Ready to see the market clearly?

Sign up now and make smarter trades today

Futures

October 29, 2025

SHARE

What Actually Moves the ES Futures Market? (It’s Not Just the S&P 500)

Most traders think ES futures simply follow the S&P 500 like a shadow. Are you one among them? If it’s a YES, you too are missing the plot! Why? It’s not just about the index! It’s about flows, hedges, and liquidity games happening beneath the surface.

In 2025, this is the reality – ES doesn’t move randomly, nor does it blindly track SPX. What moves ES futures can be anything from hedging activities of options dealers, ETF arbitrage pulling liquidity, or stop runs cascading through thin order books.

Need more knowledge? In this article, you will learn about these drivers, options flows, ETF hedging, gamma effects, liquidity behavior, and more. By the end, you won’t just be staring at candles! Instead, you’ll understand the “why” behind each move.

Also, we will show you how advanced real-time market analysis tools, like Bookmap, can reveal those hidden layers in real time.

It’s Not Just SPX: What ES Futures Actually Track

Most new traders believe ES futures simply copy the S&P 500 index (SPX). While they are closely related, that’s not the full story! That’s because:

Now, futures add another layer! Using it, traders can anticipate prices, hedging flows, and macro shifts. When traders act on these anticipations, it sometimes makes ES move differently from SPX. Let’s understand everything in detail:

ES vs. SPX: The Core Difference

| SPX (S&P 500 Index) | ES futures |

|

|

So, when people say ES “follows” SPX, it’s broadly true! But remember that ES can also lead or lag depending on market conditions.

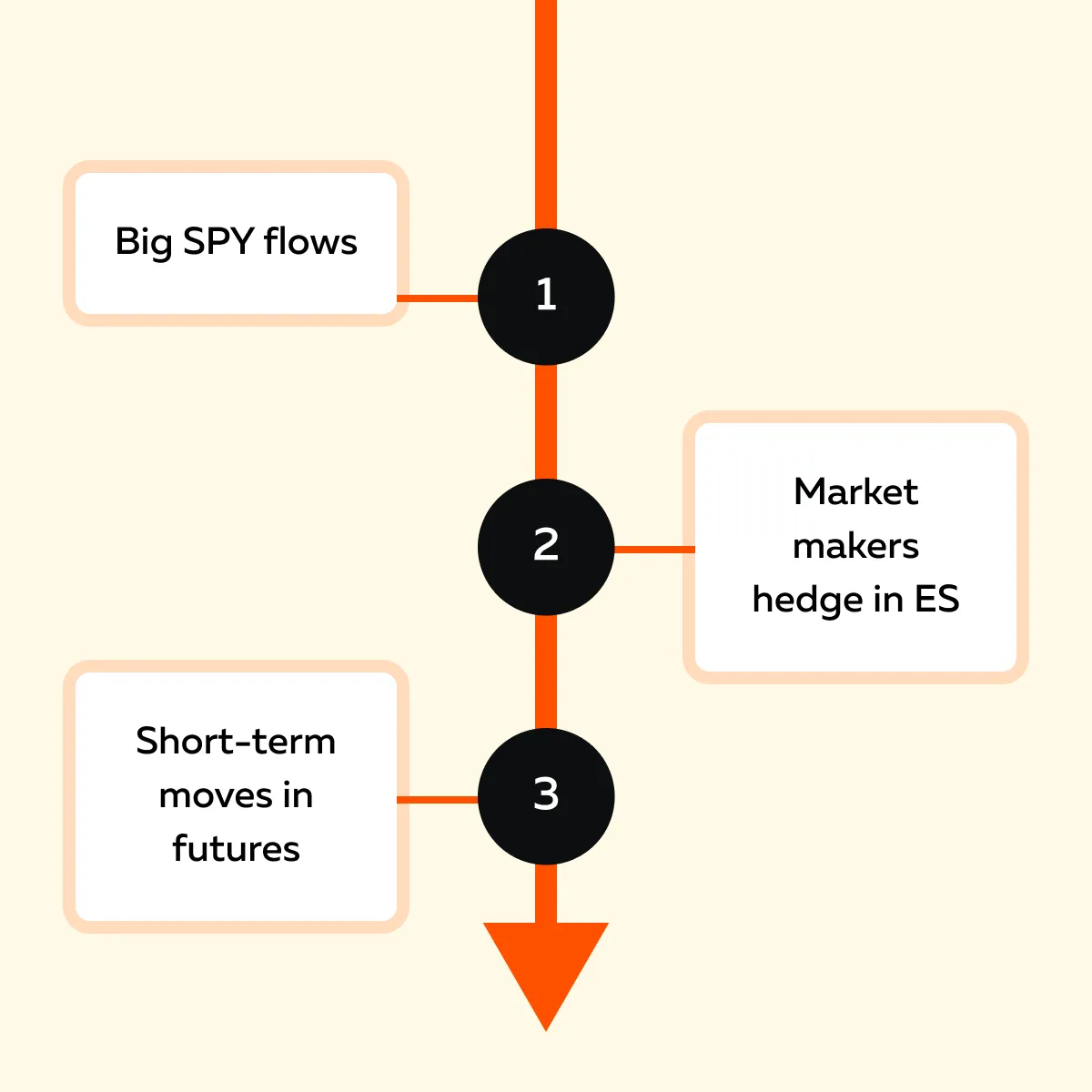

The Role of SPY ETF and Institutional Flows

The SPY ETF is one of the most heavily traded securities in the world. When large institutions buy or sell SPY in large volumes, market makers need to hedge their risk. One of the fastest ways they do that is by using ES futures. Let’s check the process:

This is why sometimes ES reacts before SPX itself shows the move.

Cross-Market and Macro Impact

Is it just about SPX and SPY? Nope! Broader flows between markets matter too. Let’s see how through three real-world examples:

| Example I: Tech Rally | Example II: Sector Rotation | Example III: Institutional Hedging on Big Days |

|

|

|

Want real-time ES order flow data? See what Bookmap reveals about liquidity shifts.

Options Flow and Gamma Exposure as Drivers

Want to know one of the most overlooked answers to what moves ES futures intraday? It is an options activity in SPX and SPY. As a trader, you must note that large flows in the options market create hedging needs for dealers. And those hedges often spill directly into ES. Let’s understand how:

The Role of Dealer Hedging

When traders “buy SPX/SPY calls”, dealers who sold those calls need to short ES futures. Why? To stay hedged. In contrast, when traders “sell calls or buy puts”, the opposite happens. Now, dealers need to buy ES futures instead.

This back-and-forth hedging makes ES move with options flow (even if SPX itself hasn’t shifted much).

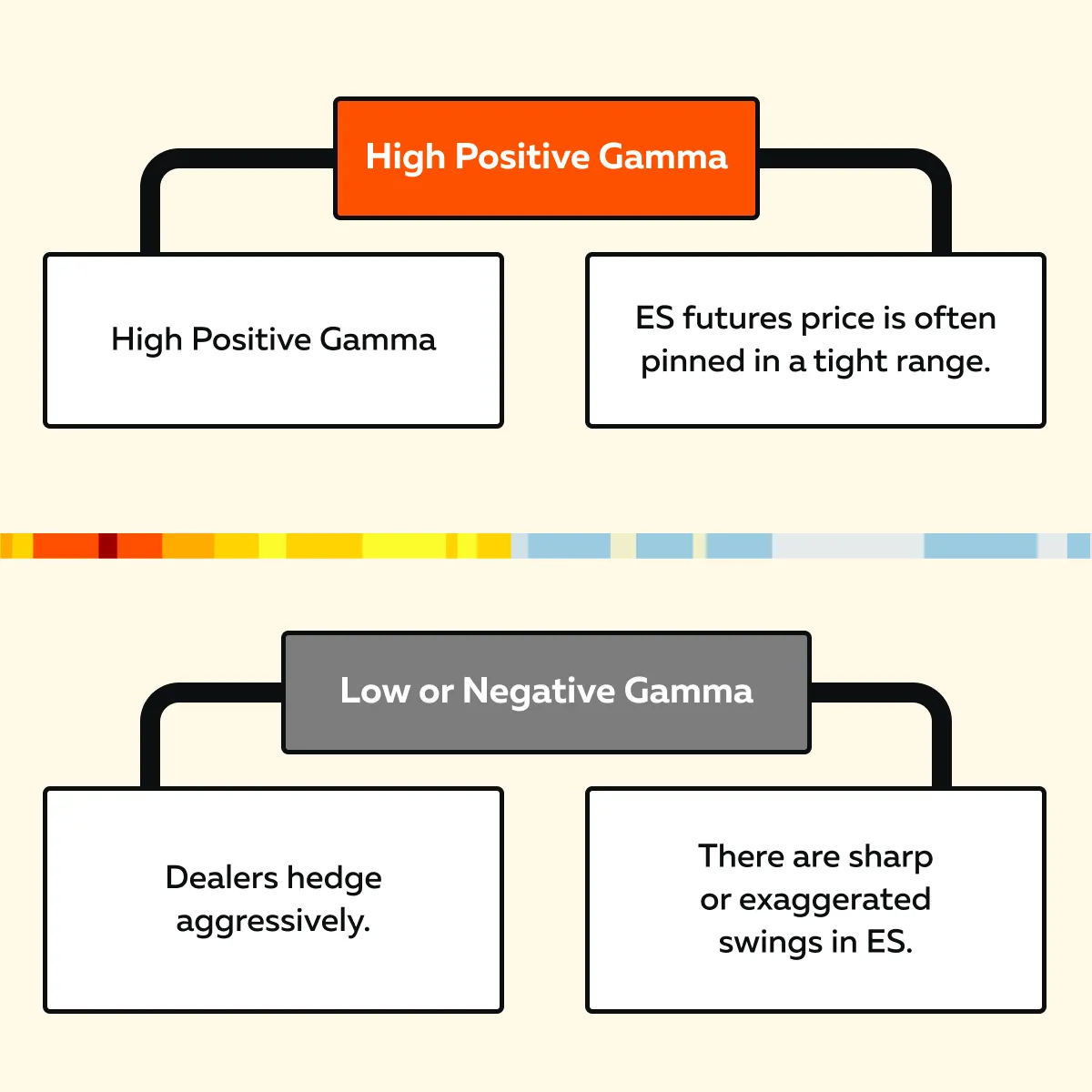

Gamma and Price Behavior

Options have something called “gamma”. It affects how much dealers need to hedge as prices move. Now, by identifying high or low gamma, you can anticipate the ES futures price movements. Check how:

This is why near big options expirations, ES can either feel “stuck” or suddenly break loose.

Zero DTE and Intraday Volatility

The explosion of zero DTE options (same-day SPX contracts) has added even more short-term movement. Now, besides gamma, options also have a value called “delta”. It shows how much the option’s price moves when the underlying ES futures move. As ES price changes during the day, the delta of options changes too.

As a result, the dealers who sold options must adjust their hedges to stay neutral. They do this by buying or selling ES futures in waves. Thus, ES fluctuates intraday, partly because dealers are constantly trading it to manage risk from options.

Want to visualize it? You can start using advanced real-time market analysis tools, like Bookmap.

How to Use Bookmap to Spot Hedging Flows in ES?

Using Bookmap, you can see order flow in real time! Only price candles? Nope! You get to see the:

- Actual volume

- Liquidity

- Aggressive buying/selling in ES futures

Let’s see how you can use Bookmap to spot hedging flows in just three simple steps:

| Step I: Watch for Sudden Bursts of Aggressive Volume | Step II: Look for Price Chasing | Step III: Compare with Context |

|

|

|

Bookmap lets you track liquidity and volume live—see how it affects ES price action.

ETF Hedging and Arbitrage Effects

Beyond the S&P index and options flows, “ETF activity” is another major factor in what moves ES futures. The most important one is SPY! It is the largest and most liquid ETF tied to the S&P 500.

Please note that ETFs are constantly:

- Created

- Redeemed

- Rebalanced

Thus, they generate hedging flows that directly influence the price of ES futures. Let’s understand in detail:

SPY Arbitrage and Futures Hedging

Authorized participants (APs) handle the creation and redemption of SPY shares. When demand for SPY rises, they can do any of the following:

- Buy the underlying S&P 500 stocks

or

- Hedge that exposure by selling ES futures.

When selling pressure hits SPY, they may do the reverse. This arbitrage keeps SPY and ES aligned. One more thing! It also means that big ETF flows can push ES up or down, even if SPX itself looks calm.

Market-on-Close and Auction Imbalances

At the end of the trading day, large market-on-close (MOC) orders often hit SPY. These flows are massive! And since dealers need to stay hedged, ES futures frequently absorb part of that imbalance.

The result? In the last 5 minutes of trading, ES can spike or drop suddenly. Not because of fundamentals, but because of ETF auction flows.

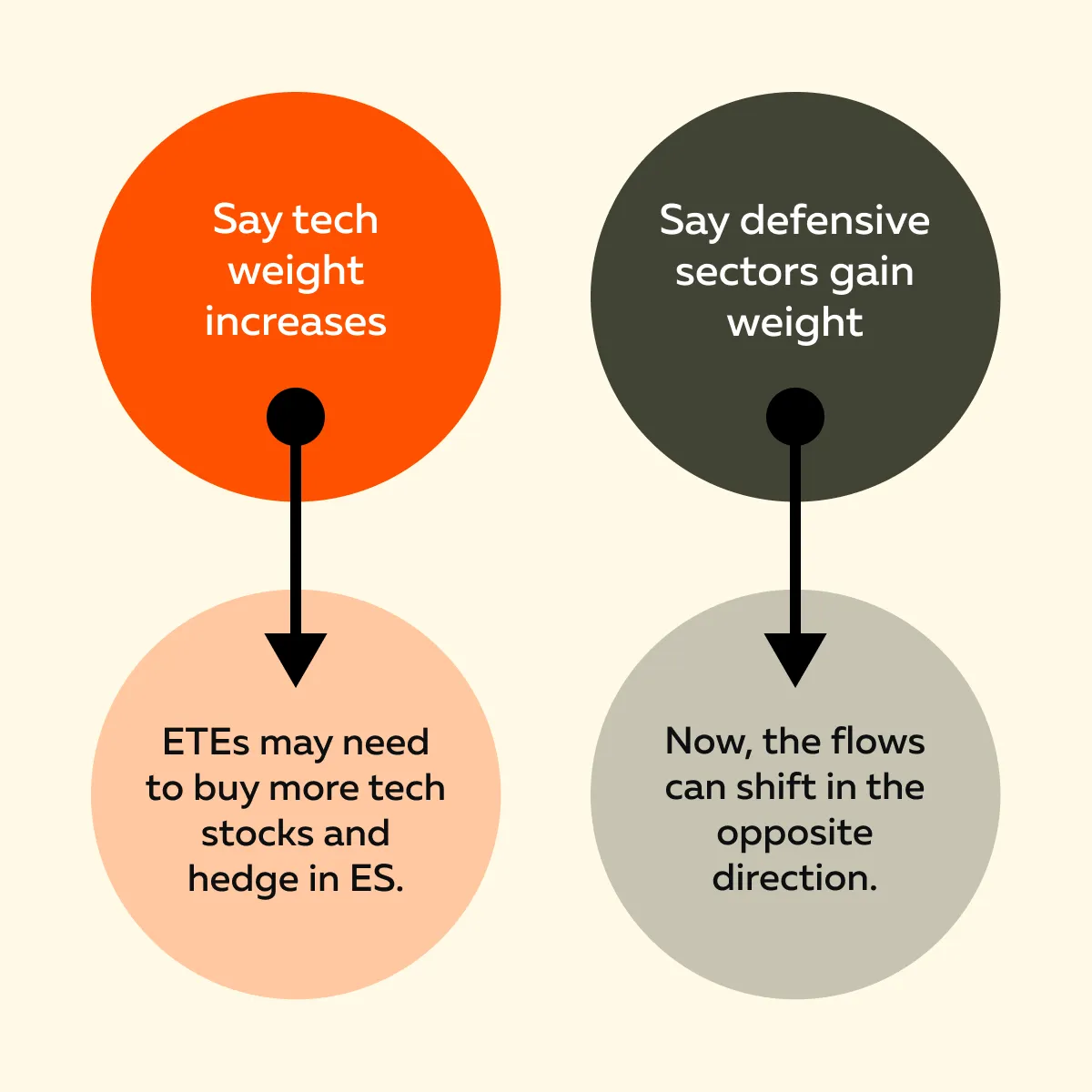

ETF Rebalancing and Sector Rotation

On monthly or quarterly rebalance dates, ETFs adjust their holdings to match index weights. This creates large supply-demand imbalances. Let’s see how:

Okay, can I visualize it on Bookmap? Yes, on Bookmap, this shows up as large passive orders. These orders cluster near VWAP levels. Usually, institutional desks carefully manage these flows.

Liquidity Behavior and Market Microstructure

Not every move in ES futures comes from big macro news, ETF flows, or options hedging. Sometimes, what moves ES futures is simply the way liquidity behaves inside the order book! Let’s see how:

Traders must note that this price fluctuation can happen even without any new information hitting the market.

Liquidity Pulling and Spoofing

Firstly, understand that liquidity is the buy and sell orders sitting in the order book. Now, if those orders suddenly vanish (“liquidity pulling”), the price can shoot through empty zones. This shoot-up can create an “air pocket.”

Furthermore, sometimes traders place fake-looking orders (spoofing) and then pull them away to nudge the price in a direction. These quick jumps are often mistaken for breakouts. But in reality, they’re just the absence of opposing orders!

Stop Runs Triggering and Creation of Liquidation Cascades

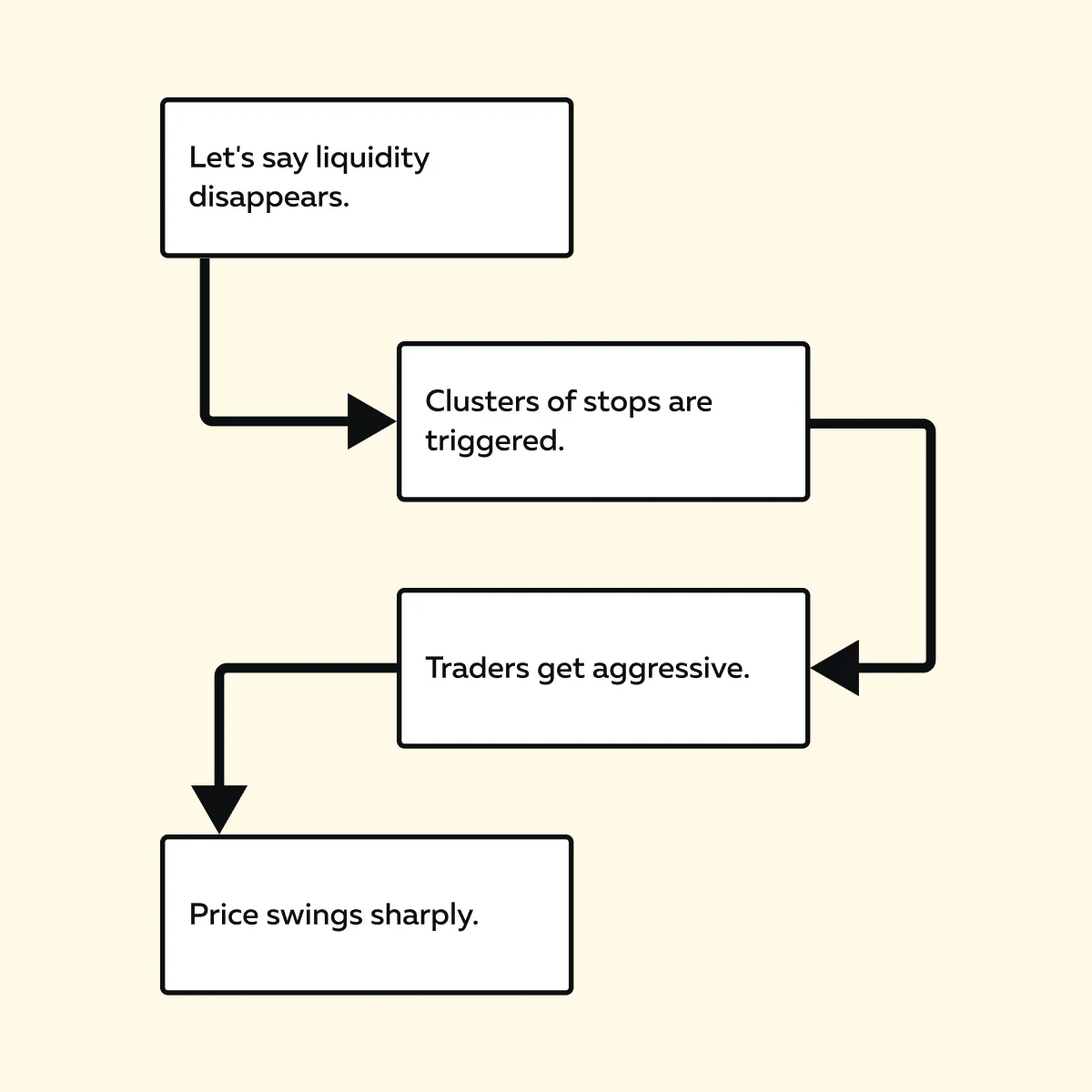

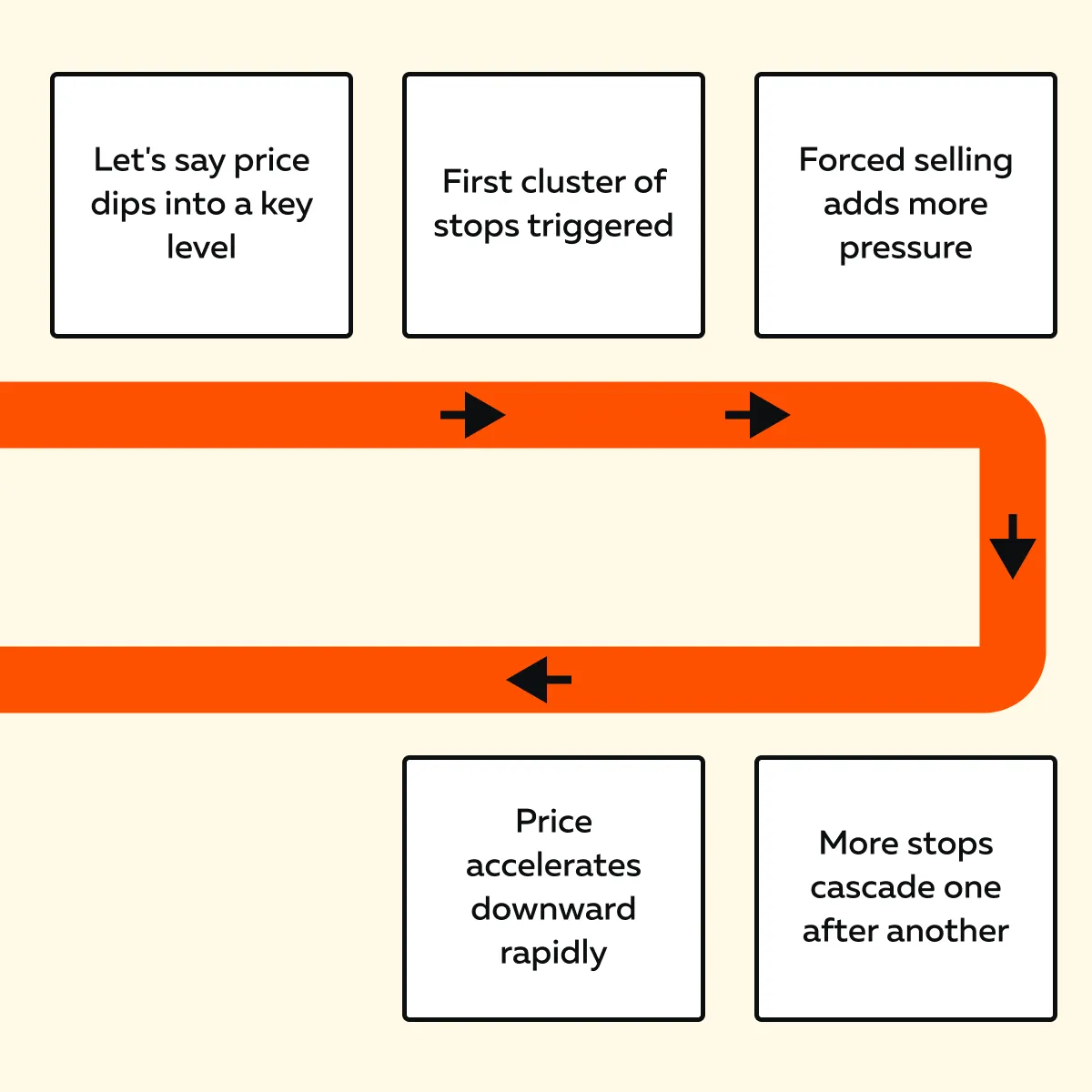

Usually, stops cluster around “obvious levels”. When price nudges through one cluster, it triggers more stops and creates a domino effect. Let’s see how:

This process is known as “liquidation cascade”. It can make ES look like it’s trending, but it’s really just stops tripping over each other.

How Do Passive vs. Aggressive Flows Influence ES Price?

Institutions often place passive orders at key levels and wait quietly for them to get filled. Now, when the price reaches them, ES may stall or reverse. In contrast, aggressive traders chase the price by hitting the order book. This often creates short-lived spikes.

Need a tool to know the difference? Bookmap can help you! Let’s see how you can use it to tell the difference between passive and aggressive flows in ES:

| Spot Passive Flows | Spot Aggressive Flows |

|

|

For more clarity, let’s see an example:

-

- Let’s say on an FOMC day, ES drops quickly from 4,600 to 4,580 within a minute.

- That’s because big buy orders (liquidity) were pulled from the book, and sell stops got triggered.

- Now, it looks like a crash. But it’s not!

- It’s mostly because of thin liquidity and forced selling.

Later, when real institutional buy orders reappear around 4,575 to 4,578, the price often increases to 4,590 or higher.

Why It Matters: Trade with More Context

In 2025, are you still only relying on charts and indicators? It’s easy to mistake noise for real signals. Instead, you should understand what really moves ES futures, such as:

- Options flows

- ETF hedging

- Liquidity shifts

This way, you start seeing the market with more context. This knowledge gives traders a big edge. To increase your edge even further, follow these four proven tips:

| 1. Avoid False Signals | 2. Improve Timing | 3. Stay Out Of Chop | 4. Trade Like Institutions |

|

|

|

|

Conclusion

So now you know that ES futures don’t move randomly! Also, they’re not just a mirror of the S&P 500 index. What really influences their price movements is a mix of these forces:

- Options flows

- ETF hedging

- Liquidity shifts

- The constant positioning of large institutions

The impact? Due to these factors, the ES can sometimes lead, lag, or even diverge from SPX. Thus, for traders, the lesson is clear – If you only focus on surface-level price moves, you’ll often mistake noise for opportunity.

To avoid this mistake, you must understand the “underlying flows” that are influencing the intraday behavior. Means? You should watch how hedging, rebalancing, and liquidity really play out in the order book. To visualize these hidden layers, you can start using Bookmap. Such market knowledge gives you the context to avoid traps + trade with confidence. Get a clearer view of ES futures movement with real-time depth data.

FAQs

1. What’s the difference between ES and SPX?

SPX is just the S&P 500 index. It is a number that shows how the 500 largest U.S. stocks are doing. You can’t trade it directly. ES, on the other hand, is the futures contract on that index. As a trader, you can buy and sell ES on the CME to speculate or hedge. Thus, you can think of ES as the tradable version of SPX.

2. Does SPY affect ES?

Yes! SPY is the ETF that tracks the S&P 500 (and trades like a stock). When big institutions buy or sell SPY in large amounts, market makers often hedge those trades using ES futures. Due to this, sometimes ES futures react to buying or selling in SPY before you see any change in the S&P 500 index (SPX) itself.

For example:

-

- Let’s say that huge money flows into SPY.

- Why? Market makers hedge by trading ES.

- This makes ES move first.

- This happens even while SPX (the index) looks the same for the moment.

3. Why does ES move before the stock market opens?

ES trades almost 24 hours a day on the CME Globex platform. That means it reacts to:

- Global news

- Overseas markets

- Overnight events (while U.S. stocks are closed).

So by the time the stock market opens in New York, ES has already priced in much of the overnight sentiment and positioning.

4. What is gamma, and how does it affect ES?

Gamma is an options term. It shows how quickly risk changes for dealers. Let’s see what happens when gamma is high or low:

| When gamma is high | When gamma is low or negative |

|

|

5. Can I trade ES effectively without watching options?

Yes, you can, but you’ll miss important context. Options flows often explain sudden spikes, stalls, or reversals in ES. Thus, even if you don’t trade options, you should keep an eye on them.

The advantage? This allows you to better understand whether a move is real demand or just dealer hedging. Such knowledge makes it easier to avoid false signals!