Ready to see the market clearly?

Sign up now and make smarter trades today

Education

October 16, 2024

SHARE

Understanding Market Moves: The Principles of Auction Market Theory

The financial markets are an ever-shifting landscape, where information

travels at lightning speed, and technologies evolve in the blink of an eye.

Auction Market Theory (AMT), often abbreviated as AMT, stands as a timeless

pillar in this whirlwind of financial dynamics. It traces its roots back to

the pioneering work of Richard D. Wyckoff, a name etched in the annals of

trading history. Wyckoff’s insights, later refined by eminent traders and

theorists like Jesse Livermore and Richard Ney during the early to mid-20th

century, continue to serve as guiding stars for modern traders.

Despite the decades that have passed since its inception, AMT retains its

relevance in the world of trading. In this article, we will not only

highlight the enduring significance of AMT but also offer a deep dive into

its core principles and explore its versatile applications across different

marketplaces.

Join us as we unravel the practical aspects of Auction Market Theory and

discover how it can empower you to craft more effective trading strategies.

What is Auction Market Theory?

At its core, AMT elucidates the mechanics of price determination within

auction-style marketplaces. It postulates that market prices are the result

of continuous auctions where buyers and sellers engage in competitive

interactions. Its understanding helps traders comprehend how supply and

demand interact to establish equilibrium prices.

- Market auction theory explained: AMT views price as the outcome of a continuous two-way auction where buyers and sellers test levels until value is found.

- Principles of market auction theory: balance vs imbalance, acceptance vs rejection, and price discovery around value areas.

AMT has several uses when it comes to

financial markets

. These are:

|

How AMT Helps: |

What is the Meaning? |

How Is It Used Practically By Traders? |

|

Gauging Market Price |

|

It helps traders and investors to:

|

|

Probes Market Behavior |

|

It sheds light on how different players influence market

|

|

Volume Analysis |

AMT emphasizes the importance of trading volume. |

Traders use it to assess the:

|

|

Identification of Market Phases |

It identifies various market phases, such as |

This helps in timing trades or investments. |

How To Use Auction Market Theory In Trading

Apply AMT by mapping value areas, watching for rejection at the edges, and waiting for conviction when price leaves balance. Tactics include fading excess back toward value, or joining initiative moves when price accepts new value after a breakout. Pair the read of balance vs imbalance with volume to confirm the shift.

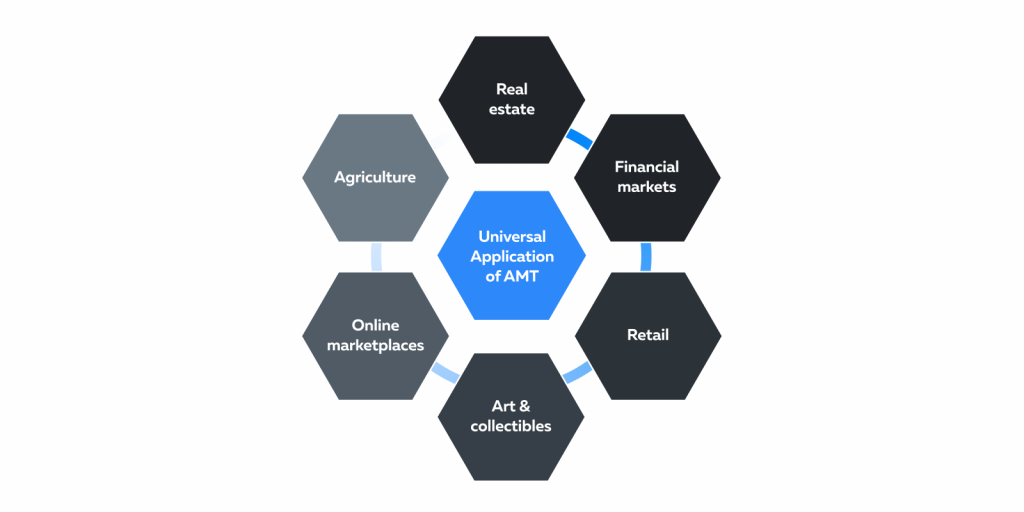

AMT Beyond Financial Markets

What sets AMT apart is its universal relevance; it extends beyond financial

markets. It can be applied to a wide range of marketplaces. Here are several

domains where AMT’s insights hold relevance:

-

Real Estate:

-

AMT helps real estate professionals understand:

-

various nuances of property price

-

buyer-seller dynamics

-

emerging market trends

-

-

-

Retail:

-

AMT principles can help retailers to make informed decisions

related to:-

pricing strategies

-

inventory management

-

sales forecasting

-

-

-

Art and Collectibles:

-

In this industry, AMT provides a framework that helps collectors

and dealers:-

gauge the value of items and

-

anticipate market shifts.

-

-

-

Online Marketplaces:

-

AMT’s principles are valuable for e-commerce platforms and

online auctions. -

By leveraging AMT insights, online marketplaces can fine-tune

their pricing strategies to align with market conditions,

thereby increasing profitability. -

They can optimize pricing and manage supply and demand.

-

For example, if a product suddenly experiences increased demand,

AMT principles suggest that the platform should ensure an

adequate supply to prevent stockouts and meet customer needs.

-

-

Agriculture:

-

AMT is a valuable tool for participants in agricultural markets,

helping them:-

understand commodity price movements

-

assess the impact of weather events

-

analyze the behavior of producers and consumers

-

-

Auction Market Theory, with its enduring relevance and broad applicability,

stands as a cornerstone of understanding and navigating the intricate

dynamics of diverse marketplaces, making it an indispensable asset for

traders and professionals across various industries.

The Core Principles of Auction Market Theory

Auction Market Theory (AMT) offers insights into the inner workings of

markets. Most traders and investors often use it to make informed

decision-making in any market, regardless of its size or complexity.

While studying AMT, it is crucial to understand the distinction between

value and price, as it helps in the identification of potential market

inefficiencies.

Value vs Price

|

What is the meaning of value? |

What is the meaning of price? |

|

|

|

How is the value determined? |

How is the price determined? |

|

|

In this Insight, Tom B. showcases how auction market theory looks in practise on the ES (S&P 500). https://bookmap.com/insights?id=185

What are the different implications of value and price?

-

Differing Perceptions:

-

Differences in value and price can lead to market

inefficiencies. -

For example,

-

A stock may be undervalued based on fundamental analysis

(high value). -

However, due to market sentiment or short-term factors, it

is trading at a lower price.

-

-

-

Long-Term vs. Short-Term:

-

Understanding the difference between value and price determines

which type of trader you are.

-

|

How do long-term investors think? |

How do short-term investors think? |

|

|

-

Determining Market Efficiency:

-

Efficient markets are those where prices closely align with

values. There is little room for

arbitrage opportunities

. -

Inefficient markets exhibit larger gaps between value and price.

They offer more potential profit-earning opportunities.

-

Practical Understanding

To solidify our comprehension of value and price, let’s explore a practical

scenario:

Imagine a tech company, XYZ Inc., with strong fundamentals and a promising

growth trajectory. Expert analysts have pegged its intrinsic value at $100

per share based on their financial models. Yet, a sudden adverse news

development precipitates a swift stock price plunge to $80 per share.

What is the Value and Price of XYZ Inc. in this Scenario?

|

Value = $100 |

Price = $80 |

|

|

Key Concepts of Auction Market Theory

AMT centers on value areas, excess, acceptance, rejection, and the auction’s constant search for balance.

- Balance: stable trade around fair value.

- Imbalance: initiative activity that pushes price to seek new value.

Excess: a failed push that often marks a turning point.

Reading these in sequence helps time entries and exits with context.

Acceptance and Rejection

In the context of AMT, understanding value areas and areas of rejection is

crucial for making better trading decisions. It provides insights into:

-

Where market participants perceive fair value and,

-

How price movements trigger reactions and shifts in trading

activity.

Let’s explore further.

|

Parameters |

Value Areas (Accepted Prices) |

Areas of Rejection (Non-accepted Prices) |

|

What does it mean? |

|

|

|

How does it impact the current market price (CMP)? |

|

|

How Do Value Areas Influence Price Movements?

|

Within Value Areas |

Entering Value Areas |

Outside Value Areas |

|

|

|

Balance and Imbalance

Gaining an understanding of balance and imbalance in AMT is essential for

traders and investors to effectively navigate changing market conditions.

|

The State of Balance |

The State of Imbalance |

|

|

What are the different scenarios causing the state of market imbalance?

Different market scenarios can create market imbalances, such as:

-

News Events:

-

Positive or negative news regarding a company, industry, or the

broader economy can upset the market balance. -

For instance, when a company’s earnings announcement either

exceeds or falls short of expectations. -

Positive news tends to attract more buyers, driving prices

upward until they reach a point where sellers are willing to

offer more shares. -

Conversely, negative news triggers selling pressure until buyers

perceive the asset as undervalued.

-

-

Sentiment Shifts:

-

A sudden shift in market sentiment, often influenced by factors

like geopolitical events or investor sentiment, can lead to an

imbalance. -

In such a situation, traders rush to either buy or sell,

creating a price gap until a new equilibrium is established.

-

-

Liquidity Shocks:

-

A lack of liquidity in the market, mostly due to a large

sell-off by a major investor, causes an imbalance. -

This leads to sharp price fluctuations as the market attempts to

find a level where buyers are willing to enter.

-

These principles of balance and imbalance are fundamental to understanding

how market dynamics evolve and play a crucial role in the strategies of

traders and investors across various markets.

The Role of Volume in AMT

Volume in financial markets serves as a barometer of trading activity. It

indicates the intensity of buying and selling and often precedes or

accompanies significant price movements. An elevated volume suggests

heightened interest or urgency among market participants.

In the context of AMT, volume and price maintain a close-knit relationship.

In an auction-like market, such as a stock exchange, volume plays a crucial

role in determining prices. When buyers outnumber sellers, prices typically

ascend, and vice versa.

When explored deeper, high-volume nodes and low-volume nodes serve as

important indicators for traders and help them identify:

-

Support and resistance levels

-

Potential breakouts or breakdown points in the market

High Volume vs. Low Volume Nodes

|

Parameters |

High-volume Nodes |

Low-volume Nodes |

|

What is the meaning? |

These denote price levels or zones on a price chart

|

These represent areas of price vulnerability or scant

|

|

How is it used by traders? |

|

|

Let us understand this concept through a practical example:

Stock XYZ Inc. is trading in a range between $50 and $60. On a volume

profile chart, you observe the following situations:

|

Situations |

What did you observe? |

What does it indicate? |

|

A |

There is a prominent peak in the volume profile chart at |

|

|

B |

There is a gap in the volume profile between $57 and

|

|

What predictions will traders make for Stock XYZ?

-

Upon observing high-volume nodes:

-

Traders may expect $55 to act as a strong support or resistance

level. -

If the price approaches $55, there might be increased buying or

selling activity.

-

-

Upon observing the low-volume node:

-

The low-volume node between $57 and $58 may be viewed as a

potential breakout point. -

Traders will monitor this area for signs of a significant price

move if the price approaches these levels.

-

Auction Market Theory And Volume Profile

Volume profile shows where trade concentrated. High volume nodes suggest acceptance. Low volume nodes mark rejection zones and potential fast rotations. Within AMT, use these nodes to define value, locate excess, and plan trades around migrations of value.

TPO Charts And Market Auction Theory

TPO or Market Profile charts arrange time at price into distributions. They visualize balance areas, single prints, and excess tails that align with AMT’s concepts of acceptance and rejection. Traders use TPO structure to frame the day type and anticipate potential range extensions.

Practical Implications for Traders

Transitioning from a state of balance to imbalance is a critical concept in

AMT as it helps traders determine advantageous entry and exit points.

Here are practical methods for using AMT principles to spot these

transitions:

|

Practical Spotting Methods |

What does it mean? |

How to spot it? |

|

Increase in Volume |

A surge in volume suggests that more participants are |

|

|

Rapid Price Change |

Sudden and significant price movements, especially those |

|

|

Breakout of Support and Resistance Levels |

When prices break through well-established support or |

|

Why is Detecting Transitions Important?

Detecting shifts from balance to imbalance is crucial for traders for

several compelling reasons:

-

Facilitates strategic entry and exit points:

-

Identifying these shifts allows traders to time entry or exit

positions. -

For example, entering a trade as the market transitions from

balance to imbalance can offer a better entry price.

-

-

Promotes effective risk management:

-

Recognizing shifts in market dynamics helps traders manage risk.

-

If the market is rapidly shifting into an imbalance against a

position, it may be wise to consider an exit to limit potential

losses.

-

-

Assists in exploring volatility opportunities:

-

Imbalance often begets heightened volatility, offering

opportunities for traders who thrive on price fluctuations. -

Understanding when and why imbalances occur can help traders

capitalize on volatility for potential gains.

-

Auction Market Theory vs Efficient Market Hypothesis

EMH assumes prices reflect available information. AMT assumes prices are discovered through an ongoing auction. In practice, AMT helps traders read how information is absorbed by watching acceptance, rejection, and volume around value. The contrast is theoretical vs procedural. AMT focuses on the process that gets price to fair value.

Strategizing with AMT

Traders commonly integrate AMT principles into their trading strategies to

maximize their advantages. Discover how you can do the same:

|

What to do? |

How to do it: |

|

|

|

|

|

|

|

|

|

|

|

|

Market Microstructure Theories And Price Discovery

AMT sits alongside microstructure ideas about how orders, liquidity, and execution shape price.

- Price discovery models: describe how new information becomes price through trade.

- Financial market analysis techniques: combine structure reads, order flow, and volume tools to judge whether the auction is balancing or seeking new value.

Auction Market Theory in Modern Trading Tools

In the modern trading landscape, technological advancements have made it

easier than ever for traders to apply AMT principles effectively. Discover

how market analysis tools like Bookmap facilitate the visualization and

utilization of AMT principles:

-

Visualize Market Data Using Depth of Market (DOM) Tools:

-

Platforms like Bookmap offer

advanced DOM data visualization

that automatically identifies high-volume nodes and low-volume

nodes. -

They provide a visual representation of order book depth,

showing the distribution of buy and sell orders at various price

levels. -

This helps in identifying:

-

Where liquidity is concentrated

-

High-volume nodes, and

-

Price rejection zones

-

-

-

Obtain Real-Time Market Data:

-

Major market analysis tools like Bookmap offer live data feeds

and real-time market data, including price and volume

information. -

Traders can monitor these feeds to spot shifts in volume and

price.

-

-

Algorithmic Trading:

-

Advanced market analysis tools, like Bookmap, support the

development and execution of algorithmic strategies that

seamlessly integrate AMT principles. -

Traders can create algorithms that respond to:

-

Shifts in volume

-

Trade around value areas, or

-

React to sudden market imbalances.

-

-

Conclusion

Despite its development many decades ago, Auction Market Theory (AMT) still

holds relevance irrespective of market conditions or technological

advancements. AMT’s core concepts, such as value areas, price rejection

zones, volume analysis, and the dynamics of balance and imbalance, remain

fundamental in deciphering market behavior.

These time-tested principles continue to guide traders in making informed

decisions, and their applicability extends far beyond the world of financial

markets. AMT offers valuable insights across diverse marketplaces, from real

estate and retail to the art world and more, underscoring its universal

importance.

Are you ready to leverage insights from Auction Market Theory in real time?

Take a deeper dive into live market dynamics with Bookmap. Join us now and

gain an edge in your trading journey.

Discover Bookmap today

FAQs

What is Auction Market Theory?

Auction Market Theory explains price movement as the outcome of a continuous two-way auction between buyers and sellers. Markets alternate between balance around fair value and periods of imbalance as price searches for new value.

How is Auction Market Theory explained?

AMT illustrates how buyers and sellers probe different price levels. Some levels are accepted through heavy trading, while others are rejected. This ongoing pattern of acceptance and rejection creates value areas and potential turning points.

What are the key concepts of Auction Market Theory?

Core AMT concepts include value areas, acceptance, rejection, balance, imbalance, and excess. Together, these describe how the market continuously discovers fair value.

How do I use Auction Market Theory in trading?

Identify the current value area, monitor acceptance or rejection at its edges, and confirm moves with volume. Traders often fade back to value after excess or join initiative moves once a new area establishes acceptance.

Auction Market Theory vs. Efficient Market Hypothesis

The Efficient Market Hypothesis focuses on how information is reflected in price. AMT focuses on the auction process driving price discovery, emphasizing observable behaviors such as acceptance, rejection, and volume patterns.

How does Auction Market Theory relate to the Volume Profile?

Volume Profile supports AMT by showing where trading activity concentrated. High-volume nodes signal acceptance, while low-volume nodes indicate rejection. These zones can guide rotations, breakouts, and value transitions.

What is the relationship between TPO charts and Auction Market Theory?

TPO charts display time at price and form distributions that align with AMT principles. Single prints and tails often highlight excess and potential reversal zones, helping traders identify market structure.

Are you looking for the definition or the practical application?

If you need a definition, refer to the overview above. For practical use, focus on identifying current value, determining whether the day is balanced or imbalanced, and watching how volume behaves at key edges.

Does Auction Market Theory apply to futures or stocks?

AMT applies to all financial markets. Highly liquid futures and equities often exhibit clearer balance areas, value migrations, and auction transitions.

How does Auction Market Theory compare to other market theories?

AMT complements market microstructure and price discovery models by offering a practical lens on how trades create acceptance, rejection, and trends over time.