Ready to see the market clearly?

Sign up now and make smarter trades today

Stocks

October 23, 2024

SHARE

Zscaler Stock: Is It a Buy? Analyzing the Market Data

Are you analyzing Zscaler stock? The 12-month price targets set by analysts show an average target of $251.87. The range is set between $185.00 and $290.00. This indicates an optimistic perspective for the stock. However, since analysts are generally predicting higher future prices compared to earlier estimates, you are always advised to perform your analysis.

To help you, in this article, we have covered Zscaler’s position in the cybersecurity market, its financial performance, and the potential opportunities and risks associated with its stock. We begin by providing an overview of Zscaler, including its growth journey, market position, and comparison with key competitors like Palo Alto Networks and Fortinet. We then examine critical financial metrics, such as revenue growth, earnings per share, and profit margins, to provide insights into the company’s recent performance and valuation.

Next, we will move onto our advanced market analysis tool, Bookmap, and demonstrate how traders can use it to easily analyze Zscaler’s market data using features such as the heatmap, Footprint charts, and add-ons like the Stops & Icebergs indicator.

Lastly, you will understand the key arguments for and against buying Zscaler stock. This will help you make an informed decision about whether Zscaler aligns with your investment strategy. Let’s begin.

Zscaler Overview: Company Background and Market Position

Zscaler is a leading cloud security company. It specializes in providing secure internet access and web gateway solutions through a Zero Trust Exchange platform. The company was founded in 2008 and has pioneered cloud-native cybersecurity solutions. It specifically focuses on protecting:

- Users

- Applications

- Data

Zscaler does so without relying on traditional network security models. With a market capitalization of approximately $22 billion (as of 2024), Zscaler plays a crucial role in the cybersecurity industry. It also helps businesses securely transition to cloud-based operations.

Zscaler’s Growth Trajectory

Zscaler launched its Initial Public Offering (IPO) in March 2018, which raised $192 million. This marked its strong entry into the public market. The company has since launched significant products like:

- Zscaler Private Access (ZPA)

and

- Zscaler Internet Access (ZIA).

These products have enhanced the company’s portfolio in Zero Trust security solutions.

Market Position and Competitor Comparison

It is worth mentioning that Zscaler is positioned as a significant player in the cybersecurity market. When it comes to competition, it competes with businesses like Palo Alto Networks and Fortinet. These companies focus on a broader range of security appliances (like firewalls and network security). Whereas, Zscaler differentiates itself with a cloud-native and Zero-Trust approach. This approach is especially appealing to organizations that focus on:

- Secure digital transformation,

and

- Remote work environments.

Now, when we talk about market share and revenue growth, Zscaler has seen a consistent revenue increase of over 50% year-over-year in recent fiscal reports. Compared to its competitors, Zscaler’s growth rate outpaces the more established players like Palo Alto Networks and Fortinet.

However, Zscaler’s primary weakness lies in its narrower focus on cloud security. This acts as a con and limits its ability to compete with more diversified portfolios offered by its competitors. Nonetheless, its unique cloud-first strategy and strong growth trajectory make it a formidable competitor in the cybersecurity market.

Analyzing Zscaler’s Current Market Performance

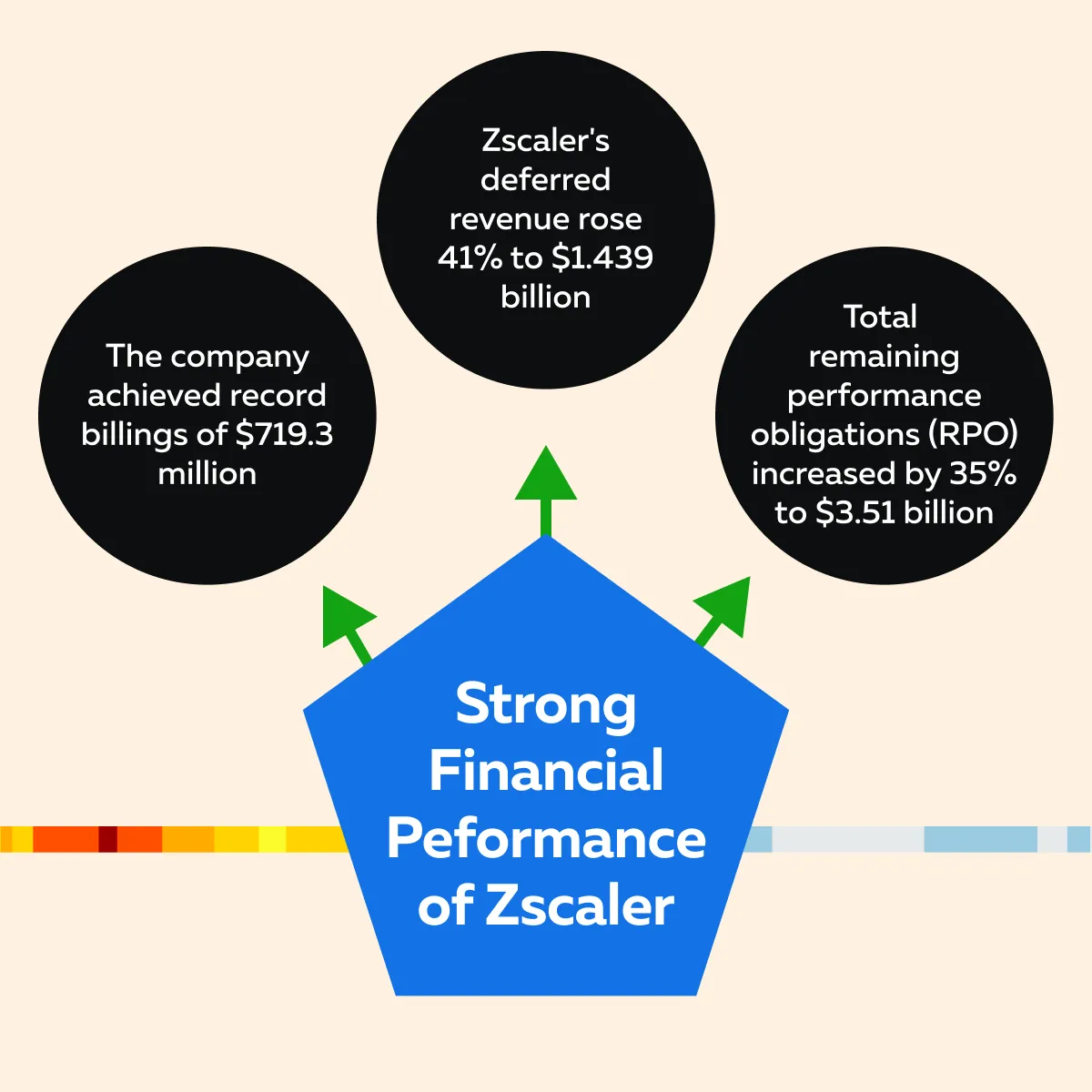

Zscaler is positioned for strong growth in its $72 billion total addressable market due to its expanding product portfolio. In the fiscal year 2023, which ended in July, Zscaler reported a 48% increase in total revenue, reaching $1.617 billion. For the fourth fiscal quarter alone, revenue grew by 43% to $455 million, surpassing analyst expectations by 5.7%. The also company maintained a strong gross margin of 80.7%. See the graphic below to gain a comprehensive understanding of Zscaler stock analysis:

Zscaler’s Stock Analysis – Annual Recurring Revenue (ARR)

Zscaler achieved over $2 billion in annual recurring revenue (ARR). The company was able to double this figure in just seven quarters. Now, the company aims to reach $5 billion in ARR by enhancing its product offerings and generating more business from its existing 7,700 customers.

The company currently has significant growth potential, as only 30% of the Global 2000 companies are among its customers. Furthermore, Zscaler has seen a 25% year-over-year increase in customers with ARR exceeding $100,000, now totaling 2,609. The company added a record 49 new customers with ARR over $1 million in the fourth quarter, bringing this number to 449 (up 37% from the previous year).

Furthermore, from a strategic point of view, the company is exclusively focused on deepening relationships with high-value clients. It now has 43 customers with ARR above $5 million. This again highlights its success in securing large-scale contracts.

Zscaler Stock Analysis – Valuation Metrics

As of September 2024, Zscaler’s Price-to-Earnings (P/E) ratio is “-115.” This indicates that the company is currently not profitable, as a negative P/E ratio reflects a loss. In comparison, its competitors Palo Alto Networks and Fortinet have P/E ratios of 109.65 and 45.83, respectively. Notably, Palo Alto Networks’ high P/E ratio suggests strong growth expectations, similar to Zscaler, but it is profitable. Whereas, Fortinet’s lower P/E ratio indicates a more mature and stable growth trajectory with lower risk compared to the other two.

Now, if we move onto the Price-to-Sales (P/S) ratio, Zscaler’s P/S is “12” in September 2024. This suggests that investors are willing to pay $12 for every $1 of the company’s sales. Interestingly, this ratio is only slightly lower than Palo Alto Networks, which has a P/S ratio of “14.3.” This indicates that the market values Palo Alto’s sales higher which is majorly likely due to its established position and consistent performance.

Meanwhile, Fortinet has a P/S ratio of 10.78, which is lower than both Zscaler and Palo Alto Networks. This shows it is valued more conservatively relative to its revenue, possibly due to its more mature market position.

Zscaler Investment Outlook

Zscaler’s negative P/E ratio and relatively high P/S ratio indicate that the market has high expectations for its future growth, despite its current lack of profitability. Investors can perceive Zscaler as a high-risk and high-reward opportunity due to its strong:

- Revenue growth,

and

- Market position in the Zero Trust security space.

However, any slowdown in growth or failure to achieve profitability could lead to significant volatility in its stock price. This is even reflected by the differences in valuation compared to its competitors. Analyze Zscaler stock like a pro with our advanced tools on Bookmap. Get started here!

Future Outlook for Zscaler

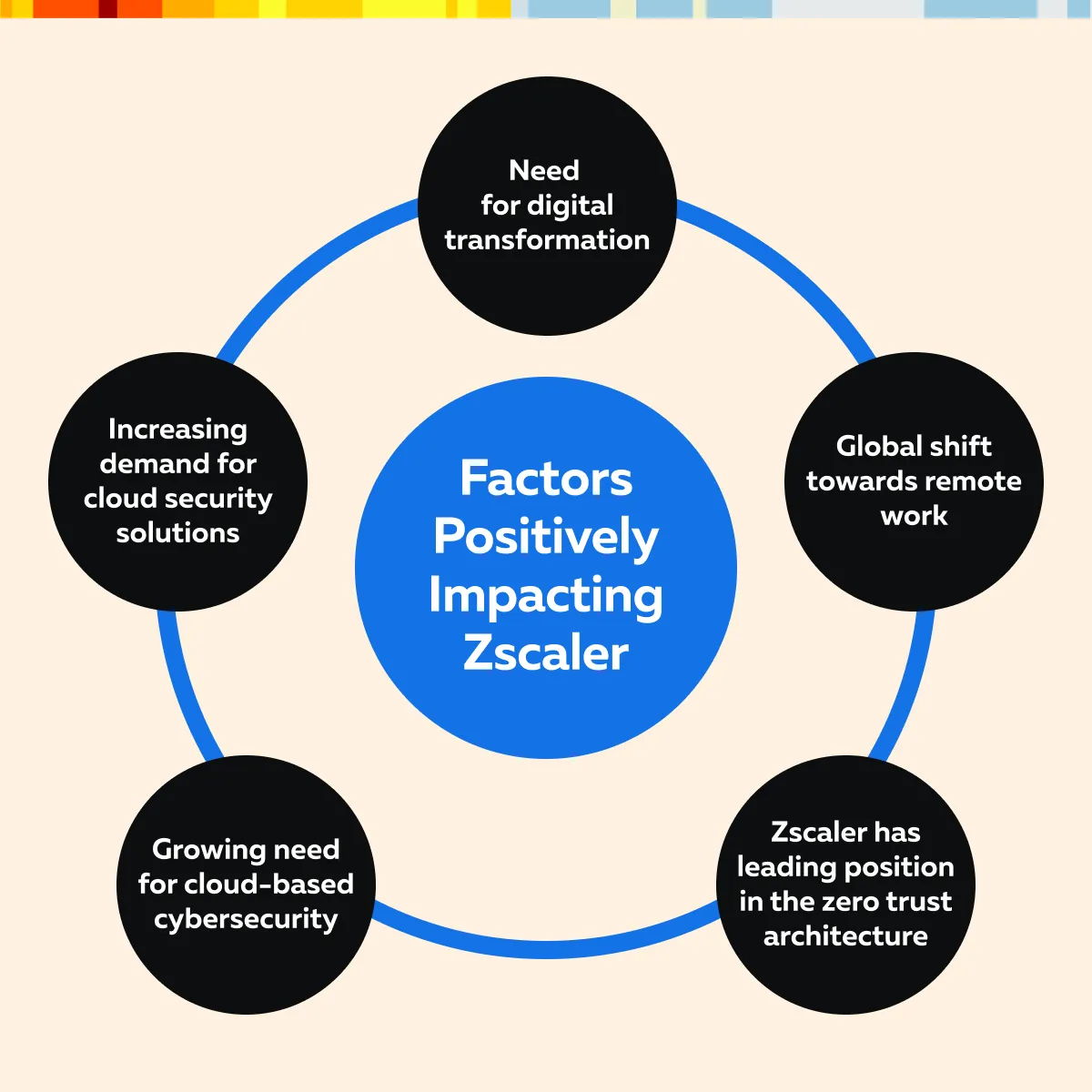

Zscaler has strong growth prospects. For more understanding, see the graphic below:

It can be observed from the above factors that Zscaler is currently in a space where it can excel with its unique cloud-native platform. The company is well-positioned to benefit from these trends. Moreover, Zscaler’s recent innovations, such as its enhanced cloud firewall and AI-driven security solutions, further strengthen its market position.

Now, if we talk about Zscaler stock analysis, most analysts generally have a positive outlook on Zscaler. Several have even raised their price targets in recent months. The average 12-month price target is approximately $251.87, with projections ranging from $185.00 at the low end to $290.00 at the high end. Notable firms like Goldman Sachs and Morgan Stanley have even raised their ratings. This demonstrates trust in the company’s future performance.

However, there are some mixed opinions as well. They are reflected in a few downgrades from firms like Barclays and Cantor Fitzgerald due to:

- Expected market challenges

- Competitive pressure from other cybersecurity firms, such as Palo Alto Networks and Fortinet,

- The rapid evolution of technology

- Changes in regulatory environments

- Potential economic downturns

All these factors could affect Zscaler’s ability to maintain its current growth rate. It must be noted that given the premium valuation of Zscaler’s stock, any significant deviation from growth expectations could lead to volatility in its stock price.

Using Bookmap to Analyze ZScaler’s Market Data

To precisely monitor Zscaler’s stock movements, you can start using our advanced market analysis tool, Bookmap. With it, you can monitor real-time order flow and identify potential trading opportunities. Moreover, you can detect patterns or changes in buying and selling pressure, which usually signal potential entry or exit points. For example,

- Say there is a surge in Zscaler buy orders at a specific price level.

- Now, this indicates strong demand.

- You considered it as a buying opportunity.

- Whereas, say there is a wave of sell orders.

- This signals an impending price drop and a selling opportunity.

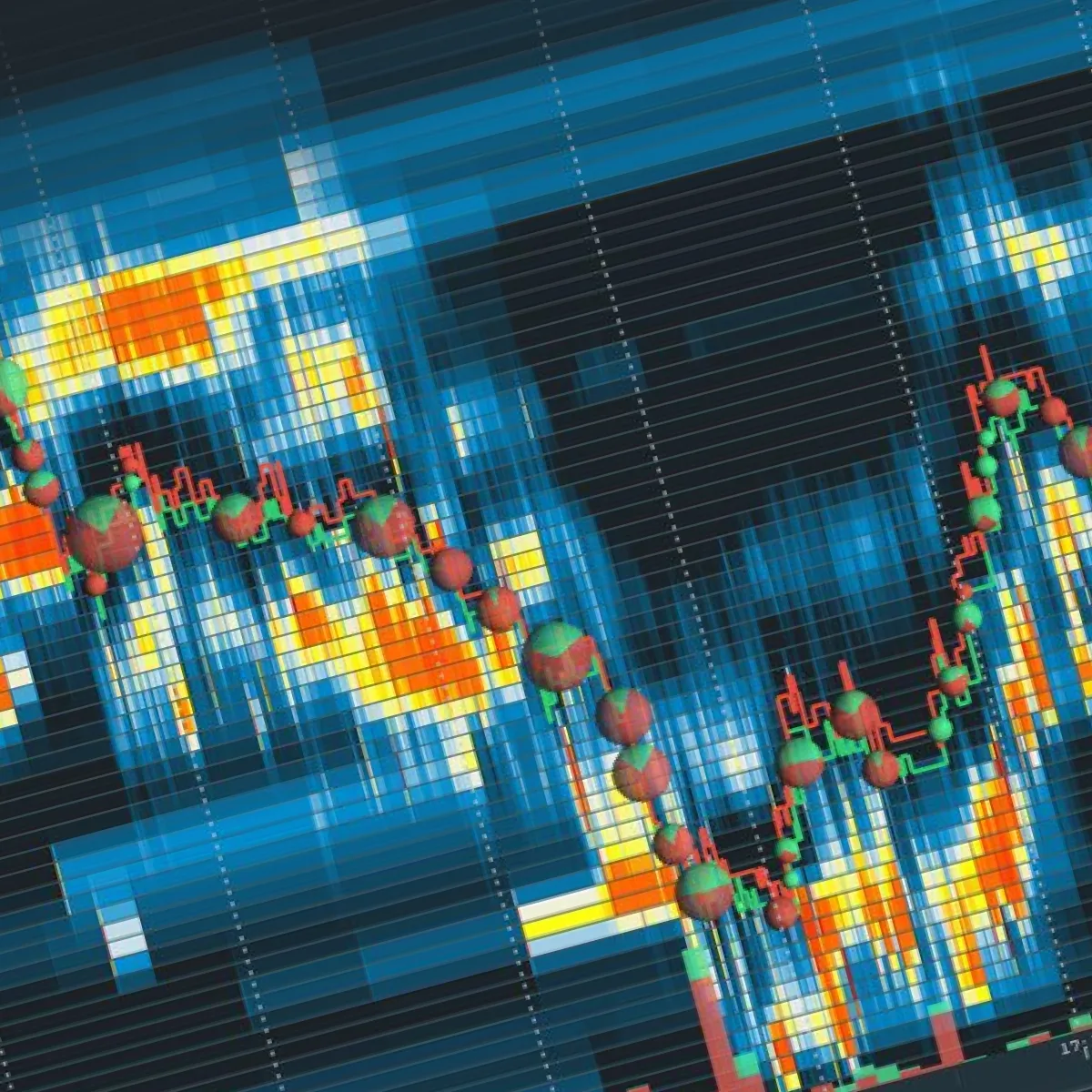

The Heatmap

We provide a detailed visualization of the order book. The heatmap feature is particularly useful for visualizing market depth and liquidity levels for any stock, including Zscaler.

For the unaware, a heatmap represents the concentration of orders at various price levels. Here brighter colors indicate higher volumes of limit orders. By analyzing the heatmap, traders can quickly identify key support and resistance levels where large orders are concentrated. This helps in predicting potential price reversals or breakouts. For example,

- Say a significant volume of buy orders is detected at a lower price level.

- Now, this indicates “strong support.”

- Whereas a large cluster of sell orders at a higher level suggests “strong resistance.”

Make informed trading decisions with real-time data on Zscaler and more. Join now!

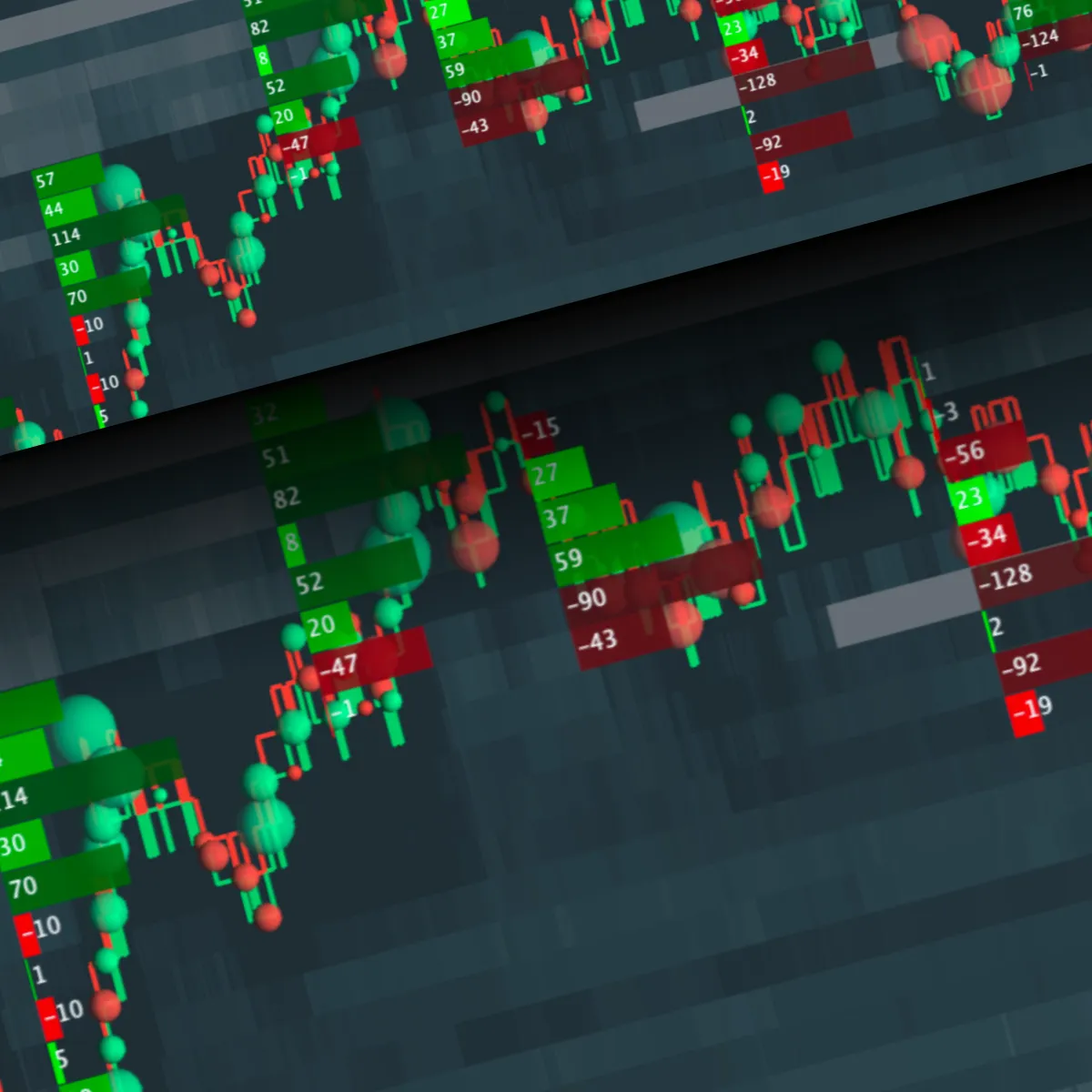

Footprint charts

Additionally, you can use our Footprint charts. These charts display the volume of buy and sell orders at specific price levels. Even they break down each price level into the number of executed trades. By analyzing this data, you can easily understand whether the market is dominated by buying or selling pressure. Also, you will get to know whether a price trend is likely to continue or reverse.

How Can You Enhance Analysis with Bookmap Add-ons?

Furthermore, we also offer several add-ons that can enhance the analysis of Zscaler’s market data. One such add-on is The Stops & Icebergs indicator. It is particularly useful for detecting hidden orders and stop runs. Using it, you can:

| Spot iceberg orders | Detect stop runs |

| These are large orders broken into smaller and visible orders to avoid revealing true intent. | These are clusters of stop-loss orders. When triggered, they cause rapid price movements. |

Another valuable tool is the Large Lot Tracker. This add-on identifies and tracks large institutional trades. By highlighting these substantial trades, the tracker allows you to follow the activities of big players in the market. Use Bookmap to get an edge in analyzing stocks like Zscaler. Sign up today!

Is Zscaler a Buy?

For more clarity on Zscaler stock analysis, let’s check out some of its pros and cons:

| Pros | Cons |

|

|

The Final Verdict

For a long-term growth-oriented investor, Zscaler could be an “attractive buy.” The company has strong market position and innovative product offerings. Also, they have a special focus on expanding their customer base. A growth investor you might tolerate the current high valuation and bet on Zscaler’s ability to continue capturing market share and increasing revenue growth over several years.

For short-term traders, Zscaler offers several opportunities based on market volatility. It must be noted that stock is sensitive to:

- News,

- Quarterly earnings, and

- Broader market conditions.

This presents opportunities for profit through short-term trading strategies. Traders can perform technical analysis and use Bookmap to easily identify entry and exit points based on real-time order flows and market sentiment.

Conclusion

Zscaler maintains a leadership position in the cloud security market. The company has an innovative approach to Zero Trust architecture and strong revenue growth. It also benefits from the increasing demand for cloud-based security solutions largely driven by a shift towards digital transformation and remote work.

Despite Zscaler’s impressive growth trajectory, its high valuation, as indicated by its elevated P/E and P/S ratios, suggests that the stock is priced for rapid expansion. For long-term growth investors, Zscaler offers potential due to its market leadership and strong growth prospects. Also, short-term traders can find opportunities in its volatility. They can use tools like Bookmap to analyze real-time market data and identify potential buy or sell opportunities.

Our features, such as the heatmap, Footprint charts, and various add-ons, can be used to get deeper insights into market sentiment, order flow, and key price levels. Are you looking to identify a precise entry or exit point for Zscaler? Try Bookmap today!