Ready to see the market clearly?

Sign up now and make smarter trades today

Education

August 25, 2025

SHARE

What Happens When Everyone’s on the Same Side? Crowded Trades and Unwinding Risk Explained

In markets, when everyone’s long, no one’s left to buy! And that’s when the real drop begins. As a trader, you must realize that crowded trades look strong on the surface, but underneath, they’re ticking time bombs. But why? Can’t you, as a trader, profit from crowded trades?

In this article, you’ll learn what a crowded trade really is and how to spot it early. You will learn about signs that suggest a brutal trade unwinding is near. You will also learn some key concepts like positioning risk, failed breakouts, and order flow unwinds.

Moreover, you’ll also understand how to avoid common mistakes in crowded setups and even profit from them if you know where to look. So, want to take advantage of panic exits? Read this article till the end to stay ahead of the crowd!

What Is a Crowded Trade?

A crowded trade happens when too many traders or investors are betting in the same direction:

- Either all buying (going long)

or

- All selling (going short).

When this happens, it creates a positioning risk. Why? In other words, if everyone’s on one side of the market, there aren’t enough people on the other side to take the opposite trade. This lack of balance makes the market fragile.

Now, let’s say:

- A key support or resistance level breaks

or

Due to these situations, everyone tries to get out at the same time! Do you know what it leads to? That’s when a “trade unwinding” begins! The price moves sharply as people rush to exit. This triggers stop losses and creates order flow unwinds.

For more clarity, let’s study a real example:

-

- In 2021, stocks like AMC and GameStop (GME) had short interest of over 100%.

- For those unaware, this means more people were betting against them than there were actual shares available.

- Later, retail traders started buying heavily (calls and shares).

- As a result, shorts were forced to cover their positions by buying.

- That caused huge price spikes!

- But once the buying slowed, many long traders panicked to exit.

- The result? Prices crashed quickly

On our advanced real-time market analysis tool, Bookmap, these stop runs were clearly visible. As a trader, you can easily observe heavy trading volume followed by “air pockets” (thin liquidity) and sharp reversals.

Why Should You Be Cautious?

Crowded trades look strong! For most traders, it’s a good way to make money. But please realize, when they reverse, they do so violently. Thus, you should know where the crowd is! Because when everyone’s long, there’s no one left to buy. And that’s when the danger starts.

Let’s learn about three major things you, as a trader, must do:

How to Spot Crowding Before It Unwinds

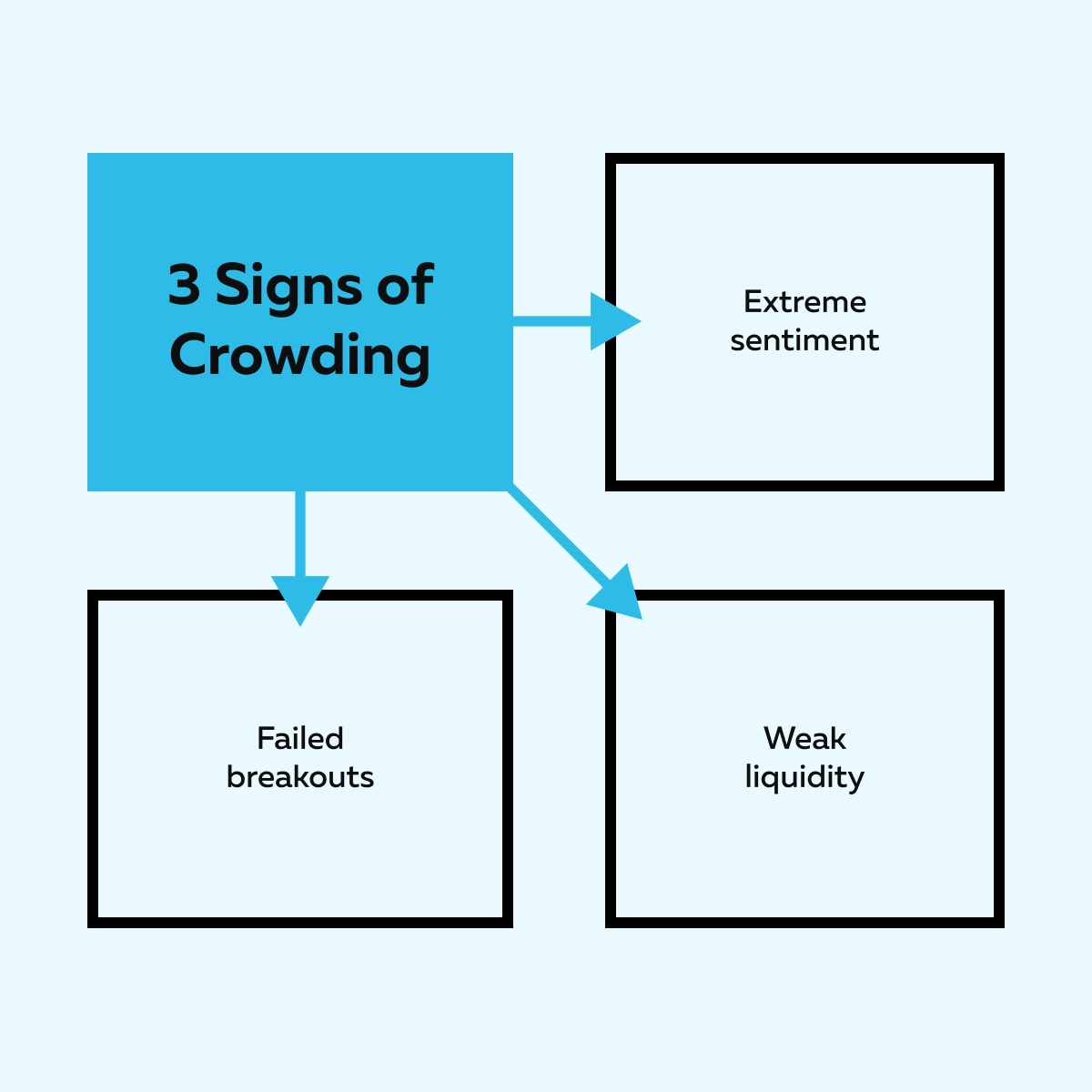

Want to stay safe during crowded trades? Spot the crowd before the exit stampede begins! But how? Below are three simple signs to watch for before a trade unwinds:

1. One-Sided Sentiment or Flow

When everyone’s long, that’s a major warning sign! Markets move when new buyers or sellers come in. But if 90% of traders are already bullish, who’s left to push prices higher? This is classic positioning risk.

As a trader, you should look out for these signs:

| Sign I | Sign II | Sign III |

| Twitter or Reddit is full of hype and overly confident posts. | Options traders are loading up on calls, with hardly anyone buying puts. | Futures data (like the COT report) or crypto funding rates show extreme long positioning. |

Please note that these are signs of a crowded trade. If market sentiment flips, a fast trade unwinding could follow. And, when that happens, prices drop hard as traders rush to exit.

2. Extended Moves Without Fresh Liquidity

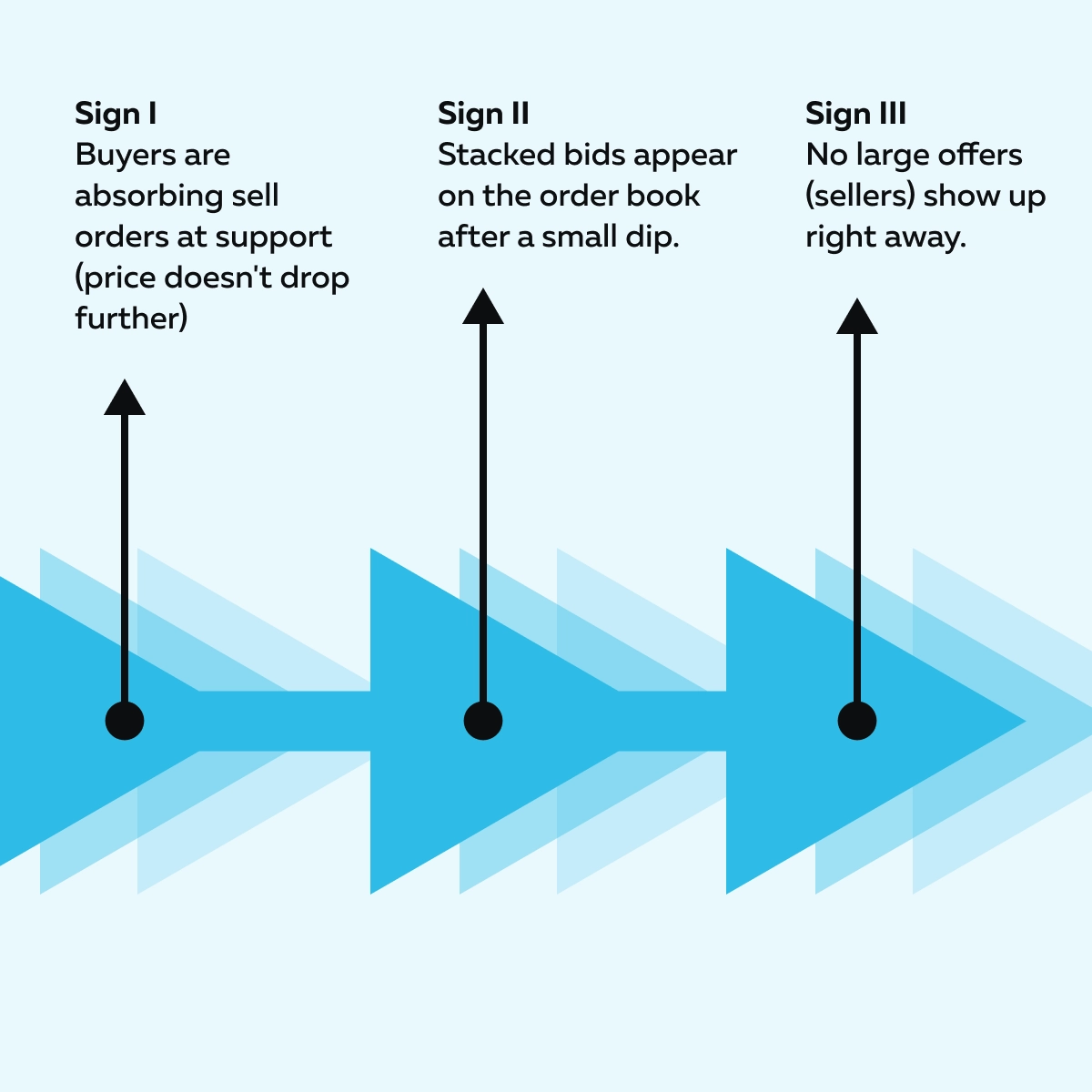

Markets need fresh buyers to keep moving up. But if a price keeps rising but no new liquidity shows up below, that’s a red flag. Let’s learn how you can spot this red flag on our advanced market analysis tool, Bookmap:

What do these observations mean? The big players (smart money) are not chasing the move. Instead, they are using the rally to exit! After some time, retail traders will be left holding the bag. Try Bookmap’s heatmap for free.

3. Failed Continuation After Breakout

Sometimes, a breakout looks strong at first! However, later, it fails to continue. This marks the top of a crowded trade. As a trader, you should watch for these three major clues:

| Clue I | Clue II | Clue III |

|

|

|

When you find these clues, realize that the breakout was just a trap! For better conceptual clarity, we have summarized the above points in the graphic below:

By spotting these signs of crowding, you can avoid getting caught when order flow unwinds and the market turns violently against the herd.

The Mechanics of the Unwind

When the crowd runs for the exit at the same time, the market doesn’t step down! Instead, it falls through the floor. Why? This is because everyone’s positioned the same way! Once the market turns, they all try to exit together at the same time.

Let’s see what usually happens:

-

- Sentiment flips or a key support/resistance level breaks.

- Suddenly, there are no bids (or offers) left.

- Now, no one wants to take the opposite side.

- As a result, the market then falls through air pockets!

- For those unaware, these are areas with little or no liquidity.

- Price drops sharply!

- This triggers more stop-loss orders, which adds fuel to the move.

- This chain reaction is what we call an “order flow unwinds.”

For more clarity, study this example:

Let’s say the ES (S&P 500 futures) rallies after a positive CPI report. At the open, traders rush to buy, and the price spikes up to 4,570. But then the buying stops! No new bids appear below the price.

Suddenly, a large trader sells aggressively at the top. This triggers a wave of stop-losses. The market quickly drops all the way back to VWAP (a key intraday average). The price moves through thin liquidity levels as everyone bails out. That’s a classic trade unwinding in action!

Why Does it Matter for Traders?

By understanding the mechanics of an unwind, you can easily spot when a strong move is actually at risk. If you’re aware of positioning risk and recognize when liquidity is drying up, you can:

- Avoid getting caught

or

- Even position yourself to trade the reversal.

How to Trade Around Crowded Setups

Crowded trades are risky! But they also offer big opportunities. The profit on offer can come your way only if you know how to approach it wisely. Let’s understand how you can protect yourself and even profit when the market feels packed on one side:

A) Don’t Be the Last to Join!

Let’s say a trade setup looks too good to be true. Now, the chances are, everyone’s already in it. That’s classic crowded trade behavior. Please understand that when everyone’s long, there’s no one left to push the price higher.

What to do instead

Don’t chase breakouts blindly! Only join if you see new support is forming, like bids stacking underneath the breakout level. This shows you the real demand. Your chances of getting trapped in a trade unwinding event also reduce significantly with this knowledge.

Wait for a Pullback to Confirm Demand

Eager to jump in? Stop! You must wait for the market to pull back and test support. This lets you see if buyers are serious or if it is just hype. Ideally, you should look for these signs:

For you, as a trader, entering after a solid pullback increases the chance of a safer and stronger move.

Trade the Unwind If the Trap Is Set

Sometimes, it’s clear the crowd is stuck! And that’s your signal to trade in the opposite direction. Let’s see how you can trade the unwind:

-

- If price breaks down with no support below, that’s your first clue.

- Wait for a failed retest of the crowded level. This is where the price tries to bounce but fails.

- Enter short there and keep your stop loss tight.

- You should always aim for the value area below (where the price previously spent time).

What are the benefits of this strategy? You can easily take advantage of the panic that comes during order flow unwinds, particularly when retail traders scramble to exit.

Common Mistakes in Crowded Markets

Crowded markets can be exciting! But they are also dangerous. This danger further increases when traders make some common mistakes. Let’s learn how you can avoid getting caught in the herd:

1. Chasing Momentum Blindly

You must understand that after big news (like earnings or economic data), price fluctuates strongly. Do you feel tempted to jump in at this time? It’s highly risky! Why? That’s because in crowded trades, momentum is usually already priced in, and you may be buying the top.

Furthermore, when everyone’s long, the move mostly stalls soon after. Late entries during a breakout are usually the first to get trapped when the trade unwinding starts.

2. Seeing Large Liquidity and Thinking It’s Support

Just because you see a big order on the heatmap or order book doesn’t mean it’s safe to buy! That liquidity might not be of real interest. Instead, it could be:

- Passive,

- Fake, and

- Even a trap.

What to check instead?

Look at the order flow and ask yourself –

- Are buyers stepping in aggressively?

- Is liquidity stacking and staying in place, or pulling away?

Please note that positioning risk increases if you trust large orders without checking whether they’re supported by real buying.

3. Mistaking Price Rise for Real Demand

Most traders believe a price rising alone means smart money is buying. This is wrong! Real demand shows up only when you see:

- Stacked bids below the price (true buyers waiting to support the move),

- Aggressive market buying followed by continuation (not rejection), and

- Less resistance overhead (offers pulling away).

If these are missing, the rise could just be late buyers entering a crowded trade! And most likely, they are setting the stage for a quick unwind.

Conclusion

Crowded trades often feel like a sure thing until they suddenly reverse and trap everyone! That’s the danger when everyone’s long or heavily positioned in one direction. Can you be safe? Yes, only when you learn to read order flow and watch how liquidity behaves. The insights so gained let you spot when a move is real and when it’s likely to unwind.

Furthermore, to gain an edge, you should start using our avant-garde real-time market analysis tool, Bookmap. It displays order flow data. By analyzing it, you can easily understand the market’s true intent. As a trader, you should also look for signs like one-sided sentiment, lack of fresh bids, and failed breakouts. These clues often show up before the big drop happens!

Want to stay one step ahead? Don’t follow the crowd blindly! See how Bookmap shows real-time positioning shifts.

FAQ

1. What is a crowded trade?

A crowded trade occurs when most traders are on the same side of the market, either buying or selling. This sounds good at first, but it creates a problem!

If almost everyone is already in the trade, there’s no one left to keep pushing the price in that direction. That makes the trade fragile. Mostly, in such cases, the price suddenly reverses.

2. How can I tell if a trade is too crowded?

To spot a crowded trade:

- You should look at the overall market sentiment. If most traders are bullish (buying) and the price stops going up, it’s a warning sign!

- Next, check order flow. If there are more aggressive buys but the price doesn’t move higher, it shows weakness.

- Also, if there’s no new liquidity supporting the move, the trade may be near its limit.

3. Do all crowded trades unwind?

Not always! Some crowded trades keep working, particularly if new buyers or sellers keep coming in. But they’re risky! Once the move slows down and no fresh support appears, the trade can unwind. Now, this causes fast price drops and panic exits.

So even if it doesn’t always collapse, a crowded setup is usually unstable and needs careful management.

4. Can I profit from crowded trades?

Yes, you can! But this can happen only if you understand the timing. The best way is to get in early, before the crowd joins. Next, you should exit before the move loses strength.

Alternatively, you can:

- Wait for the setup to fail

and

- Then trade the unwind.

You must understand when the crowd is trapped and trying to exit; sharp price moves happen! These fluctuations usually create profitable opportunities for prepared traders.