Ready to see the market clearly?

Sign up now and make smarter trades today

Education

May 5, 2025

SHARE

Why Hong Kong’s Hang Seng Index is Outperforming Global Markets

They say, “Money never sleeps!” If you are in the wild, wild west, maybe money lies somewhere in the East. Probably near China. Yes, we are talking about Hong Kong’s stock market. The Hang Seng Index (HSI), Hong Kong’s benchmark stock index, has been making headlines with its strong performance and rising investor confidence.

But what’s really driving this surge, and how does it compare to other global markets? In this article, we will explore the reasons behind the rise of the Hang Seng Index (HSI) and its significance for global investors. We will also compare HSI to major indices, such as the S&P 500, Nasdaq 100, and European markets.

Additionally, we will examine key factors driving its growth, including regulatory easing, strong foreign investment inflows, and China’s pro-growth policies. Lastly, we’ll discuss investment strategies (HSI ETFs and Hang Seng Index futures) for investors and traders like you. You will also learn how to use our real-time market analysis tool, Bookmap, for order flow tracking. Let’s begin.

Understanding the Hang Seng Index (HSI)

The Hang Seng Index (HSI) is Hong Kong’s benchmark stock market index. It deals with the performance of 50 of the largest companies listed on the Hong Kong Stock Exchange (HKEX). It serves as a key indicator of Hong Kong’s stock market health and reflects investor sentiment toward Chinese market-related equities. Let’s understand in detail:

What Is the Hang Seng Index?

The Hang Seng Index (HSI) is the primary benchmark for the Hong Kong stock market. It includes 50 major players from various sectors, such as

- Financial,

- Technology, and

- Consumer-related.

Given Hong Kong’s role as a financial hub, the HSI serves as a key indicator of economic health and investor sentiment (particularly regarding China).

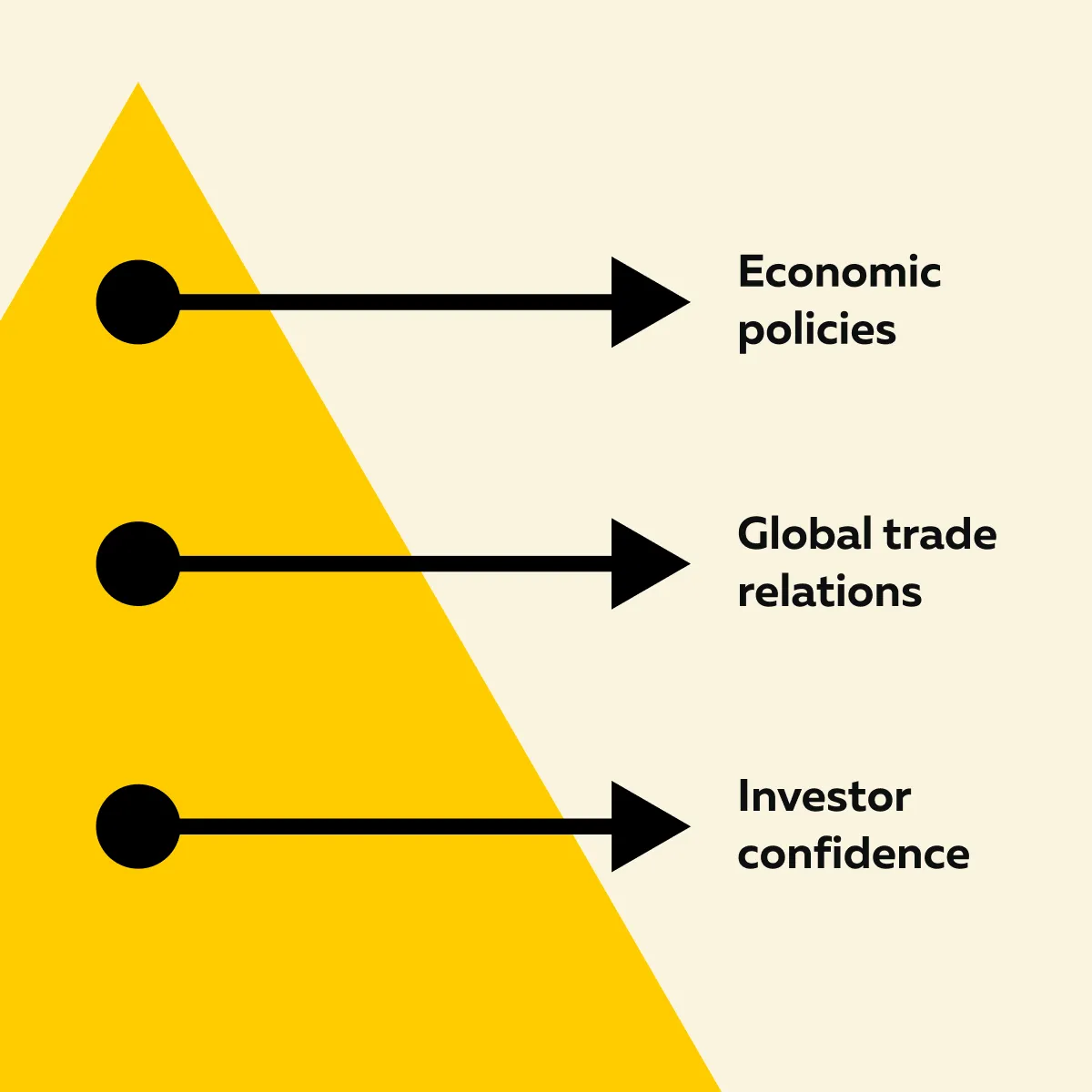

Chinese companies like Tencent, Alibaba, and Meituan influence a significant portion of the Hang Seng Index performance. Check out the graphic below to see what movements in the index indicate about China:

Moreover, as you know, Hong Kong operates under a different regulatory environment compared to mainland China. Thus, HSI also serves as a more transparent gauge of Chinese corporate performance. Also, it can be easily accessed by international investors.

This makes it an essential barometer for both:

- Hong Kong’s economy

and

- Broader Chinese market sentiment.

Why the Hang Seng Index Matters to Global Investors

The performance of the Hang Seng Index is closely tied to China’s economic outlook. Thus, it is used by investors as a tool to assess market trends. Check out the graphic below to understand what changes in China’s economic policies can have a direct impact on the HIS:

Such a sensitivity makes it a leading indicator for China-related equities (even for investors who may not have direct exposure to mainland markets).

HIS is Highly Accessible

Another reason institutional investors pay close attention to the Hong Kong stock market is its accessibility. Mainland exchanges such as the Shanghai Composite have:

- Stricter capital controls

and

- Limitations for foreign investors.

In contrast, Hong Kong provides an easier entry point for global funds. Thus, several investors looking to gain exposure to Chinese tech stocks often turn to HSI as a preferred investment vehicle.

HIS Analysis Helps to Determine Market Strength

Some analysts compare Hang Seng vs. S&P 500 to gauge regional market strength. For the unaware, the S&P 500 represents the U.S. economy and is driven by corporate earnings and Federal Reserve policies. On the other hand, the HSI reflects the state of:

- China’s economic trajectory

and

- Policy environment.

Historically, it has been observed that periods of global market outperformance in Asia often coincide with strong HSI gains (especially when Chinese policies favor growth and investment).

Why Is the Hang Seng Index Outperforming?

In recent months, the Hang Seng Index performance has shown signs of recovery. It has even outpaced many global benchmarks. Several key factors have contributed to this resurgence, such as:

- Easing regulatory pressure on Chinese tech stocks,

- Increased foreign investment, and

- Favorable economic policies from Beijing.

Let’s understand them in detail:

Easing Regulatory Pressure on Chinese Tech Stocks

Over the past few years, the Hong Kong stock market has faced significant headwinds. This happened due to China’s regulatory crackdown on major technology firms. Companies like Alibaba, Tencent, and Meituan were subjected to stringent:

- Antitrust regulations,

- Data security laws, and

- Restrictions on fintech operations.

These measures led to a sharp sell-off in tech stocks. It caused a major drag on the Hang Seng Index’s performance.

However, recent developments suggest that Beijing is shifting towards a more business-friendly stance. Now, the Chinese government has signaled a more supportive regulatory environment. This will allow companies like Alibaba and Tencent to expand their operations.

As a result, Chinese tech stocks have seen a notable rebound, which is driving the broader HSI upward. Even investors interpret this policy shift as a sign that China is prioritizing economic stability over heavy-handed intervention.

Strong Foreign Investment Inflows

Another key reason why HSI is rising is the influx of foreign capital into the Hong Kong stock market. Several factors are driving this trend:

| Factors causing a surge in HSI | Explanations |

| Attractive Valuations |

|

| Diversification Benefits |

|

| Easing Geopolitical Tensions |

|

Track institutional flows in Hong Kong stocks with Bookmap’s heatmap and order book tools.

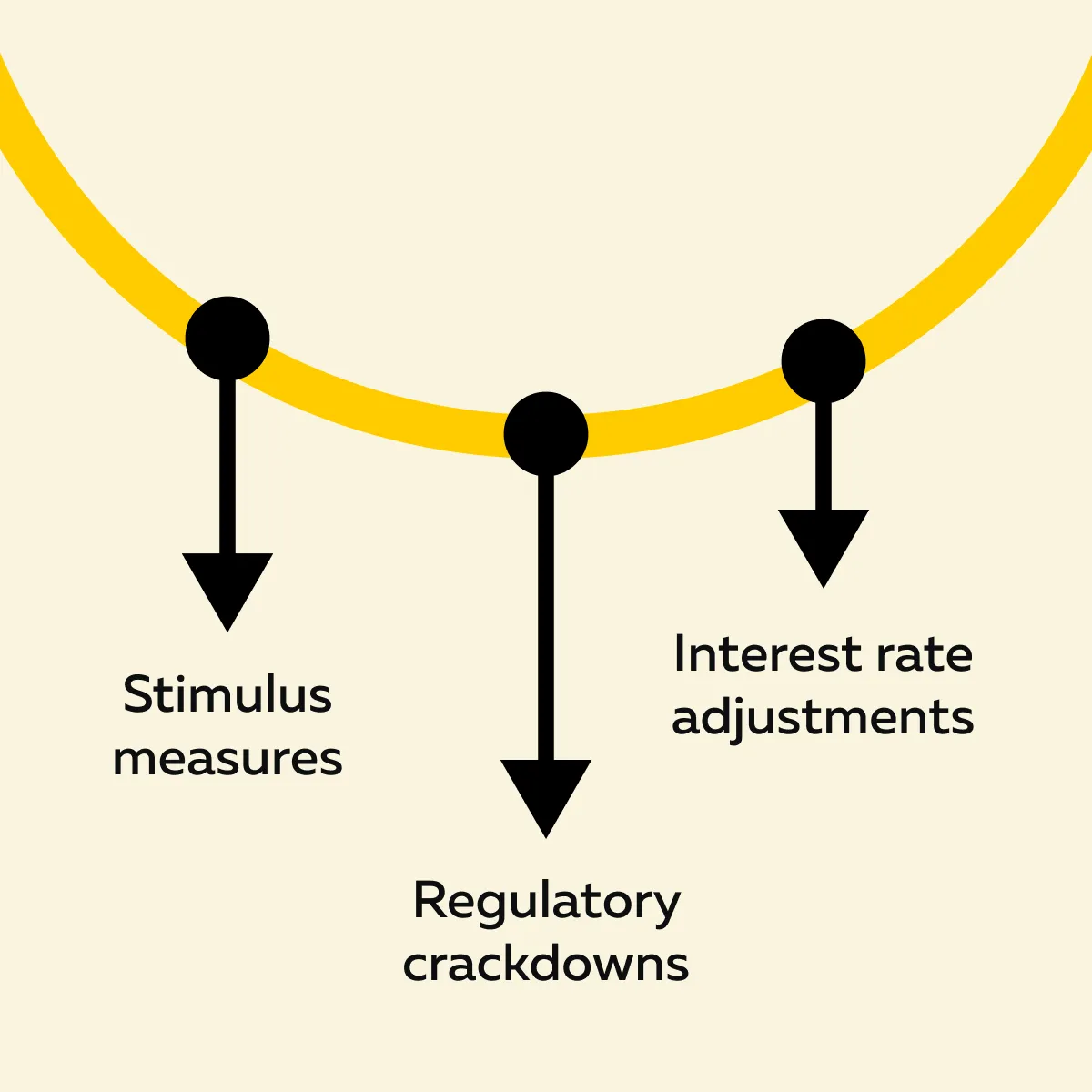

Favorable Economic Policies and Stimulus Measures

China’s government has taken proactive steps to support its economy. These steps are directly causing the HSI to rise. Some of the key economic policies and stimulus measures are:

- Monetary Easing

-

-

- Unlike the U.S., which has been tightening its monetary policy, China has adopted a more accommodative stance.

- Lower interest rates encourage:

- Borrowing,

- Corporate expansion, and

- Consumer spending.

- This benefits large-cap companies within the HIS.

-

- Government Support for Key Sectors

-

-

- The Chinese government has introduced various stimulus measures.

- These measures are boosting:

- Domestic consumption,

- Infrastructure projects, and

- Technology innovation.

- These policies directly benefit companies listed on the Hang Seng Index (particularly those in the finance and tech sectors).

-

- Hong Kong’s Central Bank Policy

-

- For the unaware, Hong Kong’s monetary policy is linked to the U.S. dollar through its currency peg.

- Thus, its financial system remains relatively stable.

- The city’s pro-business environment and capital-friendly regulations further make it an attractive hub for global investors (especially those who want exposure to Chinese companies)

Let’s understand better through an example:

Recent reductions in China’s reserve requirement ratio (RRR) and increased fiscal spending have provided liquidity to the market. This has further increased investor confidence in the Hong Kong stock market.

Comparing HSI to Other Global Indices

The Hang Seng Index (HSI) is often compared to major global benchmarks like the:

- S&P 500,

- Nasdaq 100, and

- European benchmarks such as the DAX, FTSE 100, and CAC 40.

Be aware that each index has its own strengths and market influences. Recent trends suggest that the Hong Kong stock market is rebounding due to favorable policies and attractive valuations. Let’s look at how HSI compares to these global indices:

Hang Seng vs. S&P 500

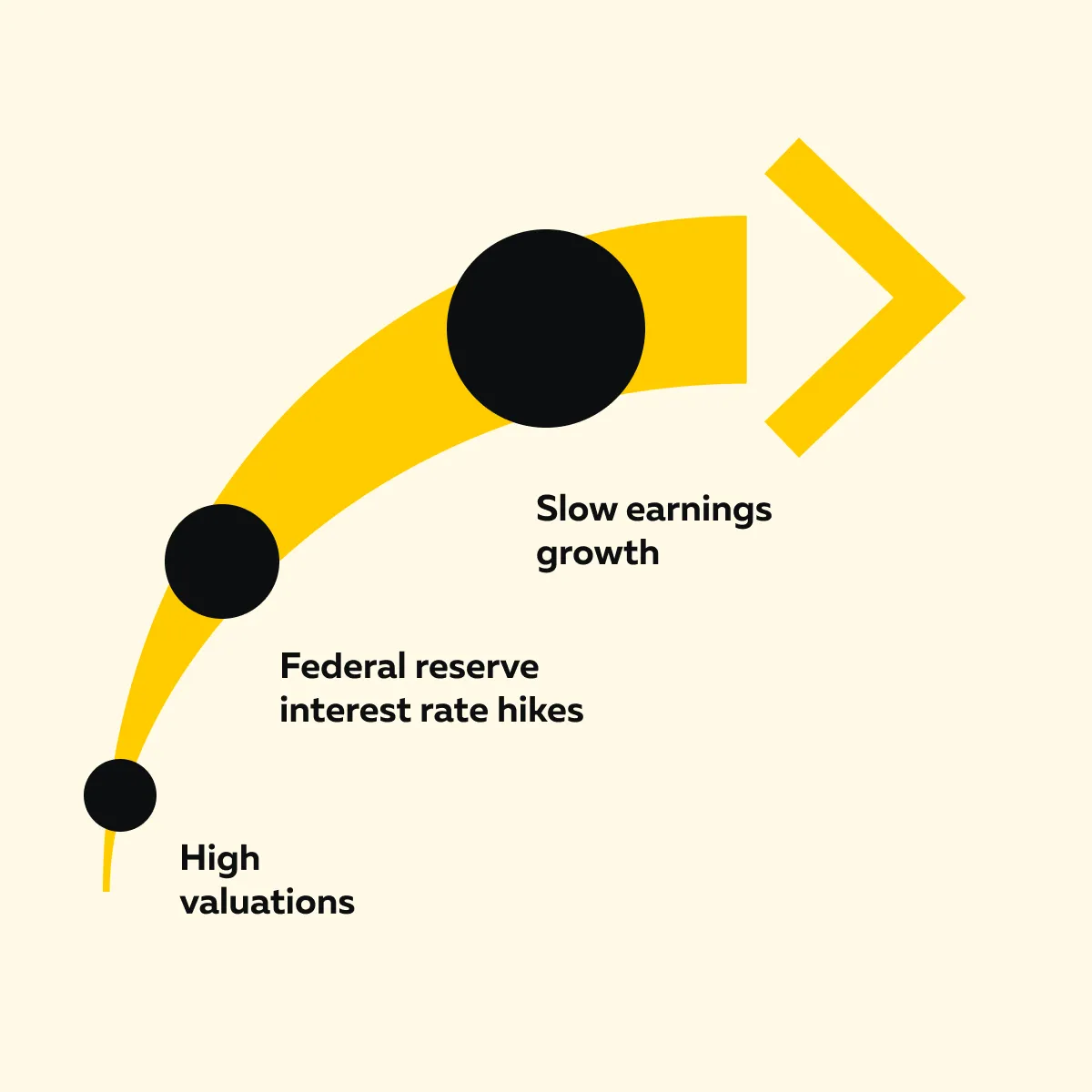

The S&P 500 has been under tremendous pressure. Check out the graphic below to understand why:

As a result, many U.S. stocks, particularly in the technology sector, have seen stretched valuations. This makes them less appealing to investors seeking value.

On the other hand, the Hang Seng Index’s performance has improved. That’s because Hong Kong-listed stocks were deeply undervalued in previous years. With China now easing regulations and introducing economic support measures, investors are turning back to Chinese market-related equities. This makes HSI a compelling alternative to the S&P 500.

A key difference between these two indices

| S&P 500 | HSI |

|

|

Investors comparing Hang Seng vs. S&P 500 may see HSI as an opportunity for diversification, particularly when the U.S. market faces headwinds.

Hang Seng vs. Nasdaq 100

The Nasdaq 100 is heavily concentrated in U.S. tech stocks, such as:

- Apple,

- Microsoft, and

- Nvidia.

While these companies have delivered strong returns over the years, they are also highly sensitive to Federal Reserve policies. Please note that when interest rates rise, tech stocks decline. This happens because higher rates reduce the present value of future earnings.

In contrast, HSI tech stocks like Tencent, Alibaba, and Meituan have already experienced a significant downturn due to China’s regulatory crackdown. Now, since the Chinese government is easing regulations, these stocks have started to recover. They are driving the Hang Seng Index’s performance higher.

Additionally, valuations in Hong Kong tech stocks remain much lower compared to their U.S. counterparts. This makes the Hong Kong stock market more appealing to value investors who:

- Want exposure to the tech sector and

- Do not want to pay premium prices (as seen in the Nasdaq 100).

Monitor global market trends with Bookmap’s liquidity and order flow insights.

Hang Seng vs. European Markets (DAX, FTSE 100, CAC 40)

European markets have several popular indices, such as:

- DAX (Germany),

- FTSE 100 (UK), and

- CAC 40 (France).

They have faced economic challenges due to:

- Slowing growth,

- Inflation concerns, and

- Geopolitical risks.

Also, many European economies are struggling with high energy costs and weak demand. This is stagnating industrial output.

In contrast, the HSI is benefiting from China’s economic support policies. These policies provide liquidity and encourage corporate expansion. For a comparative view, have a look at the graphic below:

Additionally, the sector composition of these indices is different:

- The FTSE 100 is heavily weighted toward commodities, oil, and mining companies. This makes it more sensitive to fluctuations in global commodity prices.

- The HSI is more diversified. It is a mix of financial, tech, and consumer-related sectors. Thus, it provides a broader exposure to different parts of the economy.

Trading and Investment Strategies for the Hang Seng Index

The HSI provides various opportunities for both investors and traders. Whether you are looking for long-term exposure to the Hong Kong stock market or short-term trading opportunities, there are several ways to participate in HSI performance. Below are some common strategies:

Investing in HSI ETFs

For long-term investors, exchange-traded funds (ETFs) that track the Hang Seng Index are one of the easiest ways to gain exposure to Hong Kong’s stock market. These ETFs allow investors to buy a diversified basket of HSI stocks without having to pick individual companies.

Why Invest in HSI ETFs?

- Easy access:

-

-

- Usually, foreign investors who want exposure to Chinese market-related equities face restrictions in mainland China.

- Such investors can easily invest in HSI-tracking ETFs listed on global exchanges.

-

- Diversification:

-

-

- The Hang Seng Index includes financial, technology, and consumer sectors.

- By investing in ETFs, you can get balanced exposure to Hong Kong’s economy.

-

- Lower risk compared to individual stocks:

-

- Investing in a broad index reduces the impact of any single company’s performance.

Some Popular HSI ETFs:

- iShares MSCI Hong Kong ETF (EWH)

-

-

- This ETF is listed in the U.S.

- It provides access to Hong Kong’s largest companies.

-

- Hang Seng Index ETFs on HKEX

-

- Several ETFs directly track HSI performance.

- Such ETFs are available on the Hong Kong Stock Exchange (HKEX).

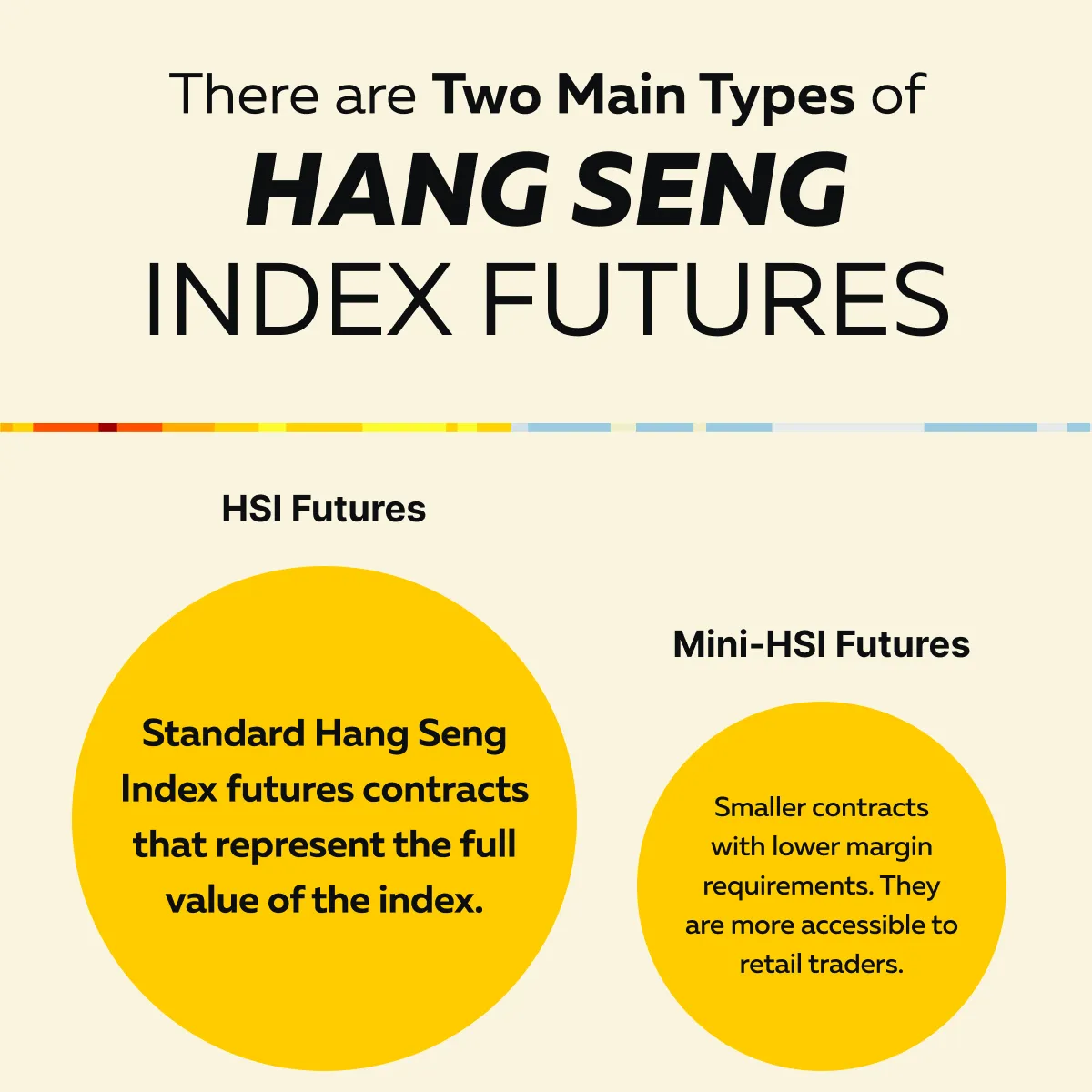

Trading Hang Seng Index Futures

For active traders, Hang Seng Index futures offer a way to trade HSI performance with leverage. These futures contracts allow traders to speculate on Hong Kong stock market movements without owning the underlying stocks:

How Can Traders Use HSI Futures?

As a trader, you can:

- Go Long on HSI: If a trader expects HSI to rise, they can buy Hang Seng Index futures to profit from the increase.

- Short Sell: If traders anticipate a market downturn, they can short futures to benefit from falling HSI performance.

Let’s understand better through an example:

- Say a trader is following institutional order flow.

- They notice strong buying activity from hedge funds.

- Based on this insight, they decided to go long on HSI futures.

- That’s because they are expecting further upside.

Master Tip

Futures trading is ideal for traders who want high liquidity. Also, such traders must have the ability to use leverage to amplify their returns. However, it also comes with higher risks.

Using Order Flow to Track Institutional Moves in HSI

Please note that large financial institutions and hedge funds control a significant portion of daily trading volume. Their buying and selling activity strongly influences HSI performance.

Thus, several professional traders track institutional order flow to understand market movements in the Hang Seng Index. For this purpose, they use our advanced market analysis tool, Bookmap.

How to Use Bookmap for Order Flow Analysis in HSI Trading

Using Bookmap’s liquidity and order flow analysis tool, you, as a trader, can see large institutional orders before they impact the market. Additionally, you can:

- Track Iceberg Orders:

-

-

- These are large orders split into smaller parts to avoid detection.

- By spotting them on Bookmap, you can gain an edge in predicting price movements.

-

- Finding Support and Resistance Zones:

-

- A spike in liquidity absorption on Bookmap’s heatmap often signals strong support or resistance levels in the Hang Seng Index.

For more clarity, let’s study an example:

Assume that a trader is using Bookmap’s heatmap. They see a large concentration of buy orders at a key price level. This suggests institutional investors are accumulating positions. Now, this clearly means HSI is likely to rise from that point.

Based on this interpretation, the trader enters a long position and tries to take advantage of the upcoming price move.

Conclusion

The Hang Seng Index (HSI) is outperforming global markets, driven by key factors such as regulatory easing, a surge in foreign investment, and China’s pro-growth policies. As Chinese tech stocks rebound and Hong Kong’s economy gains support, HSI offers attractive investment opportunities for both long-term investors and short-term traders.

When compared to the S&P 500, Nasdaq 100, and European indices, HSI stands out due to lower valuations and policy-driven growth. While U.S. and European markets struggle with high interest rates, Hong Kong’s stock market benefits from China’s economic momentum. Investors can access the Hang Seng Index (HSI) through various avenues, including ETFs, Hang Seng Index futures, and direct stock investments.

Lastly, traders like you should use our order flow analysis tool, Bookmap. They allow you to track institutional buying and selling. Stay ahead of Hang Seng Index price moves using Bookmap’s real-time data tracking.