Ready to see the market clearly?

Sign up now and make smarter trades today

Stocks

December 27, 2024

SHARE

SPY vs. QQQ: Why Traders Watch Them Closely and How to Analyze Their Market Signals

In financial markets, investing without a plan is like hitting in the dark. To make profitable trades, you will certainly need the guidance and information that others have. But how and what is the source?

Ever heard of SPY and QQQ as market indicators?

Yes, these are two essential guides for those looking to make sense of the U.S. market. SPY tracks the S&P 500 and provides a broad view of the market across various sectors. The other guide, QQQ, zeroes in on the tech-heavy stocks that often lead the charge.

This article explores the importance of both SPY and QQQ in understanding market sentiment. You’ll learn how they complement each other and give insights into market trends and sector performance. Also, we will check how macroeconomic events and earnings seasons impact these ETFs differently. Additionally, we’ll discuss the benefits of monitoring volatility and the risks associated with tech stocks. Let’s get started.

What is SPY Stock?

SPY stock refers to the SPDR S&P 500 ETF Trust. It is one of the most popular exchange-traded funds (ETFs) globally. This ETF offers exposure to the S&P 500 Index. For the unfamiliar, the S&P 500 index includes 500 of the biggest companies traded on stock exchanges in the United States. This makes SPY stock an easy way to invest in the broader U.S. stock market without buying individual stocks of each company.

Investors must note that SPY is an ETF. This means it is designed to mirror the performance of the S&P 500 index. When you invest in SPY stock, you essentially invest in all the companies within the S&P 500. This provides diversification, as your investment is spread across different industries. Importantly, your risk of individual stock fluctuations gets reduced. For more clarity, let’s understand this process in simple steps:

It is worth mentioning that ETFs such as SPY are traded on stock exchanges in the same way as regular stocks. This makes them easy to buy and sell during market hours. This flexibility, combined with the benefits of diversification and relatively low cost, makes SPY a popular investment choice.

What is QQQ?

QQQ, or the Invesco QQQ Trust, is also an exchange-traded fund (ETF). It tracks the Nasdaq 100 index. This index consists of 100 of the largest non-financial companies listed on the Nasdaq stock exchange. It must be noted that the primary focus of this index is on tech-heavy and growth-oriented companies. This makes it a popular ETF for investors seeking exposure to major technology firms.

The major concentration of QQQ is on technology stocks, such as Apple, Amazon, and Microsoft. However, this strong focus on tech makes QQQ more volatile than broad-market ETFs like SPY but also offers higher growth potential. Investors in QQQ should be aware that it responds sharply to developments in the tech sector, like earnings reports or innovations.

Additionally, since QQQ is heavily tech-focused, it also reacts quickly to economic and tech-related news. This makes it particularly appealing for swing traders who try to capitalize on short-term market movements. They are most active, particularly around big tech earnings seasons when companies like Apple or Amazon release their quarterly reports.

Why Do Traders Watch SPY and QQQ Together?

Most traders prefer to closely watch both SPY and QQQ because these ETFs give different perspectives on market sentiment. They help them understand how different parts of the U.S. stock market are performing. Let’s see how:

| SPY Gives Broader Market Sentiment | QQQ is Tech-Heavy and Growth-Oriented |

|

|

How to Monitor Both for Comprehensive Market View?

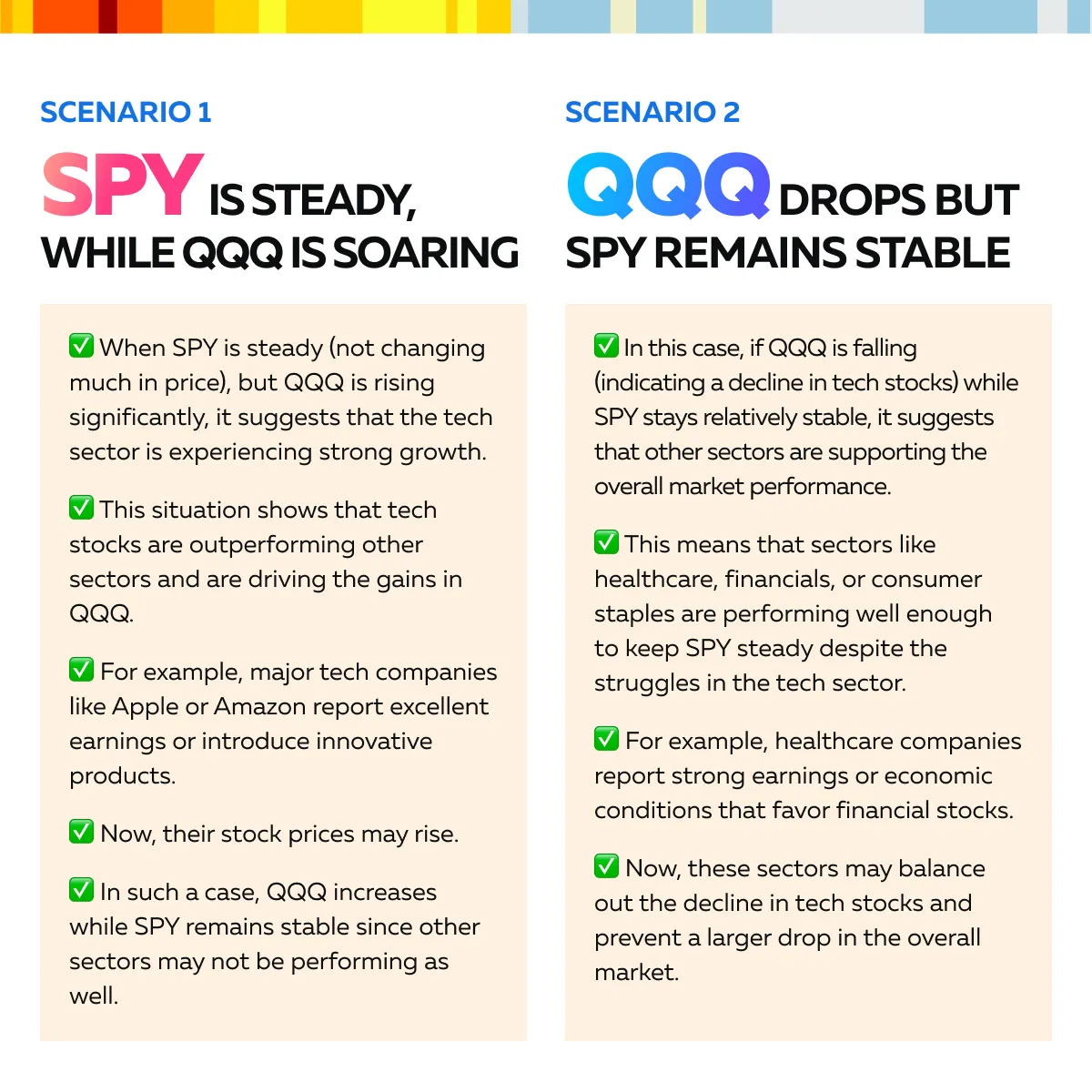

By watching both SPY and QQQ, traders get a fuller picture of the market. SPY gives them an understanding of the overall market across multiple industries, while QQQ shows the performance of tech-focused and growth stocks. For more clarity, let’s study two different scenarios:

Moreover, SPY reflects traditional sectors like industrials and financials, while QQQ is more tech-focused. Traders analyze these two to understand “sector rotation”, which shows where money moves between sectors depending on economic conditions. By comparing SPY and QQQ, traders can also gain insights into which sectors are currently strong or weak.

Correlation and Divergence between SPY and QQQ

SPY and QQQ are often correlated. That’s because they both represent parts of the U.S. stock market. When the overall market trend moves upward, both SPY and QQQ usually rise. However, their correlation can change based on the performance of specific sectors, particularly technology.

This relationship between SPY and QQQ shows how different sectors can influence market performance. Let’s see how this works under two different situations:

Situation 1: Tech Stocks Outperform

- In periods when tech stocks are performing exceptionally well (for example, during a tech boom or after strong earnings reports from major tech companies), QQQ can rise faster than SPY.

- This is because QQQ is heavily weighted in technology stocks, so its price reacts more significantly to gains in this sector.

- However, this outperformance comes with increased volatility and risk.

- Tech stocks are usually sensitive to changes in:

- Market sentiment,

- Economic conditions, and

- Therefore, while QQQ offers higher returns during a tech rally, it also risks sharper declines if the tech sector faces negative news or market corrections.

Situation II: Tech Sector Underperforms

- Now, let’s consider a reverse situation.

- The tech sector encounters difficulties due to disappointing earnings, regulatory challenges, or rising interest rates.

- Here, QQQ will decline more sharply.

- On the other hand, SPY will remain more stable due to its diversified nature.

Bonus Tip: From Situation II, we can see that SPY may serve as a safer investment option for investors looking to mitigate risk. That’s because it provides more consistent returns through its broader diversification across different industries.

Stay ahead of market shifts with the order flow and liquidity tools on our trading platform, Bookmap, which is perfect for monitoring ETFs like SPY and QQQ.

Analyzing SPY and QQQ for Better Trading Decisions

Most traders analyze SPY and QQQ side by side. This helps them to gauge the market’s overall sentiment and performance. As mentioned above, SPY represents the broader U.S. market, while QQQ is centered on the tech sector. This creates a high correlation between the two, as the tech industry is a significant part of the U.S. economy. However, their performances can vary due to the differences in sector focus. For example,

- Say the tech sector is booming.

- Now, QQQ outperforms SPY.

- It offers higher returns to investors looking for growth.

On the other hand, during periods of tech underperformance, QQQ experiences sharper declines. In such a situation, SPY provides more stability as it is diversified across multiple sectors like industrials, healthcare, and financials. This diversification cushions SPY from drastic losses that may hit tech-heavy funds like QQQ.

Therefore, we can clearly see that the correlation and differences between SPY and QQQ help traders balance risk and returns effectively. For more clarity, let’s study an example related to QQQ vs. SPY performance during the COVID-19 pandemic:

- During the COVID-19 pandemic, tech stocks experienced a massive surge.

- This caused QQQ to significantly outperform SPY.

- From March 2020 to the end of 2020, QQQ, which tracks tech-heavy companies in the Nasdaq 100, soared by about 48%.

- This rapid growth was primarily driven by increased demand for tech services like cloud computing, e-commerce, and streaming.

- This trend benefited companies like Apple, Amazon, and Microsoft.

- In comparison, SPY, which tracks the broader S&P 500, increased by about 16% over the same period.

- While still profitable, SPY’s gains were lower due to its exposure to sectors that were hit hard during the pandemic.

- Traders who recognized the booming demand for tech services during the pandemic allocated more to QQQ to benefit from its stronger returns.

This divergence clearly shows how, during periods of tech outperformance, QQQ provides higher returns, but when tech falters, SPY’s diversification offers more stability. To optimize your trading, Use Bookmap’s advanced analytics to track real-time price movements in SPY and QQQ.

Impact of Economic Indicators on SPY and QQQ

Be aware that several traders closely watch macroeconomic events like Federal Reserve announcements or GDP reports to gauge their effects on SPY and QQQ. These events influence market sentiment and stock prices differently across sectors. Check the graphic below to see some common factors:

Please note that these factors lead to fluctuations in both ETFs but with varying impacts due to their sector composition. A key example of this is when the Federal Reserve raises interest rates. In such situations, tech-heavy stocks, like those in QQQ, drop more steeply during rate hikes. This happens because when rates rise, borrowing becomes more expensive. This impacts tech firms’ profits and stock prices. Meanwhile, SPY remains more stable, as other industries like financials or industrials might be less affected by the rate hike or may even benefit from it.

Volatility in SPY and QQQ

Volatility in the tech sector leads to greater fluctuations in QQQ than SPY. Because QQQ is concentrated in growth-oriented tech companies, its value swings more sharply in response to industry news or economic events. Check the graphic below to see how traders take advantage of this volatility:

For example,

- During earnings seasons for major tech companies like Apple, Amazon, and Google, QQQ often experiences increased volatility.

- Traders anticipate big moves in these stocks based on their earnings reports.

- This leads to opportunities for strategies like:

- Scalping (quick, small trades)

or

- Swing trading (holding positions for some days)

- In comparison, SPY is more diversified across multiple sectors.

- It sees less extreme price fluctuations during the same period and provides more stability.

Conclusion

SPY and QQQ are important tools for traders who are looking to understand market sentiment. SPY offers insight into the overall U.S. stock market by tracking a wide range of industries. Contrarily, QQQ focuses specifically on the tech sector and growth-oriented companies. By monitoring both ETFs, traders gain a well-rounded view of how different sectors are performing. Even they can easily identify potential opportunities or risks in the market.

For example, if tech stocks are soaring, QQQ might outperform SPY. This situation indicates a strong tech rally. On the other hand, if the tech sector is struggling, SPY’s broader diversification provides more stability. This helps traders manage their risks.

To develop strong and profitable trading strategies using SPY and QQQ, traders must analyze the real-time market. They can do so using our advanced market analysis tool, Bookmap. It allows traders to visualize market data, track price movements, and analyze order flow. Using it, traders can easily enhance decision-making and gain a clearer picture of market dynamics. Do you wish to monitor SPY and QQQ precisely? Use Bookmap and stay ahead of the competition!