20% Off Just for Blog Readers — Until September 30.

Use code BLOG20-SEPT for 20% off your first month of Bookmap Only valid through September 30.

Futures

August 6, 2025

SHARE

What Institutional Front-Running Looks Like in Futures

Say the market is a poker game. Now, do you know what institutional traders did? They saw your cards before you even looked at them! Yes, and this act is known as “institutional front-running.” In this tactic, the smart money doesn’t wait for obvious moves. Instead, it creates them!

Front-running mostly occurs at round numbers, heatmap walls, and previous highs/ lows. Want to learn how to trade around these traps?

In this article, you’ll understand how front-running works legally using public data and how to spot front-running. You’ll also discover the tools and behaviors that reveal order flow manipulation in the futures, from iceberg absorption to spoof-like tricks. Read this article till the end to think like institutions and stop being the liquidity they profit from!

What Is Institutional Front-Running in Futures?

Institutional front-running in futures occurs when big players, like hedge funds or trading algorithms, take positions just before the market moves. How? They take these positions by predicting where retail traders or large orders might appear.

If we talk about its illegal form, front-running means a broker uses private client information to trade ahead of them. But here, we’re talking about legal front-running! It is based on public information like the following:

or

- Common retail behaviors.

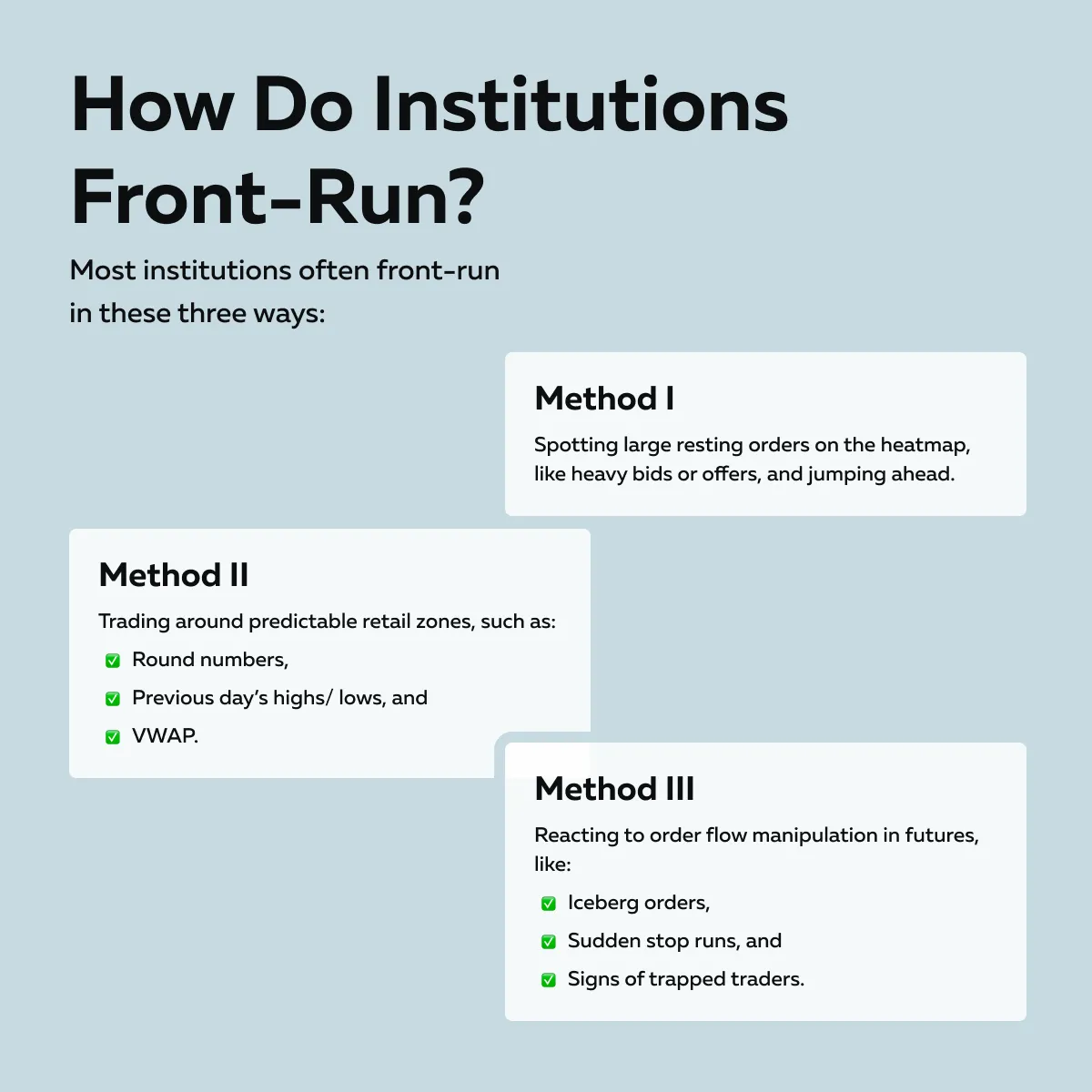

How Do Institutions Front-Run?

Please note that all these methods also act as hints to front-run! By spotting front-running, you gain a better edge, particularly if you watch how the price reacts near these obvious or crowded areas.

Learn how to trade with institutional flow instead of being a step behind. → Compare Plans

Key Behaviors That Signal Front-Running

Front-running in the futures isn’t always obvious! But if you watch closely, there are “certain price behaviors” that can reveal how institutional traders get ahead of the crowd.

Through the signals mentioned below, you can spot front-running and learn how order flow manipulation in futures actually plays out:

1. Price Reverses Just Before a Liquidity Level

One classic sign of institutional front-running is when the price gets close to a major liquidity level, like a large cluster of resting bids or offers. However, the price doesn’t quite touch it! Instead, it suddenly reverses just 1 or 2 ticks above or below that level.

Why does this happen?

Most institutional traders and smart algorithms don’t wait for the actual level to be hit. They front-run by entering a little early! This way, they avoid slippage. More importantly, by doing so, they trap retail traders who are waiting to enter at the visible level.

Let’s understand better through an example:

-

- ES futures are dropping toward the day’s low, where there’s a 200-contract buy order sitting.

- Price gets close but bounces back just one tick above it.

- On the tape, you see heavy absorption!

- You observe that large sell orders are being quietly bought up.

- That’s a sign someone is front-running in the futures.

- They are trying to catch the move before the level is officially tested.

2. Spoof-Like Behavior That Pushes Traders to React

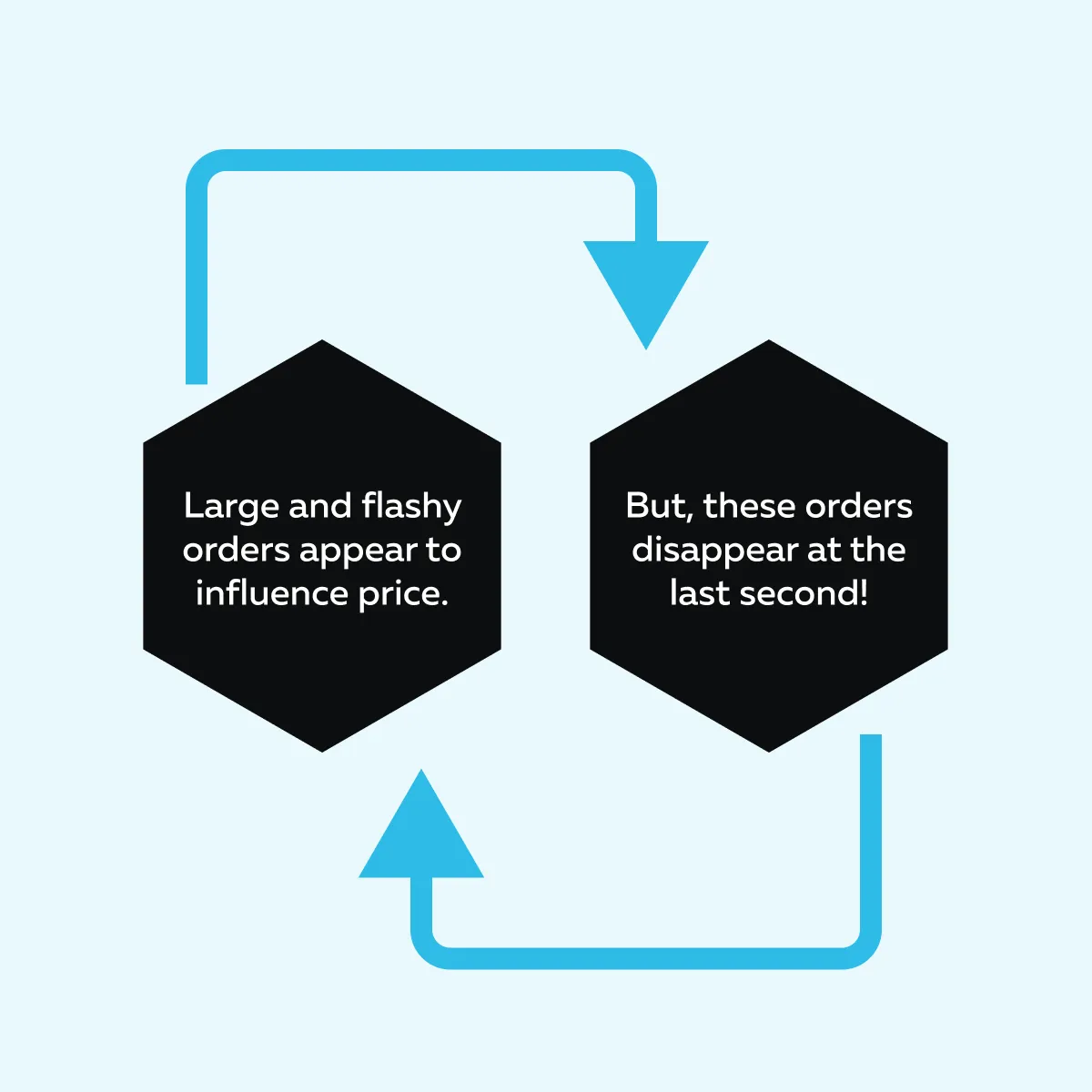

Another sign of front-running in futures is when you see spoof-like behavior! Check out the graphic below:

Please realize that institutional players often use these tactics to manipulate order flow without breaking the law. Let’s understand better through an example:

- A huge sell order (offer) suddenly shows up above the current price.

- This triggers retail traders to chase longs.

- They do so, fearing the market will run higher.

- But as the price rises toward that large offer:

- The order vanishes

and

- The market quickly reverses.

- But why? To bait reactions and then trade in the opposite direction.

While this isn’t always illegal spoofing, it’s a form of order flow manipulation in the futures. In this manipulation, institutions cleverly place orders and then cancel them.

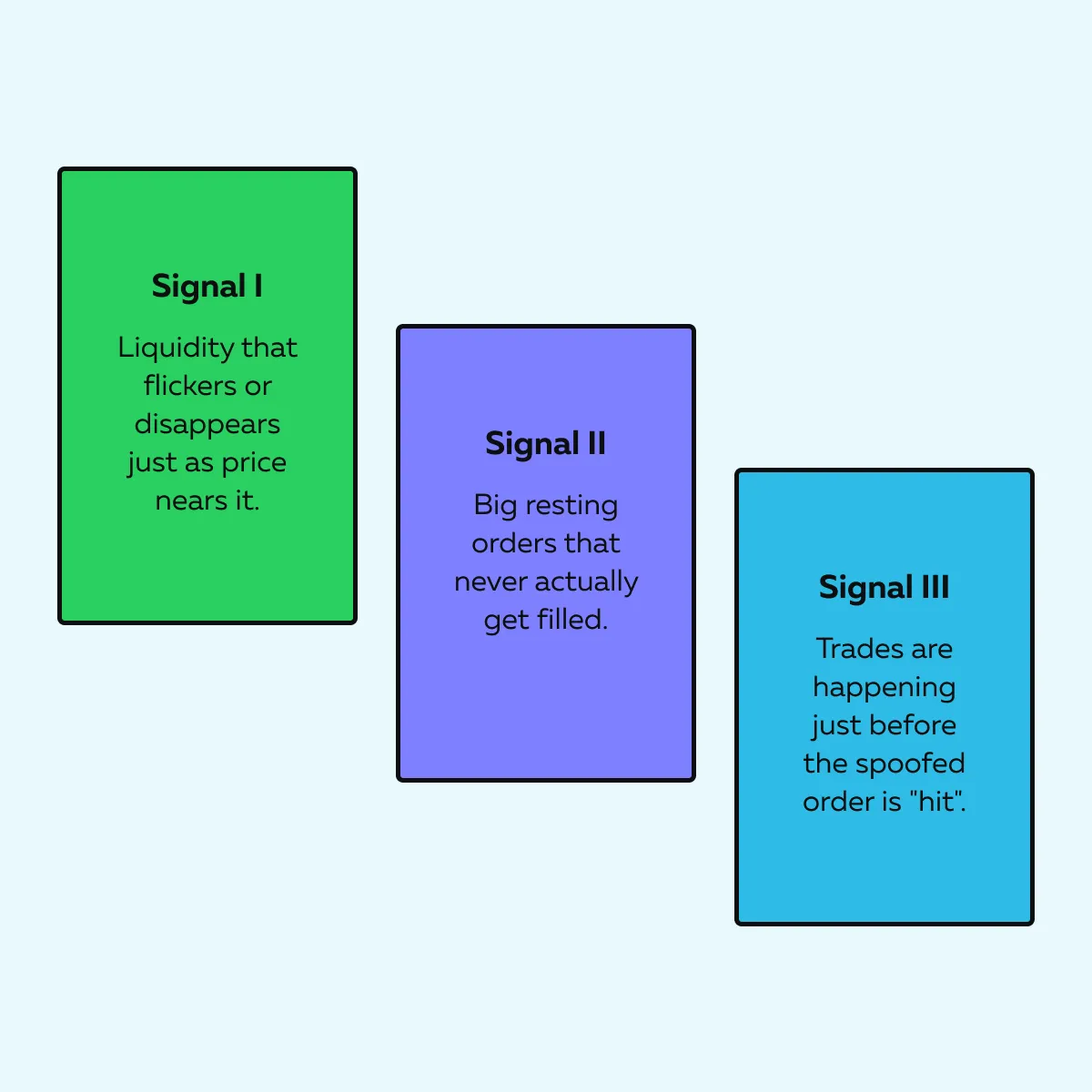

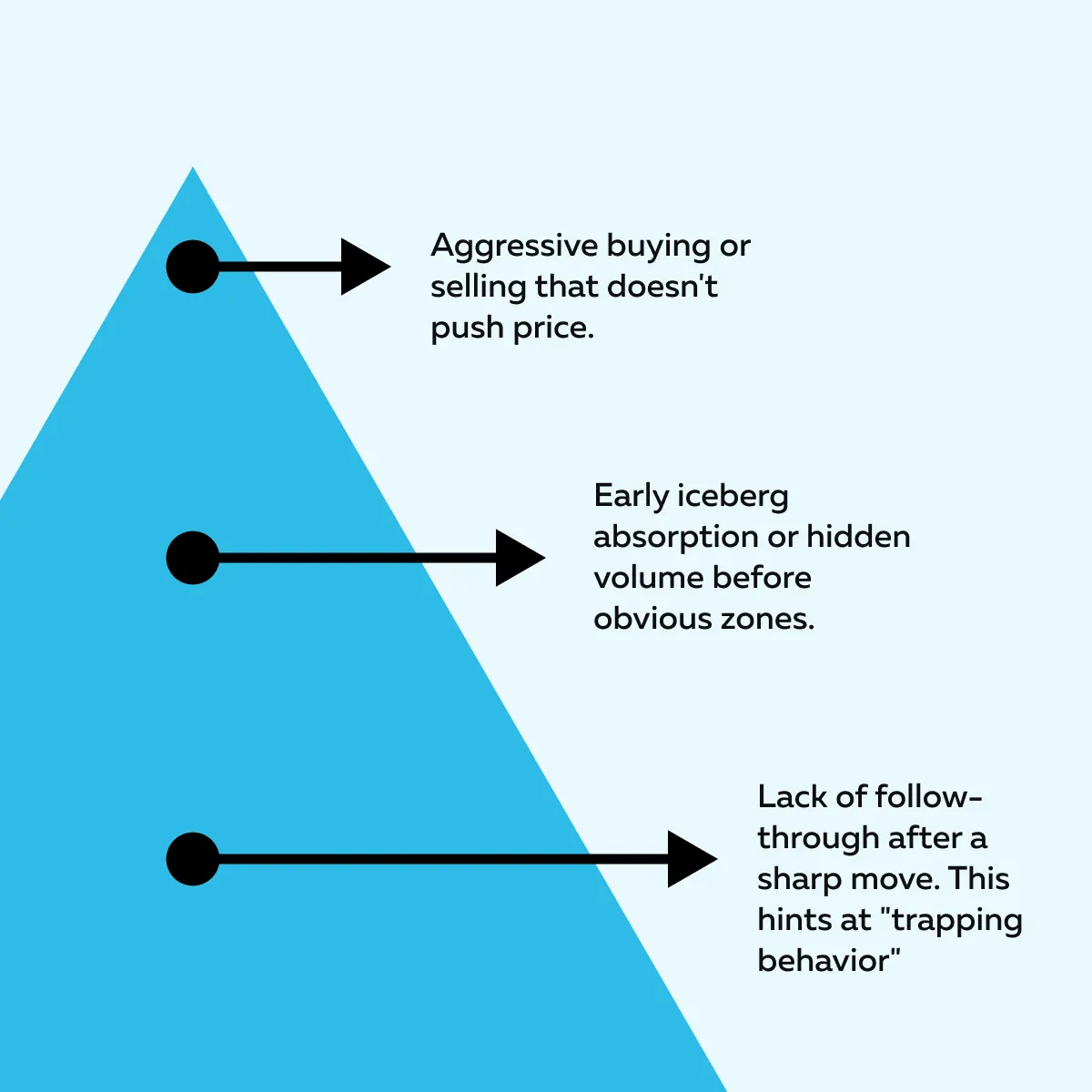

Want to spot it? As a trader, you must watch these three key signals to spot front-running:

Yes, this behavior is subtle! But once you recognize the patterns, it becomes a powerful signal of institutional front-running in action.

3. Iceberg Absorption Ahead of Obvious Triggers

Please realize that not all institutional front-running in futures is loud and visible. Some of the most successful tactics happen quietly through:

- Iceberg orders

and

- Smart absorption.

For those unaware, iceberg orders are hidden orders that don’t show their full size on the order book. However, these orders still soak up volume behind the scenes.

Let’s understand how it works:

Just before the price hits a major liquidity level, like a large bid or offer, you might notice that:

- Price pauses

or

- Price reverses early.

This happens even when there is no clear reason why! What’s really happening? Institutions may be using iceberg orders to quietly absorb aggressive traders ahead of the obvious trigger point.

Again, this type of order flow manipulation in futures is subtle. You won’t see it with just candlesticks! Instead, you need to watch the tape or start using our advanced real-time market analysis tools, like Bookmap.

What to look for?

When using our advanced market analysis tool, Bookmap, ideally, you should look for the following:

- Heavy volume prints at non-obvious levels.

- No large resting orders are showing, yet the price doesn’t move further!

- Price reverses, and only in hindsight do you realize size was getting filled.

By spotting these hidden moves, you can easily detect front-running. This lets you avoid getting caught where retail traders often get trapped.

4. Pre-emptive Stacking or Pulling

Another common sign of front-running in futures is when institutions manipulate the order book before a big move. They do so by either:

- Stacking bids/ offers early

or

- Suddenly pulling them away to shift market behavior.

Please note that these are classic order flow manipulation tactics. They are used to:

- Trick retail traders

and

What is Pre-emptive stacking?

Pre-emptive stacking occurs when algorithms place large buy or sell orders just ahead of visible liquidity. For example:

- There’s a big support level with resting bids.

- Now, front-running algorithms start stacking bids just above it.

- This absorbs early retail selling.

What is Pre-emptive pulling?

On the flip side, pre-emptive pulling happens when large orders are suddenly canceled. Let’s say the price is breaking out. And just as that happens, big offers behind the move disappear! This creates an air pocket. In this pocket, the price moves faster and tempts retail traders to chase.

To spot front-running here, you, as a trader, must watch for the following:

- Large bid stacking just above known support zones.

- Sudden liquidity pulls right as breakouts occur.

- Imbalances in the order book that appear strategically timed.

Common Places Front-Running Occurs

Front-running in futures often happens at predictable locations. These are places where retail traders commonly enter or exit! Please note that institutional players know about these zones. To exploit them, they usually position themselves early to take advantage.

Thus, as a trader, you must understand these common traps. This knowledge lets you:

- Spot front-running

and

- Avoid getting caught in manipulated moves.

Let’s study some common places where front-running occurs:

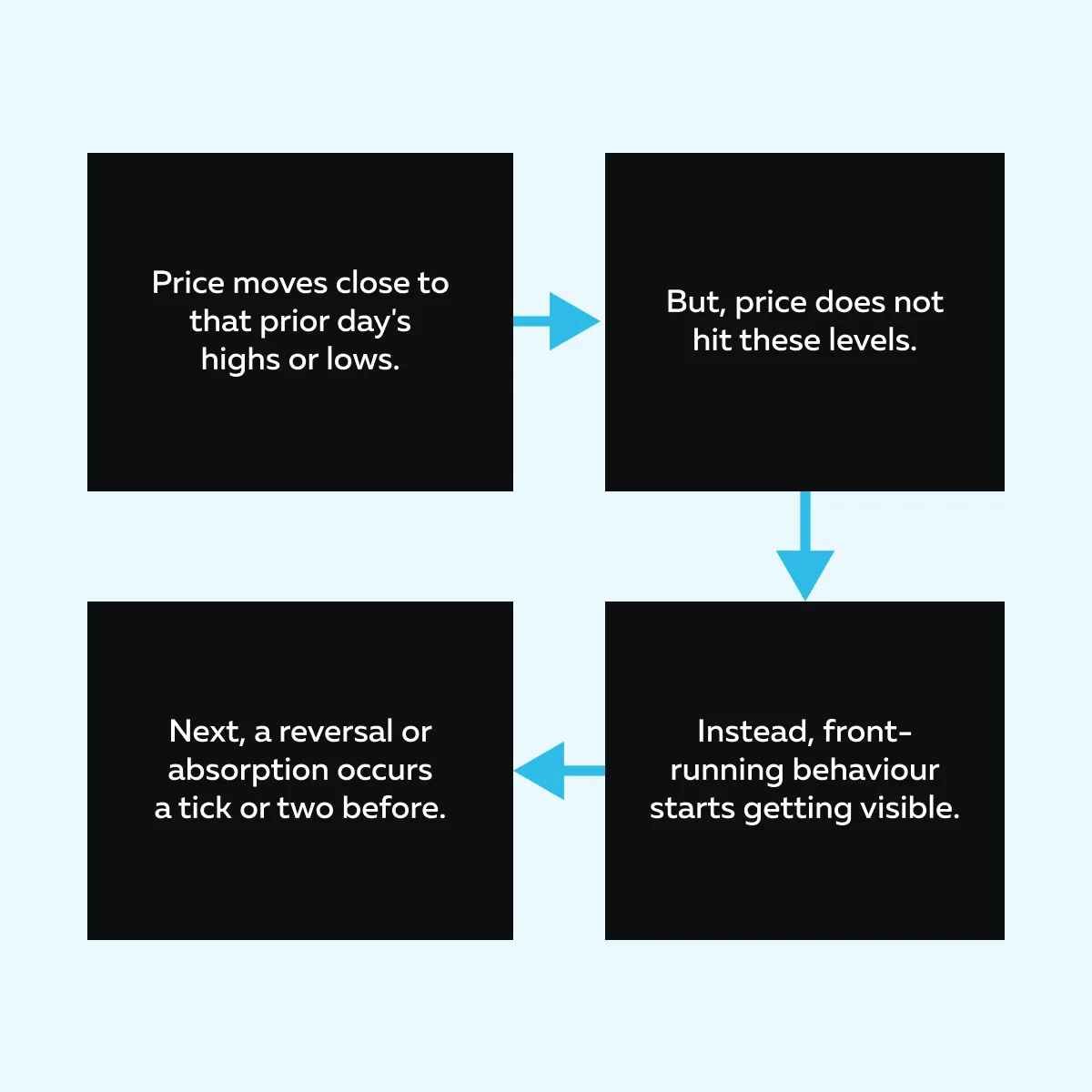

Prior Day Highs and Lows

Retail traders often place stop orders:

- Just above the previous day’s high

or

- Just below the previous day’s low.

These are obvious trigger zones that institutions love to target. What happens here? Check out the graphic below:

This strategy lets institutions trap late traders and flip their own positions early. In this way, institutions use public behavior to their advantage.

Don’t chase moves—understand how they’re created. Real-time liquidity tools help. → Compare Plans

Round Numbers and Psychological Levels

Levels like 4300 in ES or 15000 in NQ act like magnets for retail traders. These psychological levels feel significant and gather a lot of visible orders.

Now, please note that institutions front-run these areas. They do so by either:

- Entering just before the level

or

- Using it to trap momentum chasers.

It’s a subtle form of order flow manipulation in futures! In this manipulation, institutions use retail expectations against them.

Heatmap Walls That Rarely Get Touched

On our avant-garde real-time market analysis tool, Bookmap, you’ll often see big blocks of liquidity. These blocks are known as “heatmap walls.” But here’s the catch: not all of them are real. Some are just there to bait traders!

If you observe that the price keeps reacting before even touching these walls, it’s a red flag. It means the wall is being used as a magnet. There is no genuine level of interest!

This behavior often signals institutional front-running, where price is manipulated to trigger emotions and not orders.

How to Trade Around Front-Running Behavior?

If you want to survive and thrive in futures trading, you must learn how to:

- Spot front-running

and

- Avoid falling for the traps institutions set.

Be aware that institutional front-running is designed to shake out retail traders and steal momentum. But with the right mindset and tools, you can trade around it and not into it.

Below are some tips you can follow:

1. Don’t Chase Obvious Breakouts Blindly!

For instance, you see the price heading toward a breakout level with big liquidity above. But that liquidity suddenly gets pulled. Now, that’s your warning sign! This kind of move is often a setup for order flow manipulation in futures. Here, the real intention is to trap breakout chasers.

So, as a trader, what can you do?

Instead of jumping in blindly, wait for true confirmation. You can see it in these ways:

- Real volume hitting the tape.

- Liquidity stacking instead of pulling.

- Actual follow-through beyond the level.

That’s how you avoid being the liquidity, and instead, trade with the smart money!

2. Enter Where Institutions Enter and Not Where They Exit

Don’t trade at the exact spot where it looks like the action is! Institutions usually front-run those levels by entering early. They particularly do so when absorption or hidden interest shows up.

So, as a trader, what can you do?

Watch for these signs:

3. Use Real-Time Tools That Reveal Volume and Liquidity Changes

Traditional tools like Level II and DOM (Depth of Market) have limitations. They only show the top of the book. Also, everything moves so fast that you can miss key moments!

The perfect solution? Start using our advanced market analysis tool, Bookmap. By using it, you can:

- Visualize liquidity stacking or pulling in real-time.

- Spot where volume hits vs. where it fakes out.

- Replay action to see:

- Who got trapped,

- Where size entered, and

- How the market shifted.

Our advanced market analysis tool, Bookmap, is one of the best ways to spot front-running and anticipate the trap. So, from today, trade like an institution and not like a target!

Conclusion

Most of the time, institutional front-running doesn’t leave clear evidence. So, how to spot them? The signs are there if you know where to look! With experience and by using the right tools, like our modern real-time advanced market analysis tool, Bookmap, you can easily spot front-running.

As a trader, you can try to spot some of these visible cues: early absorption, flickering liquidity, or price reversal just before key levels. Your aim should be to stop reacting blindly and start reading order flow manipulation in futures as it unfolds.

When you understand how liquidity and volume interact, you can anticipate smart money moves instead of getting trapped by them. Want to see large players react before the crowd? Order flow shows you how. → Compare Plans

FAQ

1. What is front-running in futures?

Front-running in futures is when big traders, like institutions or algorithms, enter a trade just before a price move that they expect will happen. They do this at the near obvious levels on the chart, like:

- Support/ resistance,

- Large orders, and

- Round numbers.

Please note that they’re not guessing randomly! Instead, they’re using clues from the:

- Order book,

- Volume, and

- Retail behavior.

By analyzing these clues, big traders jump in early and ahead of the crowd. Their goal is to be first in line before the move begins!

2. Is front-running illegal?

It depends! If a broker uses private client information to trade ahead of their own customers, that’s illegal front-running. On the other hand, a legal front-running is based on public information, such as:

- Visible orders on the DOM,

- Price levels that retail traders commonly use, and

- Common behaviors seen in the market.

When it’s legal, institutions are not breaking the rules. They’re just better at reading the game and reacting faster!

3. Can I spot front-running on the DOM or Level II?

Sometimes, yes, but it’s not easy! The DOM (Depth of Market) and Level II show only the current bids and offers. And that too changes very quickly. You need sharp focus and lots of experience to catch patterns there.

However, on our modern real-time market analysis tools, Bookmap, you get a visual replay of what happened. On Bookmap, you can clearly see:

- Where large orders appeared,

- Where these orders were pulled, and

- Where they were absorbed.

This information allows you to see how the market behaved over time and not just in the moment!

4. Why does the price often reverse just before touching big liquidity?

This is a classic sign of institutional front-running! Big players don’t want to wait for the price to hit an obvious level because by then, too many traders are already watching it. So, they enter a few ticks early to:

- Avoid slippage

and

- Reduce risk.

This move also traps retail traders who wait for the level to get hit. Such trapped traders could only see the market reverse before they could enter. The result? A fakeout or quick reversal that catches many off guard!