Ready to see the market clearly?

Sign up now and make smarter trades today

Trading Basics

June 26, 2025

SHARE

Trading the First 15 Minutes: Liquidity Patterns at the Open

You must have heard that the early bird gets the worm! But in trading, the early bird often gets trapped.

The market open is one of the most exciting and risky times to trade. In just a few minutes, a massive volume pours in, and overnight positions are adjusted. During this phase, several institutions and retail traders clash in a high-speed battle for direction. Even the price action is fast and full of false moves! Do you have a plan to manage this? If not, it will be chaos for you!

However, for traders who understand order flow, liquidity patterns at market open, and how to spot traps versus real momentum, the first 15 minutes can offer some of the day’s best opportunities. Wish to join their ranks? In this article, you will learn how to profitably deal with the opening storm using our advanced real-time market analysis tool, Bookmap.

Read till the end to stop guessing and start trading with structure and intent.

Why the Open Is So Volatile (and So Dangerous)?

The market open is one of the most active and unpredictable times of the trading day. During this time, overnight positions get closed rapidly. This happens because many traders and funds hold positions overnight. As soon as the market opens, they either take profits or cut losses. This sudden rush of orders creates sharp price moves in the first 15 minutes of trading.

Additionally, some other prominent reasons for this volatility are:

- Market makers are still adjusting

-

- At the open, market makers are figuring out where buyers and sellers are.

- They’re adjusting spreads and trying to find where liquidity is sitting.

- Until things settle, prices usually jump around.

- Big and small traders hit the market at the same time

-

- Institutional traders and retail traders both act at the open.

- Their orders clash.

- This creates “liquidity imbalances.”

- For the unaware, this means there are more aggressive buyers than sellers (or the other way around).

- This imbalance leads to fast moves that can reverse just as fast.

- Traders rush in too early.

-

- Many traders are eager to catch the first move of the day.

- They enter trades before confirming if there’s:

- Real support

- Strong buying and selling pressure.

- Due to a lack of understanding of order flow trading at the open, they often end up on the wrong side of the move.

It looks clear, but it’s not!

Often, the market open looks directional. However, you must realize this move is often just a reaction to:

- Overnight news

or

- Early order flow.

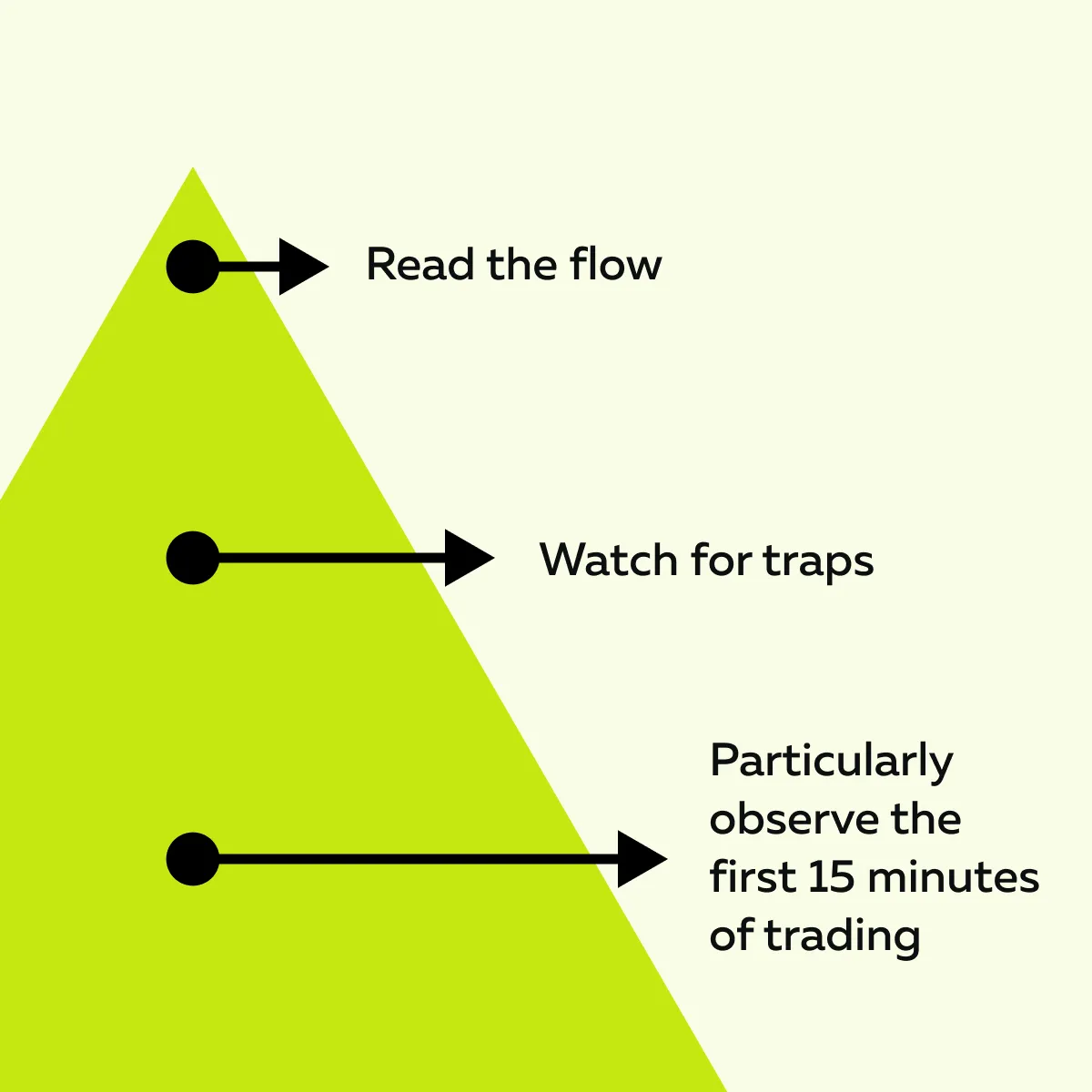

These moves trap traders who don’t understand the liquidity patterns at market open. This is why trading the open requires more than speed. Check out the graphic below to know what you must do:

Learn how professional traders navigate the open—watch liquidity to reveal where the market wants to go.

Key Liquidity Behaviors in the First 15 Minutes

The first 15 minutes of the trading day reveal how major players are positioning and adjusting. By watching liquidity patterns at market open, you can spot:

- Early traps,

- Fakeouts, and

- Real interest.

These behaviors shape the tone for the day. Let’s understand them in detail:

1. Liquidity Pulls Right Before the Open

One common pattern is when strong-looking buy or sell orders vanish just seconds before the market opens. Initially, it looks like there’s solid support or resistance, but then those orders get pulled.

When this happens, the price moves quickly in either direction. These fast moves are called “opening whipsaws.” They happen because the “support” or “resistance” wasn’t real. Instead, it was just temporarily there.

The Indication

This behavior shows that institutions don’t want to take the first hit. They wait to see what retail traders and other participants will do in the first moments. By holding back, they can react instead of leading.

The Strategy

By using our avant-garde market analysis tool, Bookmap, you can easily notice big orders disappear right before the bell. That’s a clue! This means that the area is now thin, and an “air pocket” has been created. Now, the price can fluctuate rapidly without much resistance.

When trading the open, try to spot these vanishing liquidity zones. This lets you avoid:

- Jumping in blindly

and

- Getting trapped.

2. Opening Drive: Real Momentum or False Start?

Some market opens start with a strong push in one direction. This is called an opening drive. Usually, it seems like the start of a big move. However, not all drives are real. Some are just short bursts that fade quickly.

So, how do you tell if the move is real or just a fake start?

Check out these three major signs:

| Sign I: Aggressive volume is hitting the market | Sign II: Price is moving with support behind it | Sign III: Offer liquidity is pulling back |

|

|

|

If you see all these signs, the move is likely real. It shows that:

- Buyers (or sellers) are committed

and

- The market is driving in one direction with strength.

But what if these signs are missing?

If you don’t observe the signs mentioned above, it means that the price is moving into empty space, with no real interest behind it. These moves can:

- Reverse quickly

and

- Trap traders who chase too soon.

3. Trapped Volume and Quick Reversals

At the open, the price often breaks:

- Above a premarket high

or

- Below a premarket low.

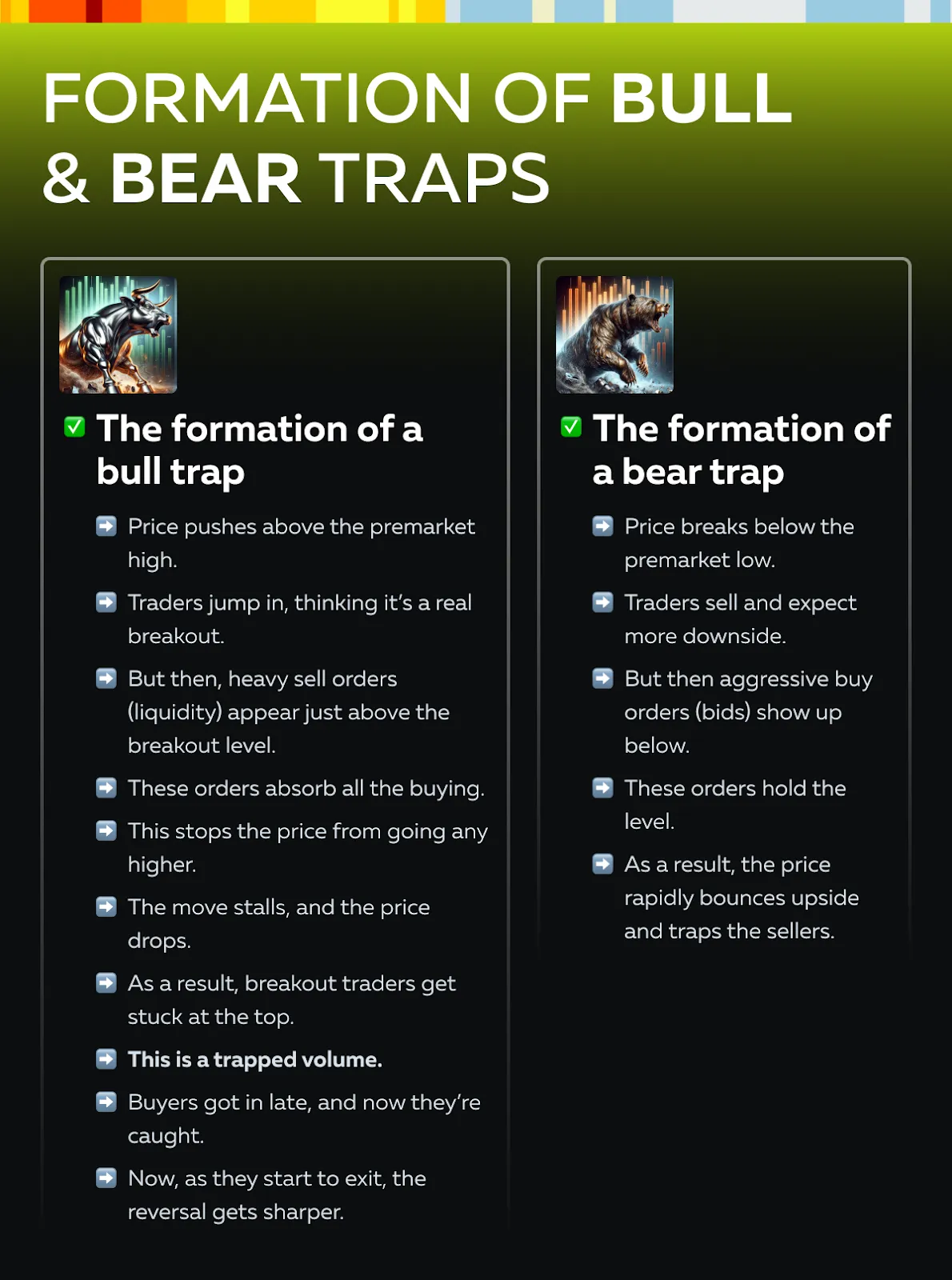

Usually, these breakouts look strong at first, but sometimes they’re just traps! Let’s see how a bull trap and a bear trap happen:

Want to gain a competitive advantage? By using our advanced market analysis tool, Bookmap, you can see these moments. Check out the graphic below to learn what our modern real-time market analysis tool, Bookmap, shows:

Please note that these signs are key for trading the open. Through them, you can understand:

- When a breakout has real strength

or

- When it’s likely just a trap based on order flow trading at the open.

By recognizing liquidity patterns at market open like this, you can avoid bad trades. Sometimes this even puts you on the right side of a fast reversal!

A Simple Framework for the Open Using Order Flow

The market open is one of the most important parts of the day. It brings in a huge amount of volume and decision-making. In the first 15 minutes:

- Traders adjust overnight positions

and

- Institutions show their hand and start taking sides.

In this phase, the market often picks a short-term direction that can last for hours. But trading the open isn’t about jumping in right away! It’s about waiting and watching:

- Where the big volume goes

and

- How the price reacts to it.

Please note that the best trades come after the market gives clues about direction through order flow and liquidity patterns at the market open.

Want to trade the open professionally? Remember, it is not a one-size-fits-all approach! But you can follow this step-by-step framework to trade smartly:

| Time | What to Watch For |

| Pre-Open (9:20-9:30 AM) |

or

|

| First 1-3 Minutes |

or

|

| 3-7 Minutes In |

|

| 7-15 Minutes In |

and

|

Some Pro Tips

- Let the market tell its story first! The first 1-2 candles are often noisy and full of traps.

- Say the price breaks a level. But there’s a big wall of resting orders (just a few ticks above that). It starts absorbing volume. Now, that’s a warning! It is always better to fade (trade against) the move than follow it.

- Our Bookmap’s heatmap isn’t just a display! It shows intent. It tells you where participants are placing orders and whether they’re real or meant to deceive.

Trade the open with more confidence—see real-time liquidity shifts using Bookmap.

Mistakes to Avoid in the First 15 Minutes

In the first 15 minutes of the trading day, many traders get trapped or take losses. But why? This does not happen because the market is unfair. Instead, this happens because they are:

- Rushing to trade

and

- Ignoring key signals in the order flow.

Below are three common mistakes to avoid when trading the open:

1. Trading the First Breakout Without Confirmation

It is tempting to jump in the moment the price breaks above a high or below a low. It feels like the move is just beginning! But that first breakout is often a fakeout.

Just because a price breaks a level, it doesn’t mean it will continue to rise. You need to check if there’s real support behind the move.

For example:

- Say the price breaks above a range.

- Now, check if bids are stacking below it.

- That means buyers are stepping in to support the breakout.

If there’s no support (just price moving into thin air), then the breakout may fail and reverse quickly.

The Pro Tip

Patience is key! You must wait to see if the market confirms the breakout with real volume and support.

2. Ignoring Where Liquidity Is Pulling

Using our Bookmap’s heatmap, you can see:

- Where liquidity is

and

- Where traders are placing large orders.

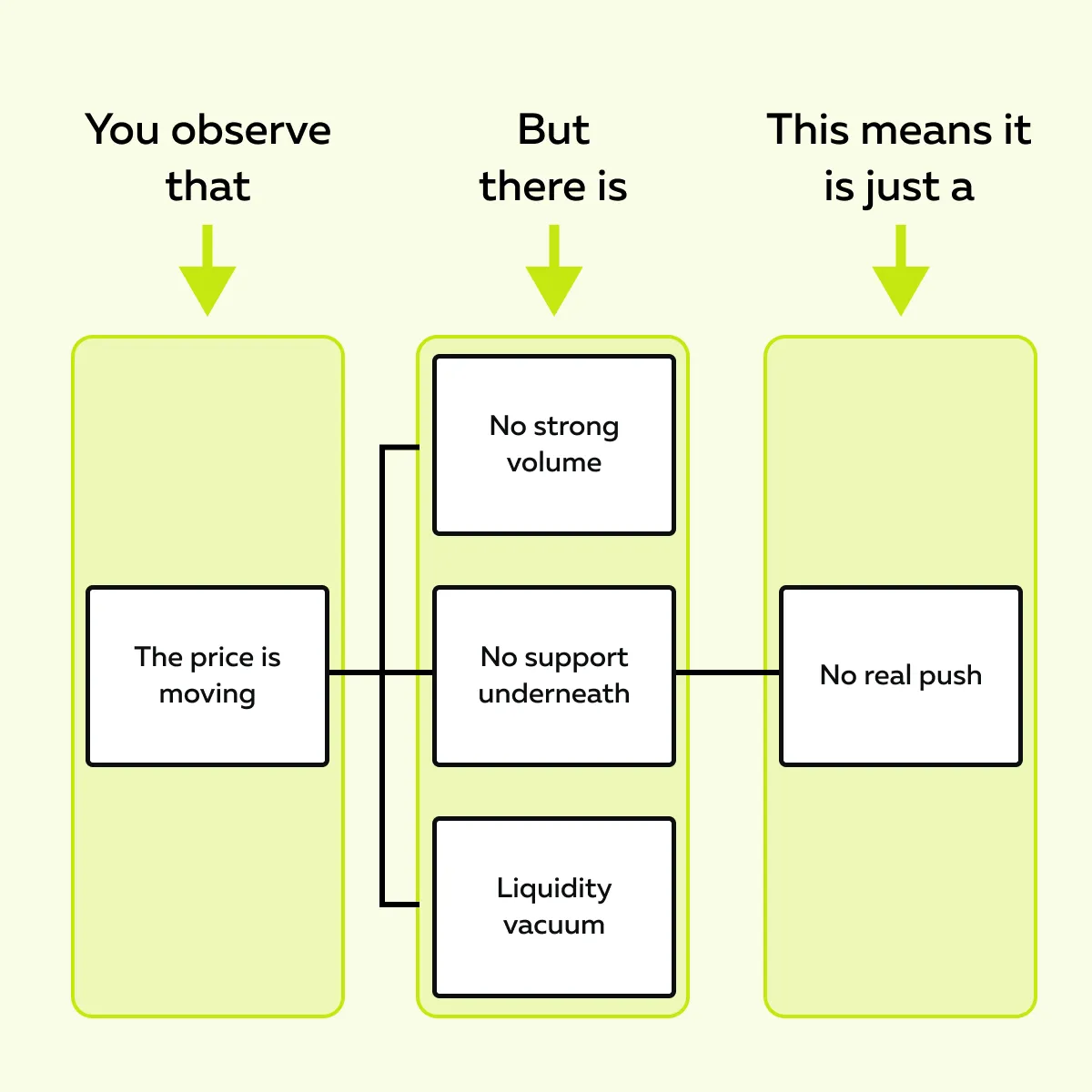

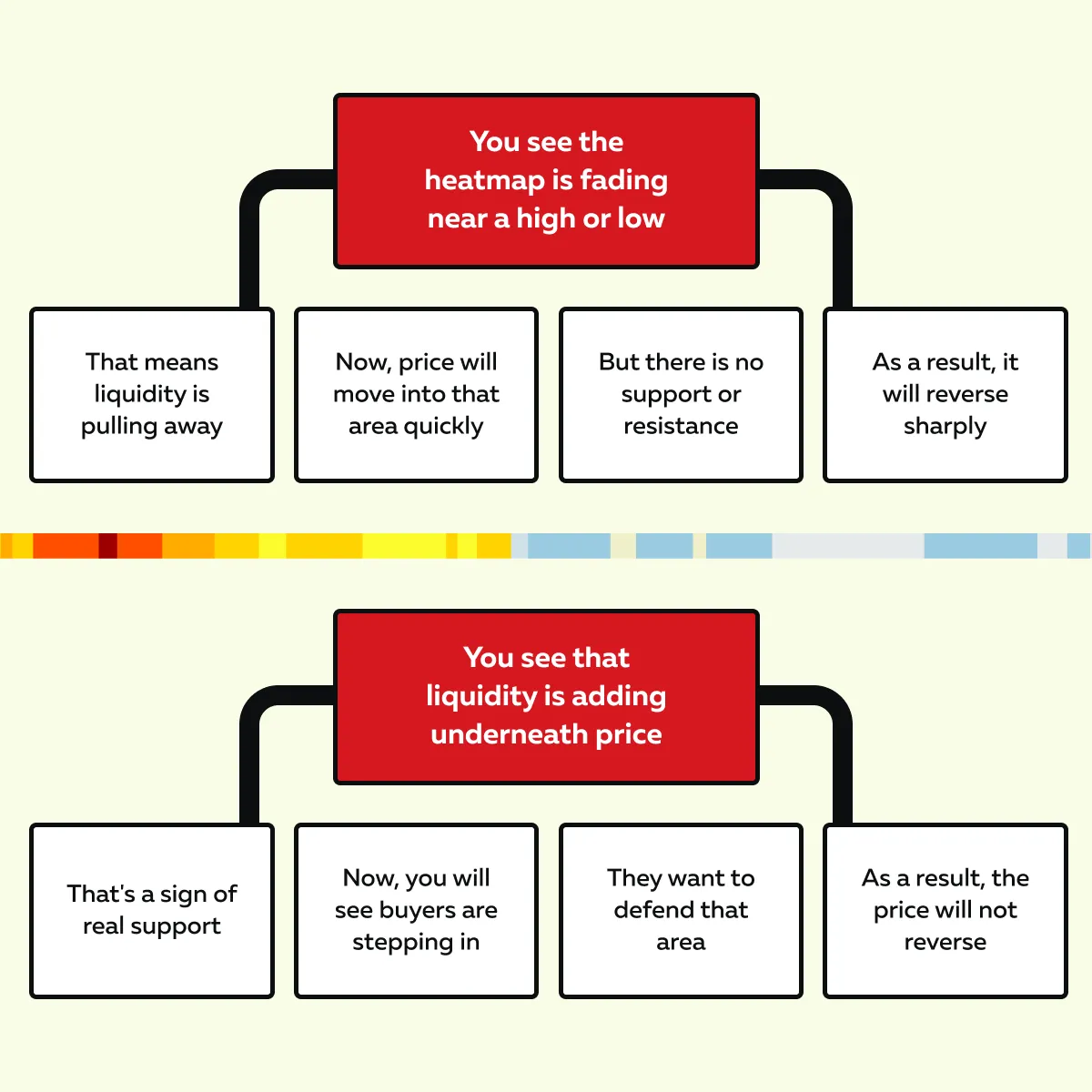

If you are not watching how this liquidity moves, you might walk right into a trap! Let’s understand how this works through the graphic below:

If you ignore these signs, you may chase price into thin zones where it turns around sharply.

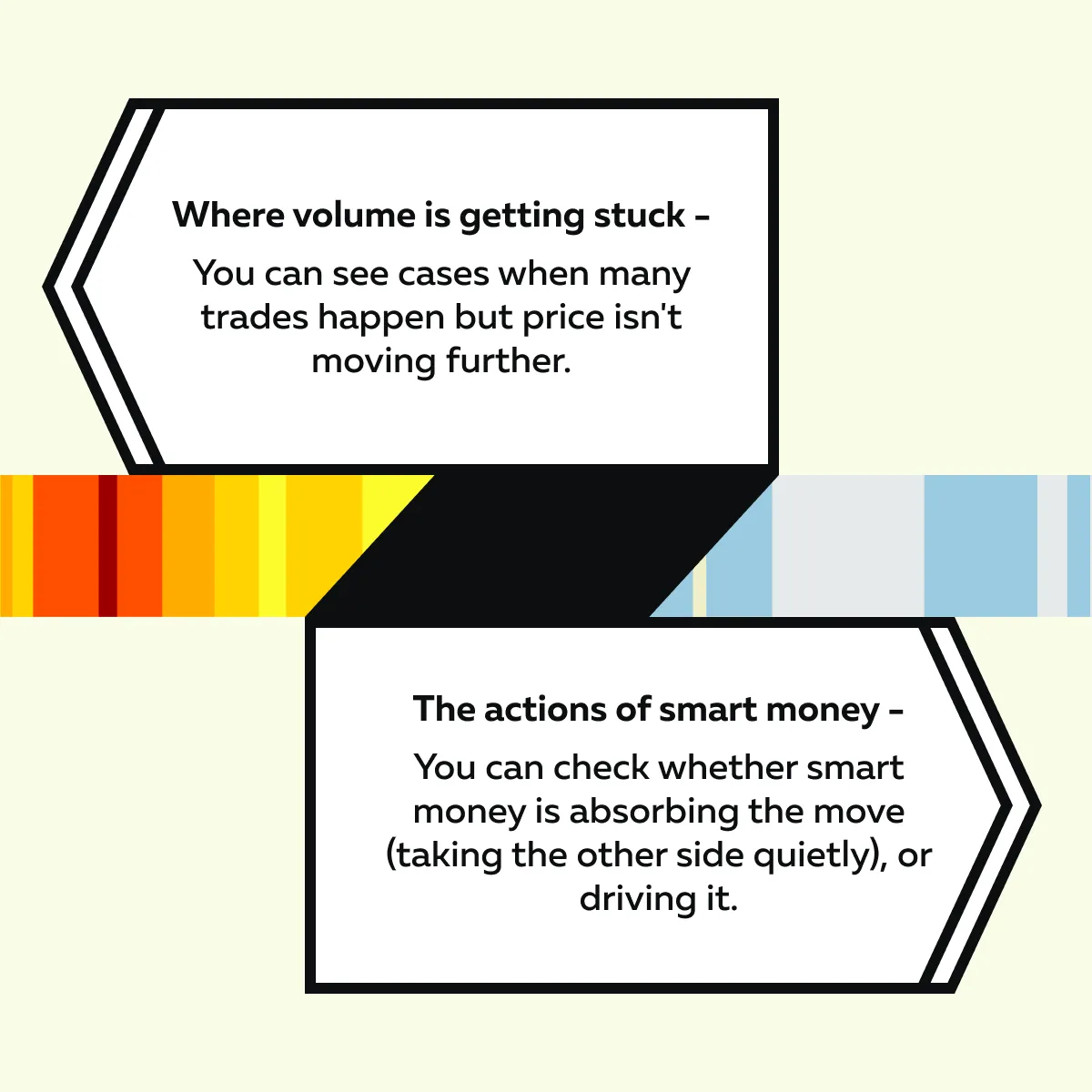

3. Forcing Size Too Early

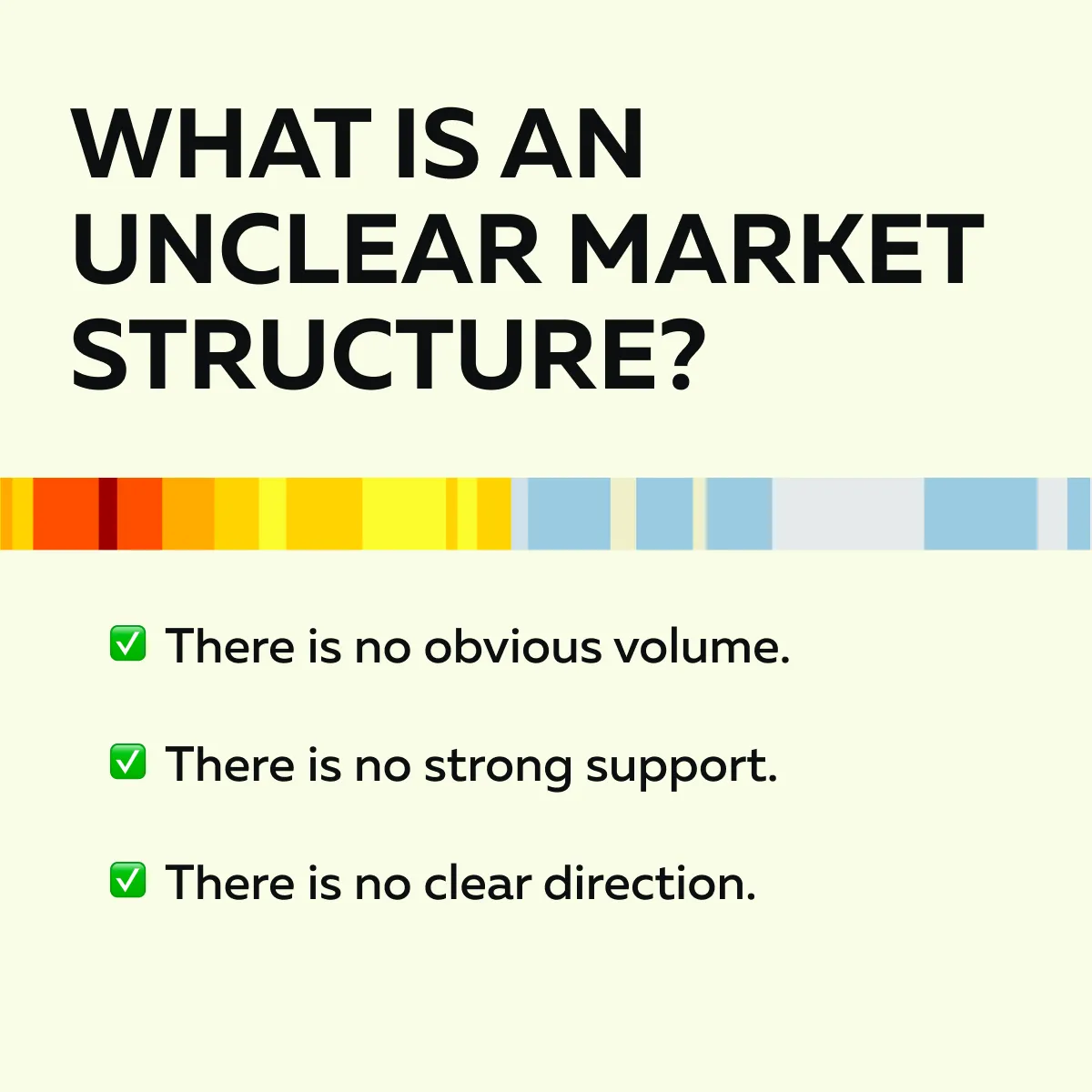

A lot of traders want to hit the open hard! They do so thinking that a larger size means more profit. But it must be noted that in the first few minutes, the market is still unstable. In this phase, the market structure is also unclear. Check out the graphic below to learn what it is:

Trading full-size in such an unclear market is highly risky. Thus, if you’re new to order flow trading at the open:

- Please trade with smaller position sizes.

- Use wider stops to give the price room to move, and

- Wait for clearer signs from the market before sizing up.

You must realize that the open can be powerful, but it’s also full of traps! Thus, it is always smarter to start light and learn the rhythm. Ideally, you should only add size when the trade shows real signs of strength (like liquidity patterns at market open that support your setup).

Conclusion

The first 15 minutes of the trading day can bring big opportunities! But you must stay patient and focused. That’s because many traders get caught chasing fast moves without understanding what’s really happening under the surface.

So, how to succeed? You need to read the order flow, spot where real liquidity is, and wait for clear signs of strength or weakness.

With the help of our advanced market analysis tool, Bookmap, you can see where volume is hitting, where support is building, and where traps might form. Instead of reacting to every price spike, you can follow a plan. Just watch how the market behaves and trades when the structure lines up.

Always remember, the best setups come to those who let the first moves reveal the real story! Don’t guess what’s real in the first 15 minutes—track aggressive volume and hidden support with Bookmap.

FAQ

1. Why is the market open so volatile?

During the market open, multiple trades happen all at once. Both small and big players are placing orders at the same time. Additionally, in this phase, traders are:

- Reacting to news

and

- Adjusting overnight positions.

This creates sharp moves and price jumps as the market tries to find direction.

2. How can I avoid getting trapped during the open?

Don’t chase the first price move! Instead, wait and see if real buyers or sellers show up. Always look for signs like:

- Orders building underneath the price (support)

or

- Volume pushing through levels.

If you can’t see these signs, it means the move is a trap and will quickly reverse.

3. What tools help most during the first 15 minutes?

Our avant-garde market analysis tool, Bookmap, lets you see:

- Where big buy or sell orders are sitting,

- Where volume is hitting, and

- Whether the price is moving with real support.

This lets you see what’s actually happening and not just what the chart looks like.

4. Should I avoid trading the open altogether?

No, you don’t have to skip the open. Instead, you should be careful. Follow these tips:

- Start small,

- Wait for clear setups, and

- Learn to read the behavior of price and volume.

The open offers profitable opportunities, but only if you have a plan and don’t rush.