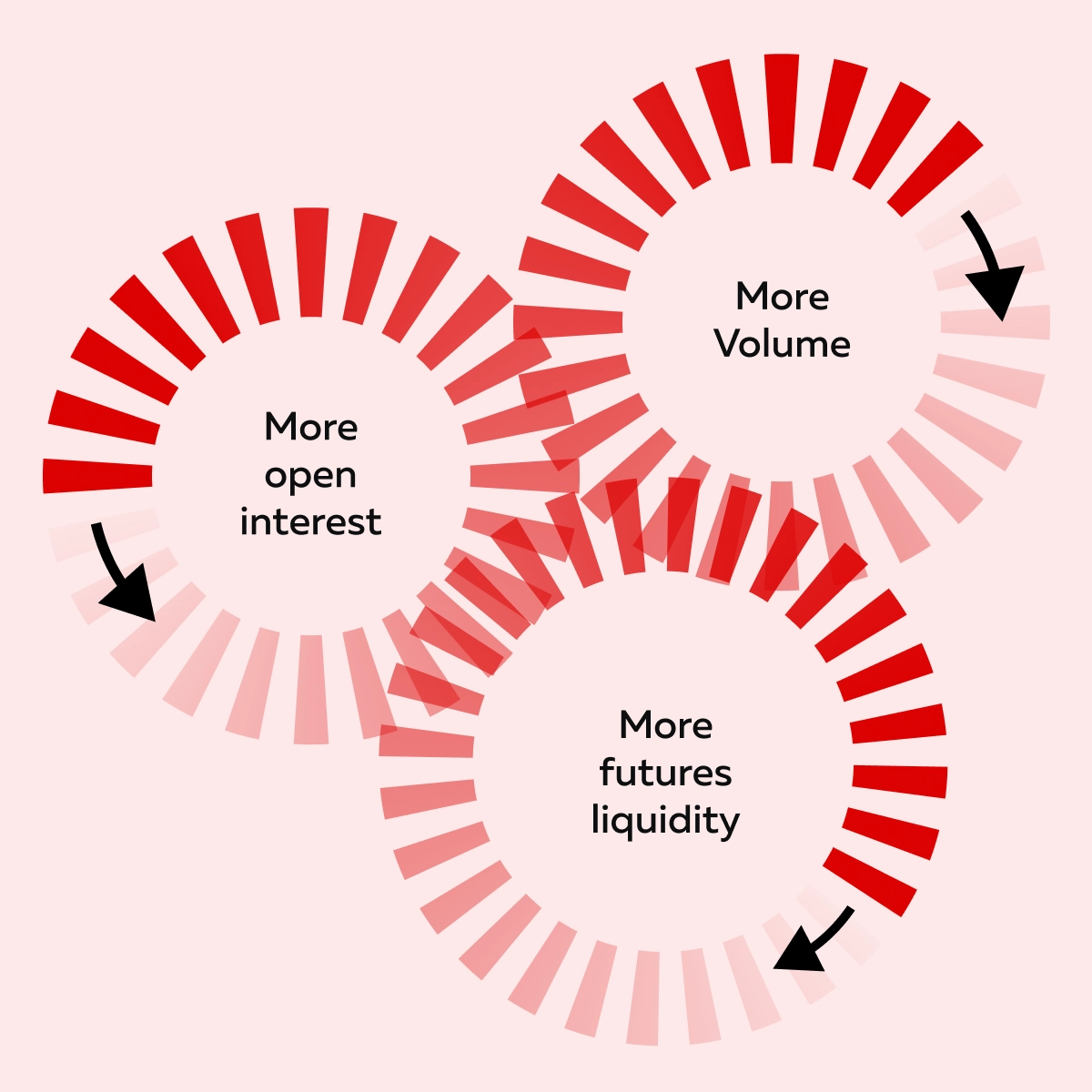

As a speculator, you’re providing liquidity in this process. But to avoid trading noise, make sure you’re in the contract where the real action is. Want to know the characteristics of such a contract? See the graphic below:

Upgrade your toolkit for rollover season → Bookmap Plans & Pricing

Order Flow Clues That Help During Contract Rollover

During futures contract rollover, price action becomes harder to trust! Any solution? Yes, you must use our advanced market analysis tool, Bookmap, to gain an edge. Using it, you can easily analyze how liquidity, volume, and trade behavior shift between the expiring and new contracts. This knowledge lets you avoid traps!

So, want to read the flow smartly? Let’s learn how you can do it:

Real-Time Heatmap Behavior

Our real-time market analysis tool, Bookmap, has heatmaps that show “resting liquidity.” It displays the limit orders waiting to buy or sell at specific prices. During rollover:

-

- Watch for sudden changes in visible liquidity.

- Large limit orders may appear or vanish quickly near key levels (like VWAP or prior highs/lows).

- If one contract starts looking “dead” (few orders, no movement), it’s time to shift focus.

- As a tip, always compare both contracts side by side.

- This lets you precisely spot where the action is building.

Volume Dots and Trade Clusters

In our advanced market analysis tool, Bookmap, “volume dots” show where aggressive market orders are hitting the book. By analyzing them, you can easily identify real buying or selling pressure. But during contract expiry futures periods, context is key:

-

- You might still see aggressive trades on the old contract.

- But that doesn’t mean it’s still tradable!

- Ideally, you should check if those large trades are starting to show up in the new contract instead.

- That’s a sign that institutions or algorithms are moving over.

What is the benefit of spotting this sign? You can avoid false signals, particularly if you’re trading futures near expiration and using trade intensity to guide your entries or exits.

Bookmap MBO Tools

Bookmap’s MBO (Market-by-Order) tools give you deep insight into individual orders. Let’s see what all you can do with them:

| Practical Usage of Bookmap’s MBO Tools | Explanation |

| Iceberg orders |

|

| Stop runs |

|

| Passive liquidity |

|

Conclusion

So, by now, you must have understood that futures contract rollover is not just a routine shift. It’s a critical event that changes how the market behaves. As expiration approaches, liquidity and volume move from the old contract to the new one. Such a movement often makes price action more volatile and less reliable.

Are you still trading the expiring contract or using outdated support/resistance levels? You could be exposing yourself to poor fills, slippage, or confusing signals. Need some good news? By watching open interest, tracking order flow, and resetting your technical levels, you can stay one step ahead.

Additionally, you can start using Bookmap, our advanced market analysis tool. It helps you avoid rollover traps and even spot fresh trading opportunities as they emerge. Learn how Bookmap tracks rollover volume shifts in real-time → Compare Plans.

FAQ

1. When should I switch to the next futures contract?

Ideally, make a switch when the new contract has more volume than the current one. This usually happens 3 to 5 days before the old contract expires. That’s when most traders and big institutions move, and the market becomes more active in the new contract.

2. Why does liquidity feel different during rollover week?

During rollover week, traders and liquidity providers start placing orders in the new contract. That leaves the expiring contract with:

- Fewer orders,

- Wider spreads, and

- More unpredictable price movement.

That’s why trading feels unstable during this time!

3. Can I still trade the expiring contract?

Yes, you can! But it’s riskier. That’s because the old contract has lower liquidity. Due to this, you can experience:

- Worse fills,

- More slippage, and

- Fewer reliable technical levels.

Therefore, most traders move early to the next contract to avoid these issues and trade under better conditions.

4. How can Bookmap help during rollover?

Our advanced market analysis tool, Bookmap, shows you where the volume and liquidity are in real time. You can clearly see when traders leave the old contract and move to the new one. Such knowledge lets you avoid trading in a “dead” contract. As a result, you get to stay with the active market.